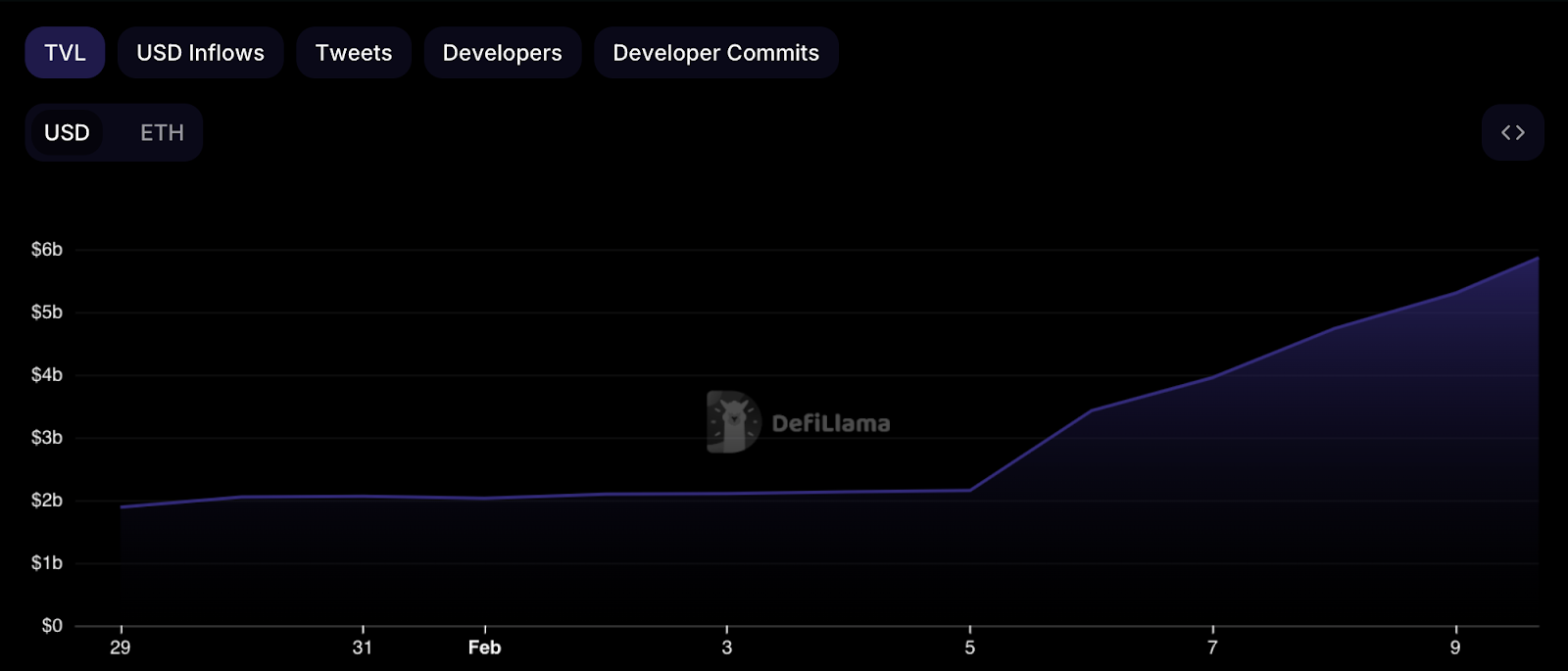

Eigenlayer, an Ethereum layer 2 solution enabling staked ether (ETH) to be “restaked” for other blockchains’ security, has observed a nearly twofold increase in its Total Value Locked (TVL) after temporarily removing a cap initially aimed at averting excessive centralization.

According to DeFiLlama, Eigenlayer’s TVL escalated from $2.16 billion to $3.84 billion within a mere 24-hour period following the protocol’s decision to eliminate caps for specific token types.

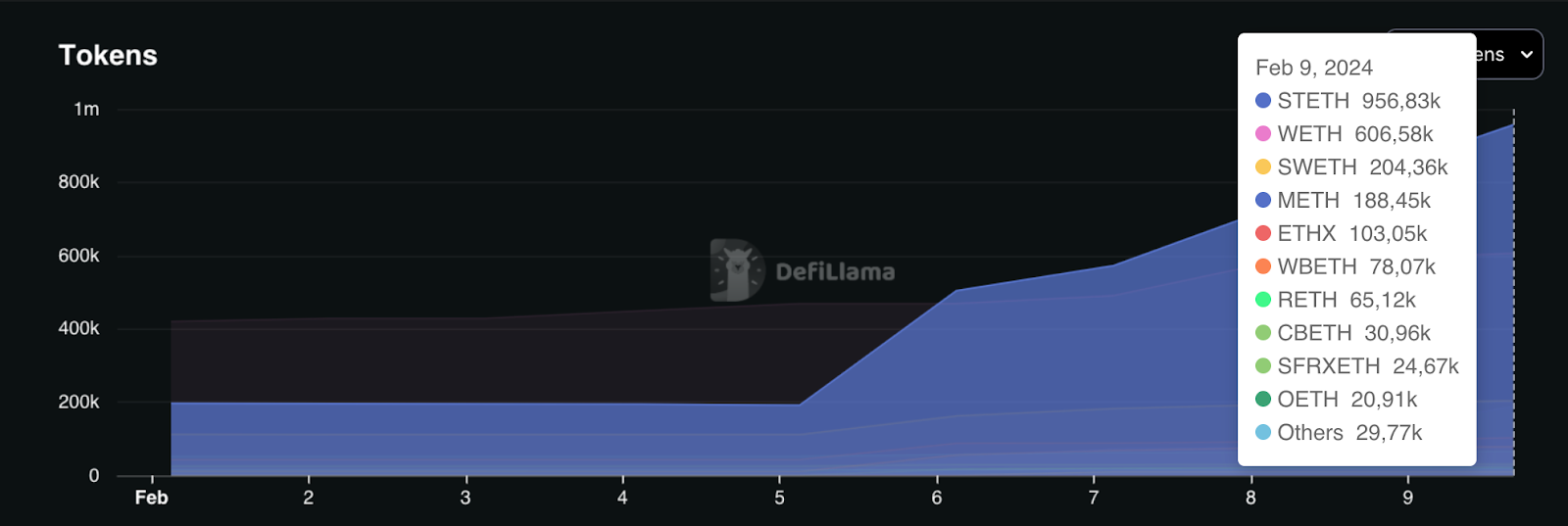

The surge primarily stemmed from stETH, a liquid staking token issued by Lido, constituting $560 million of the fresh deposits.

Eigenlayer had implemented these caps last year to prevent any single token from monopolizing the network, opting instead for an open marketplace model where validators select services to secure.

Eigenlayer articulated in a blog post outlining its original stance that in a completely neutral protocol, a single token could dominate, jeopardizing decentralization. This could undermine the market for programmable trust, potentially empowering a single counterparty to influence winners and losers or engage in detrimental activities.

The protocol resumed token restaking and suspended the 200 Ethereum (ETH) cap for a week-long duration, aiming to eventually remove caps permanently to encourage organic demand while introducing new limitations to prevent any token or participant, such as an exchange, from controlling over 33% of governance. Eigenlayer is part of a growing trend of “shared security” protocols leveraging Ethereum’s $34 billion in staked ETH to secure other chains. Users deposit staked ETH or liquid staking tokens into Eigenlayer’s smart contracts, earning additional rewards for assuming risk, thereby providing instant economic security to newer projects without necessitating the establishment of their validator networks.

While Ethereum founder Vitalik Buterin has lauded the concept, he has cautioned against implementations potentially burdening the base chain. Proponents argue that Eigenlayer strikes a balance by remaining blockchain-agnostic, securing $50 million in Series A funding last March.

Happy to announce that EigenLabs, the team behind the initial development of the EigenLayer protocol, has raised $50 million in a Series A round led by @blockchaincap pic.twitter.com/8tmvBkcttX

— EigenLayer (@eigenlayer) March 28, 2023

Ethereum’s transition to proof-of-stake has prompted the emergence of various centralized and decentralized services for staked coin yield generation. With its mainnet launch scheduled later this year, Eigenlayer aims to capitalize on the burgeoning interest in staking.

Many investors are leveraging platforms like Eigenlayer to “restake” tokens they’ve already committed, compounding their rewards. However, concerns about unintended consequences persist, as articulated by Buterin.

For now, Eigenlayer continues to attract tens of millions of dollars daily. The team plans to reimpose a temporary cap on Friday, Feb. 9, as they explore avenues to strike a reasonable balance between neutrality and decentralization, leaving the protocol community to determine the next steps.

🟦 EigenLayer Restaking Reloaded! 🟦

From NOW until Feb 9th, 12 PM PT, dive back into the world of LST restaking! All pools are fully uncapped, featuring both the existing pools and welcoming new partners @fraxfinance, @liquid_col, & @0xMantle. pic.twitter.com/yDGHiJjX3m

— EigenLayer (@eigenlayer) February 5, 2024