Puffer Finance, a liquid staking platform integrated with Ethereum’s EigenLayer protocol, has successfully raised $18 million in a Series A funding round to prepare for its mainnet launch.

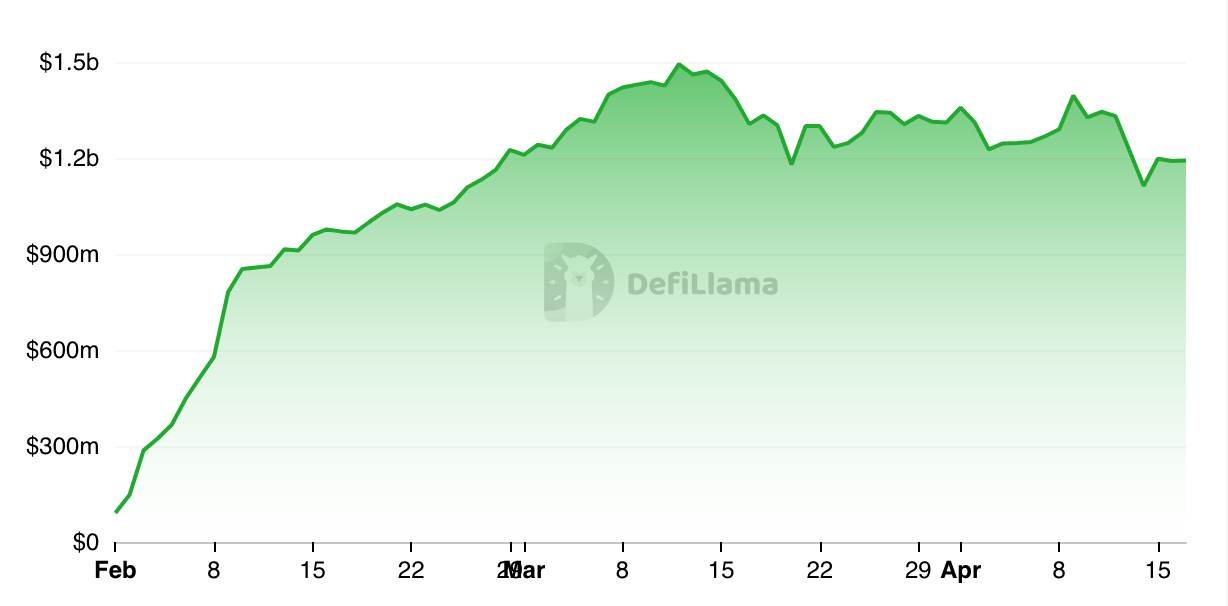

The funding round, announced on April 16, was led by Brevan Howard Digital and Electric Capital, with significant contributions from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Avon Ventures (affiliated with Fidelity Investments), Mechanism, Lightspeed Faction, Consensys, Animoca, GSR, and several angel investors. As per DeFiLlama data, Puffer Finance achieved a total value locked (TVL) of $1.2 billion shortly after its initial testing phase in February. Overall, the protocol has secured $23.5 million in venture capital funding.

Puffer Finance’s innovative technology enables Ethereum validators to stake with as little as 1 ETH, significantly lower than the typical 32 ETH required for individual staking. Participants who stake ETH through Puffer receive Puffer liquid restaking tokens (nLRTs), which they can use to farm yields in other decentralized finance (DeFi) protocols alongside their Ethereum staking rewards.

This approach, known as liquid staking, has been established in various blockchains like Cosmos and recently transitioned to Ethereum following the Merge upgrade to proof-of-stake. Puffer Finance emphasized its commitment to reducing barriers for home validators while providing an advanced liquid restaking solution.

In a strategic move, Puffer Finance secured an investment from Binance Labs, further solidifying its position in the Liquid Restaking ecosystem. The platform also hinted at forthcoming technological advancements coinciding with its mainnet rollout.

EigenLayer, the underlying protocol for Puffer Finance, recently surpassed DeFi lending giant Aave in TVL, with $10.4 billion worth of assets committed after lifting restrictions on staking limits temporarily.

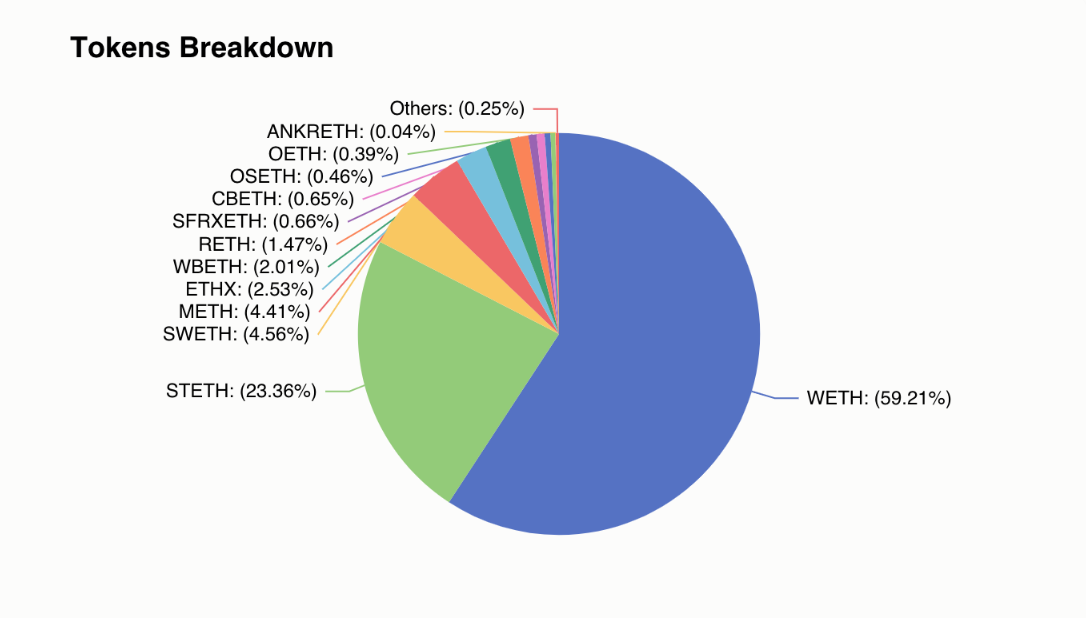

With over 107,900 unique depositors, EigenLayer predominantly sees staked tokens in Wrapped Ether (wETH) and Lido Staked Eth (stETH), as per DefiLlama’s statistics.

Liquid staking protocols represent the largest DeFi category, with nearly $55 billion locked across approximately 160 protocols, primarily driven by Lido’s dominance with $35 billion in locked value.