Omni Network and Ether.Fi have inked a significant deal, with Ether.Fi pledging $600 million worth of ether (ETH) for restaking to enhance security on the Omni Network.

Omni is proud to announce a commitment of $600M of staked ETH from @ether_fi to secure the Omni Network.

This first-of-its-kind deal positions us at the forefront of the growing restaking ecosystem. pic.twitter.com/dbjgMBqaS8

— Omni Network 🤖 (@OmniFDN) March 4, 2024

The Omni Network functions as a blockchain facilitating seamless communication between various Ethereum rollups or scaling solutions, ensuring low latency and robust security. Both Omni and Ether.Fi have embraced EigenLayer’s pooled security model, with the staked ether set to be restaked on EigenLayer.

Under the agreement, Omni will whitelist Ether.Fi’s liquid token eETH and appoint Ether.Fi’s node operators to operate its Actively Validated Service (AVS). The staked ether will serve as a protective measure against security breaches and asset depegs.

This deal follows closely on the heels of Ether.Fi’s completion of a $23 million Series A funding round and will involve Ether.Fi delegating one-third of its $1.8 billion total value locked.

EigenLayer plays a central role in the Ethereum restaking ecosystem, hosting projects like Ether.Fi and Puffer that streamline the restaking process and offer additional rewards in the form of loyalty points.

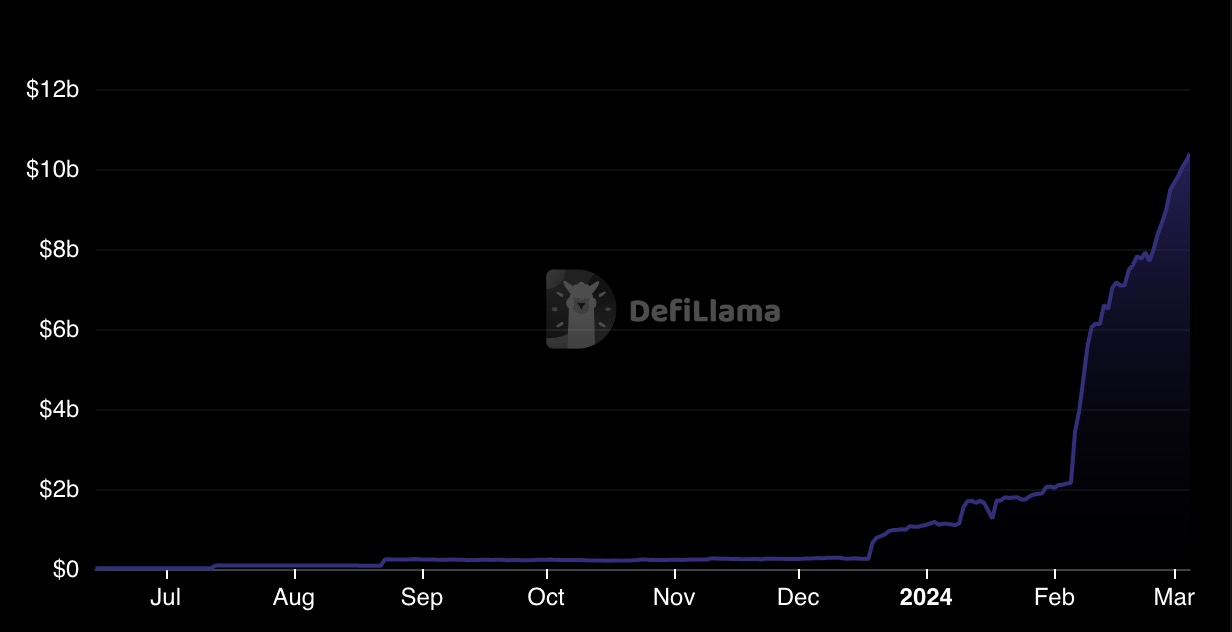

Liquid restaking allows for increased yield or rewards on natively staked ether, with Ether.Fi presently offering 3.92% returns and loyalty points across EigenLayer. These loyalty points are anticipated to become convertible into token airdrops. The liquid restaking market has experienced substantial growth since December, with EigenLayer’s total value locked (TVL) skyrocketing from $250 million to $10 billion, according to DefiLlama data.

Ether.Fi is gearing up to launch a campaign dubbed the “final countdown” on Monday, potentially linked to a governance token airdrop for participants accumulating points through restaking.

The final countdown is coming. https://t.co/4NdBwIhY9K

— ether.fi (@ether_fi) March 2, 2024