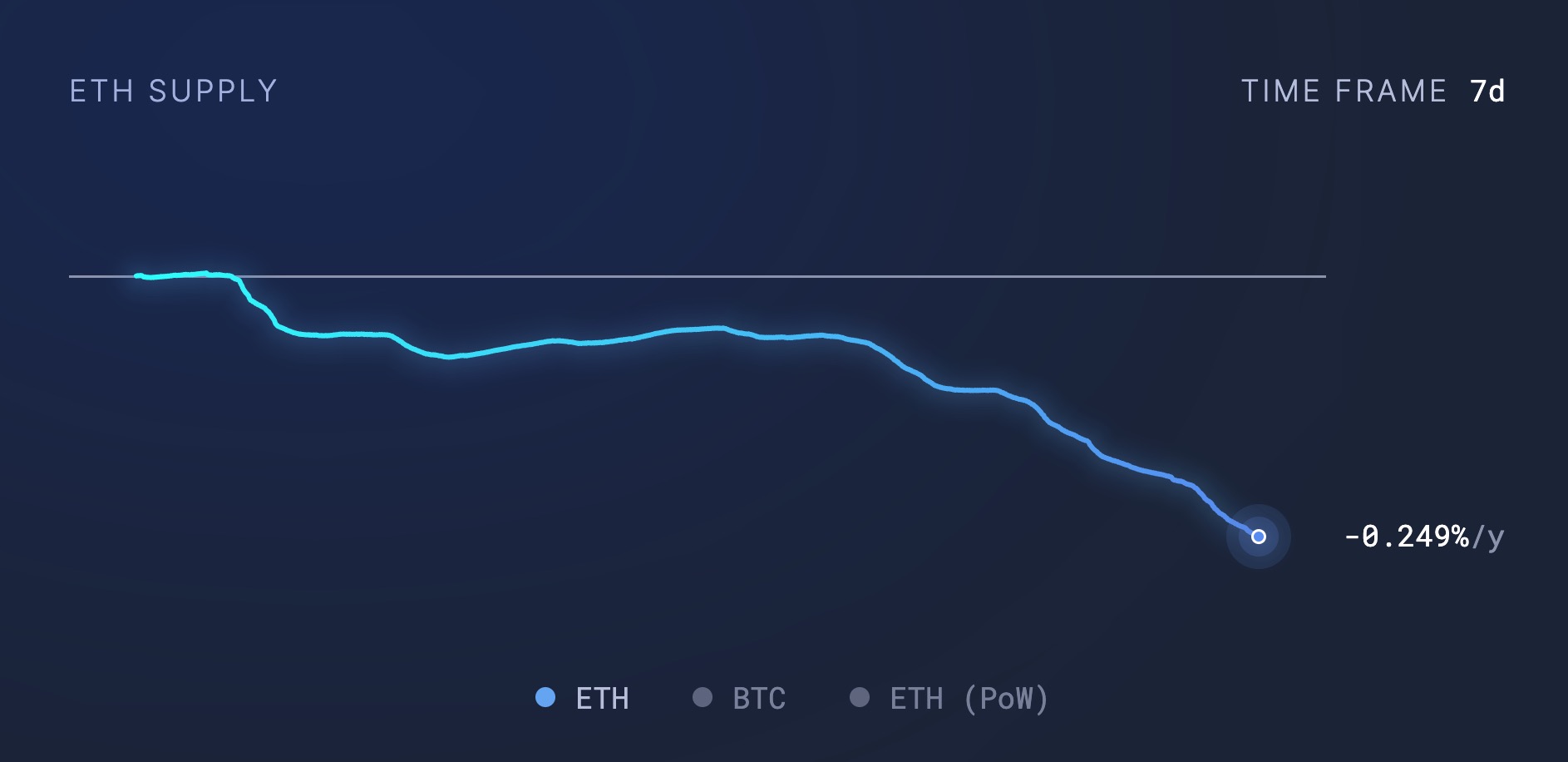

The recent surge in Ethereum’s on-chain activity has led to a spike in gas fees, resulting in an increase in Ethereum’s burn rate and a new post-merge low in the circulating supply of Ether.

According to data from Ultra Sound Money, over the past two weeks, more than 21,000 ETH worth $62.8 million have been burned, bringing the circulating supply of Ether below 120.16 million.

Since the activation of Ethereum’s Shanghai upgrade, also known as The Merge, in September 2022, Ethereum’s supply has decreased by 362,628 ETH.

The Shanghai upgrade shifted Ethereum to Proof of Stake consensus, reducing new Ether issuance by approximately 90%.

Despite over 1.05 million ETH entering supply as rewards for stakers since The Merge, Ethereum’s burn mechanism has permanently destroyed over 1.4 million ETH during the same period.

The recent increase in transaction fees coincides with a rise in decentralized exchange (DEX) trade volumes, NFT sales, and activity on Layer 2 networks, amidst bullish momentum in the crypto markets.

DEXes processed over $5 billion worth of trades in the past 24 hours, a 134% increase since February 4, according to DeFiLlama.

Meanwhile, NFT volume surged to $33 million on February 19, a 114% increase since February 2, according to data from Dune.

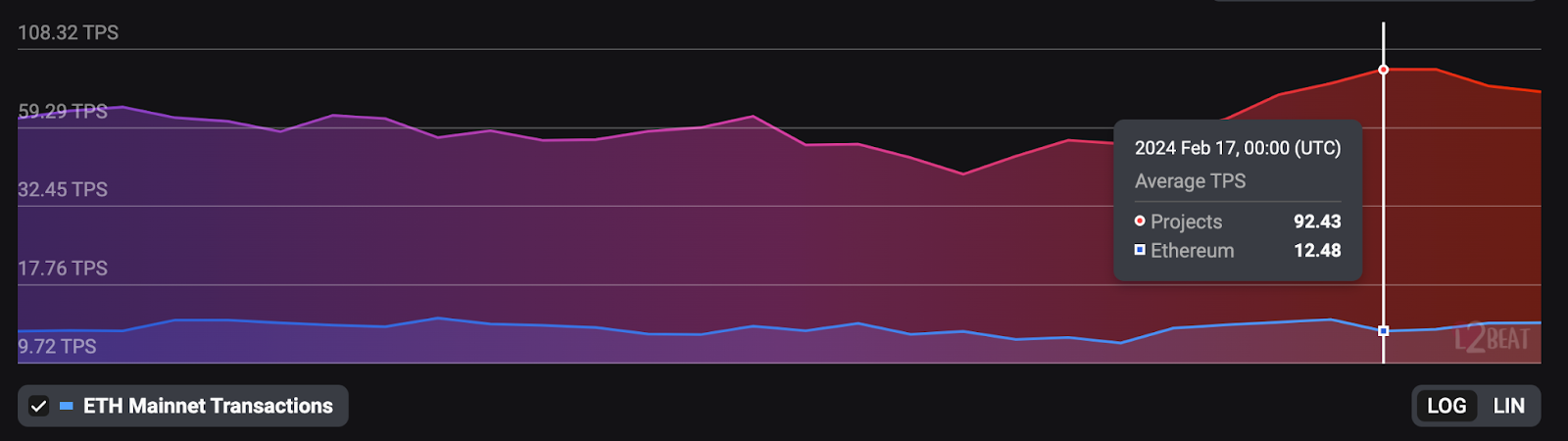

Activity on Layer 2 networks has also intensified, contributing to Ethereum mainnet congestion as L2 transactions are submitted for finalization. Data from L2beat shows combined Layer 2 throughput reaching its second-highest level on record during February 17 and February 18, with L2s processing over 92.4 transactions per second on average.

Average transaction fees have doubled in the past three days, as reported by Etherscan.

Analysts attribute the rise in gas fees to the launch of the ERC-404 token standard in early February, which facilitates NFT fractionalization using both ERC-20 and ERC-721 tokens, leading to gas-intensive transactions.

The launch of ERC-404 has sparked interest in the tokenization of Real-World Assets (RWA), resulting in a rush to adopt it and a subsequent spike in gas prices. PANDORA, an ERC-404 token, surged 5,000% within a week of its launch on February 2.

Last week, Cygaar, a pseudonymous developer, introduced DN-404, a token standard aimed at enhancing the efficiency of transactions by building on ERC-404.

DN404 (Divisible NFTs) 🥜

DN404 is an efficient implementation of a co-joined ERC20 and ERC721 pair that offers full compliance with the ERC20 and ERC721 standards.

Shoutout to the avengers: @optimizoor @0xCygaar @0xjustadev @0xQuit @AmadiMichaelshttps://t.co/oGAYOgFkoi

— Pop Punk (@PopPunkOnChain) February 12, 2024

DN-404 claims to reduce gas costs by 20% compared to ERC-404, while also enhancing security.