Lido Finance, the leading liquid staking protocol in the Ethereum ecosystem, has achieved a significant milestone by reaching one million Ethereum validators. The announcement came through an April 29 post on X.

1 million validators pic.twitter.com/fELATWQPIu

— Lido (@LidoFinance) April 29, 2024

Liquid staking protocols like Lido Finance play a crucial role in democratizing staking for retail users with limited capital. Typically, these users would require 32 ETH to operate their own validator nodes on Ethereum.

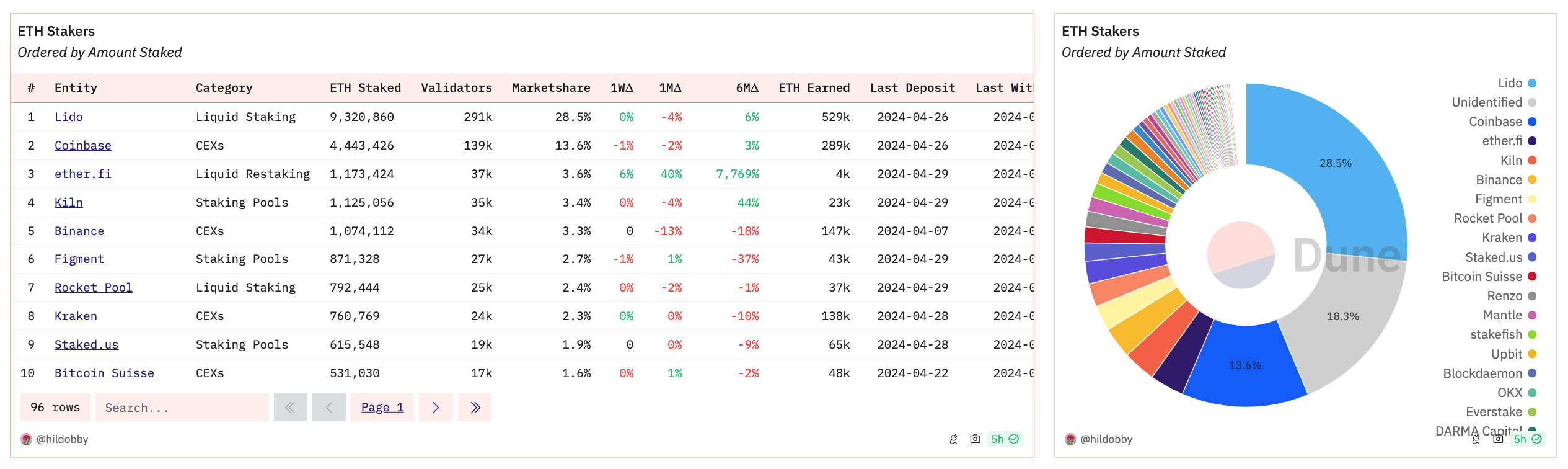

Currently, Lido Finance holds the lion’s share, accounting for 28.5% of staked ETH, while 13.6% is staked through the Coinbase exchange, as per data from Dune. Approximately 27% of the total ETH supply is currently staked.

The popularity of liquid staking protocols, including Lido, has soared due to the liquidity benefits they offer to users. By staking their ETH with Lido, users receive Lido Staked ETH (stETH) in return, which can then be utilized in other DeFi protocols.

This contrasts with traditional staking methods, where staked Ether tokens remain locked up and inaccessible for the duration of the staking period.

The total value locked (TVL) in DeFi protocols has experienced substantial growth, surging from $36 billion in the fourth quarter of 2023 to a peak of $97 billion in the first quarter of 2024. Presently, the total DeFi TVL stands at $93.09 billion, according to DeFiLlama.

The significant increase in DeFi TVL, up by 65.6% quarter-on-quarter, can be largely attributed to the rise of liquid staking protocols like Lido, as highlighted by on-chain intelligence provider Messari.

In Q1 2024, the trend of DeFi went in one direction, up ⬆️

DeFi TVL increased by 65.6% QoQ to reach $101 billion, this uptick was primarily driven by asset price appreciation and liquid restaking.

Explore the full report on the State of DeFi ⬇️ https://t.co/6ZoyFJTv6w pic.twitter.com/awOtGZV5u1

— Messari (@MessariCrypto) April 18, 2024

Liquid staking protocols have collectively amassed over $48.7 billion in TVL, with Lido accounting for a substantial portion, exceeding $29.7 billion. Rocket Pool follows in second place with $3.83 billion in TVL, according to DeFiLlama.

Despite their dominance, concerns have been raised by notable figures in the crypto space regarding the potential centralization risks associated with platforms like Lido. Ethereum co-founder Vitalik Buterin expressed such concerns in a blog post from September 2023, emphasizing the need for safeguards against such risks.