Ryan Lovell, Director of Capital Markets at Chainlink Labs, challenges the conventional wisdom that tokenization’s primary domain lies within traditional finance, advocating instead for its profound impact in harnessing real-world data.

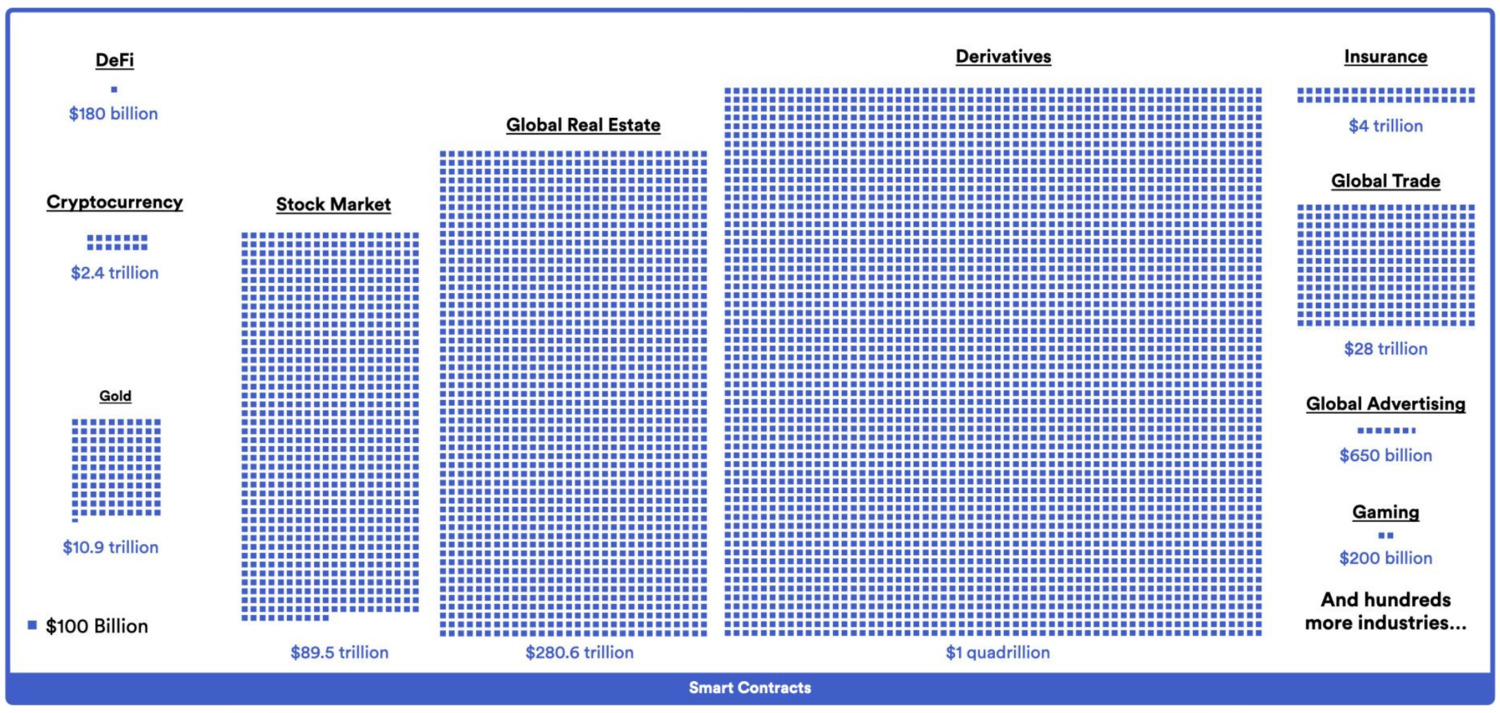

In the burgeoning landscape of blockchain technology, the tokenization of real-world assets (RWA) emerges as a monumental opportunity, with potential market sizes scaling into the hundreds of trillions of dollars.

1/ The tokenized RWA opportunity is measured in trillions of dollars.

By tokenizing an asset, blockchain-enabled superpowers are unlocked, from near-instant settlement to enhanced liquidity, fractional ownership, DeFi integration, & more.

Breaking down the RWA megatrend 🧵👇 pic.twitter.com/e4WYSB8iAo

— Chainlink (@chainlink) April 23, 2024

While numerous projects explore tokenizing assets spanning cash, commodities, and real estate, Chainlink’s researchers assert that the most transformative potential lies beyond the realm of traditional finance.

Outlined in their comprehensive industry report titled “Beyond Token Issuance,” Chainlink underscores the pivotal role of interoperability and real-world data in unlocking the true value of tokenized assets. By bridging this critical divide, asset managers stand to unleash dormant capital with superior returns, access previously elusive markets, and cultivate innovative revenue streams through bespoke financial products.

Moreover, the seamless integration of blockchain and traditional assets into a unified financial ecosystem promises to streamline client portfolios, curtail operational costs, and usher in a new era of digital financial innovation.

While the focus on real-world data tokenization remains paramount, Chainlink underscores the imperative of not neglecting traditional finance as a fertile ground for technological advancement and adoption.

Chainlink’s proactive engagement with traditional finance, epitomized by strategic partnerships with industry stalwarts such as ARTA TechFin and ANZ Bank, underscores its unwavering commitment to catalyzing the widespread adoption of tokenization and blockchain technology in real-world applications.