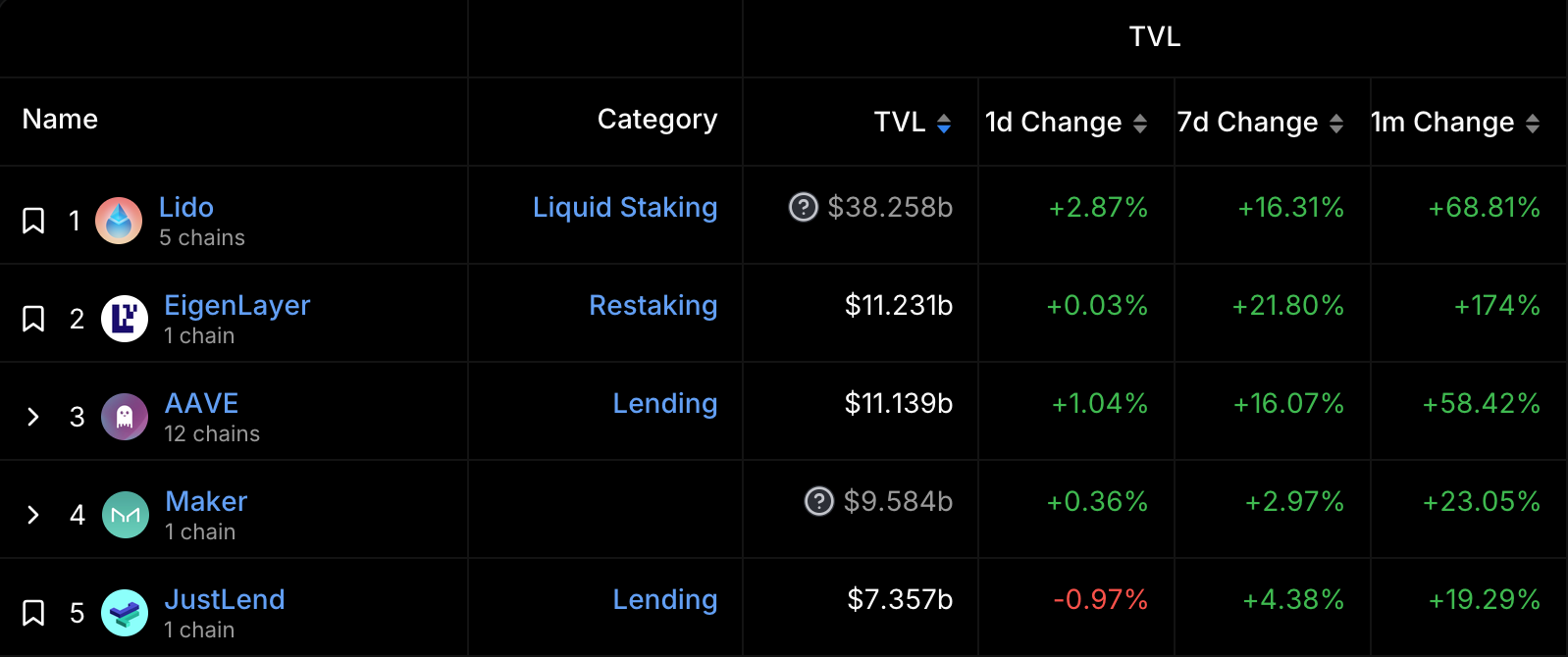

EigenLayer’s total value locked (TVL) has exceeded $11.24 billion. This milestone places EigenLayer as the second-largest protocol by TVL, surpassing the popular decentralized finance platform Aave.

This development follows EigenLayer’s decision to temporarily eliminate deposit caps within its network.

As of the latest data, EigenLayer’s TVL stands at $11.24 billion, while Aave’s TVL is at $10.7 billion, according to information sourced from DeFiLlama.

The shift in TVL has sparked discussions among commentators regarding whether staking, including liquid staking, should be factored into a protocol’s TVL, especially considering that staked native assets are typically excluded from the count.

I don't think restaking (or liquid staking) should be counted as TVL if we're not going to count staked native assets as tvl 🤷

— Austin Federa | 🇺🇸 (@Austin_Federa) March 5, 2024

In DeFi protocols like Aave, TVL encompasses the total tokens deposited into smart contracts, serving as collateral for borrowing and yield generation. However, borrowed assets are not included in TVL calculations to avoid inflating the figure.

In contrast, EigenLayer enables users to participate in network security and earn additional rewards by depositing native staked ETH or liquid staked ETH into smart contracts, subjecting them to slashing conditions.

Carlos Mercado, a data scientist at Flipside, emphasized the importance of adjusting TVL calculations to account for native assets versus synthetic versions like wrapped ETH or staked ETH. Failing to do so risks inflating TVL figures due to potential double-counting of tokens.

Mercado suggests that this principle applies to protocol-specific TVLs as well. He notes that EigenLayer’s restaking mechanism may lead to triple counting of TVL when depositing assets such as stETH or cbETH.