Binance Labs, a crypto venture firm, has disclosed its investment in Renzo, an interface to the EigenLayer ecosystem.

According to an announcement on February 22, Binance Labs joins a consortium of venture firms and crypto ecosystems that invested $3.2 million in seed funding rounds in January. However, the specific amount invested by Binance in the startup remains undisclosed.

We’re excited to announce we have invested in @RenzoProtocol!

Renzo is an LRT and Strategy Manager for EigenLayer. The protocol serves as the interface to the EigenLayer ecosystem by securing AVSs and offering additional yields.

Read more👇https://t.co/hamISS7unm

— Binance Labs Fund (@BinanceLabs) February 22, 2024

Renzo offers Ethereum smart contracts facilitating communication between participants, node operators, and Actively Validated Services (AVS). Essentially, this allows users to reallocate assets, delegate them to node operators, and interact with service modules within the blockchain.

An Actively Validated Service could be a protocol or service within the EigenLayer ecosystem, based on the Ethereum proof-of-stake model but with its verification semantics. Similar to Ethereum, AVS also offers token rewards to attract users and node operators, claiming to provide higher yields than Ethereum staking.

The restaking process involves depositing ETH or Liquid Staking Tokens (LST), such as stETH. In return, users receive an equivalent amount of ezETH, a liquid restaking token representing a repositioning in Renzo.

For users, the risks are similar to those associated with staking services and are generally inherent in the DeFi ecosystem, such as susceptibility to smart contract vulnerabilities, management risks, and loss exposure due to underlying asset price fluctuations, making it unsuitable for low-risk-tolerant investors.

Binance’s investment in Renzo coincided with venture firm Andreessen Horowitz (a16z) allocating an additional $100 million to fund EigenLayer. According to reports, a16z was the sole investor in the round. Last March, the protocol completed a $50 million funding round led by Blockchain Capital.

Accelerating Ethereum Together: @eigenlayer ♾ @a16zcrypto

We are excited to announce that Eigen Labs, the core development team contributing to EigenLayer and @eigen_da, has raised $100 million from a16z crypto.https://t.co/M2JQ8HZZ0h

— EigenLayer (@eigenlayer) February 22, 2024

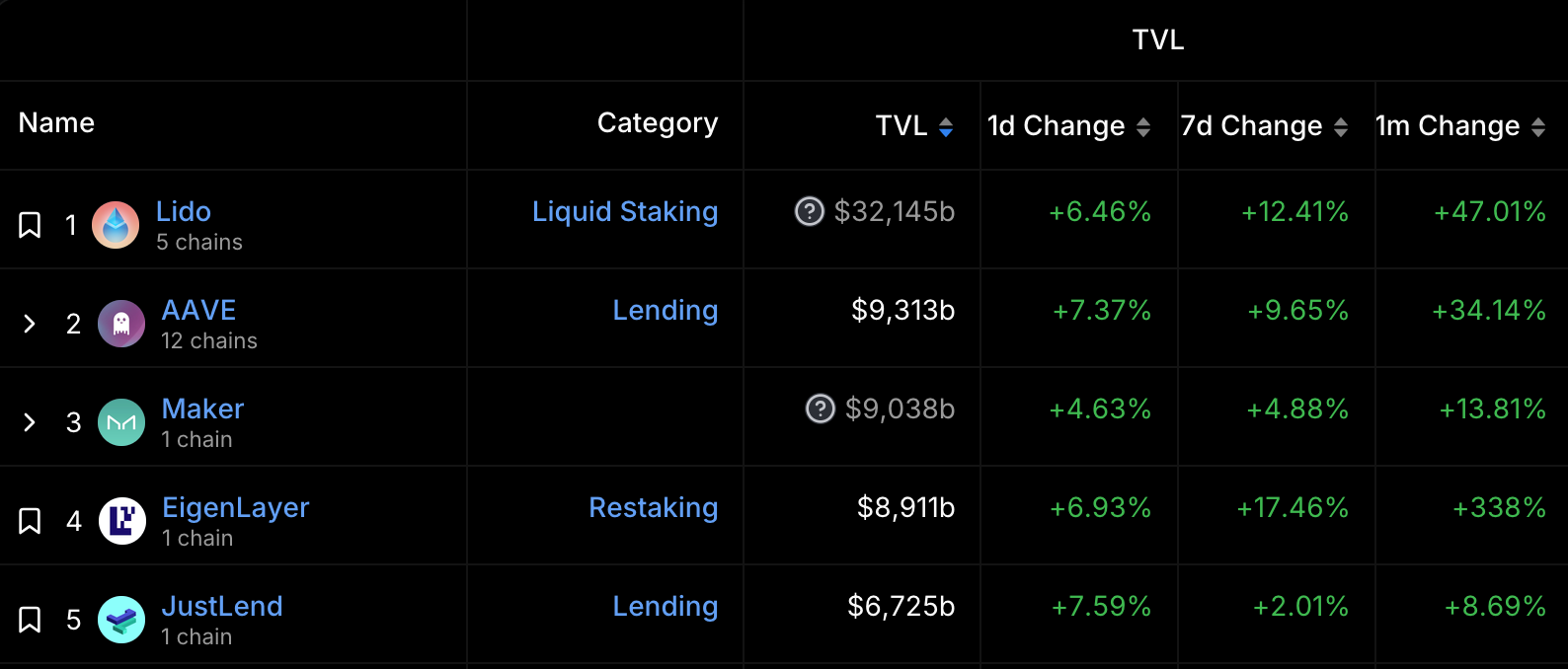

According to DefiLlama data, EigenLayer now ranks third among Ethereum protocols, with a total locked value of $8.91 billion, marking a 338% increase from the previous month.