On April 24, Renzo Protocol‘s restaked Ether token (ezETH) experienced a price depeg, briefly plummeting to $688 on the Uniswap decentralized exchange before recovering its price parity with Ether (ETH), as per Dexscreener data.

Analysts attribute the incident to a broader sell-off following the conclusion of Renzo Protocol’s season 1 airdrop. Pseudonymous crypto analyst Tommy suggested that users might have sold ezETH to acquire ETH for farming other liquid restaking tokens (LRTs) or protocols.

An objective analysis on what happened on @RenzoProtocol (Depeg, airdrop, token pie chart)

0) Overview

Renzo is the second largest LRT with 1mn ETH staked, 33.5% market share (Etherfi has 37.9% share)Renzo announced it's token $REZ and airdrop plan on Apr 23, together with… pic.twitter.com/HNh1nQHVRv

— Tommy (@0xtommy_eth) April 24, 2024

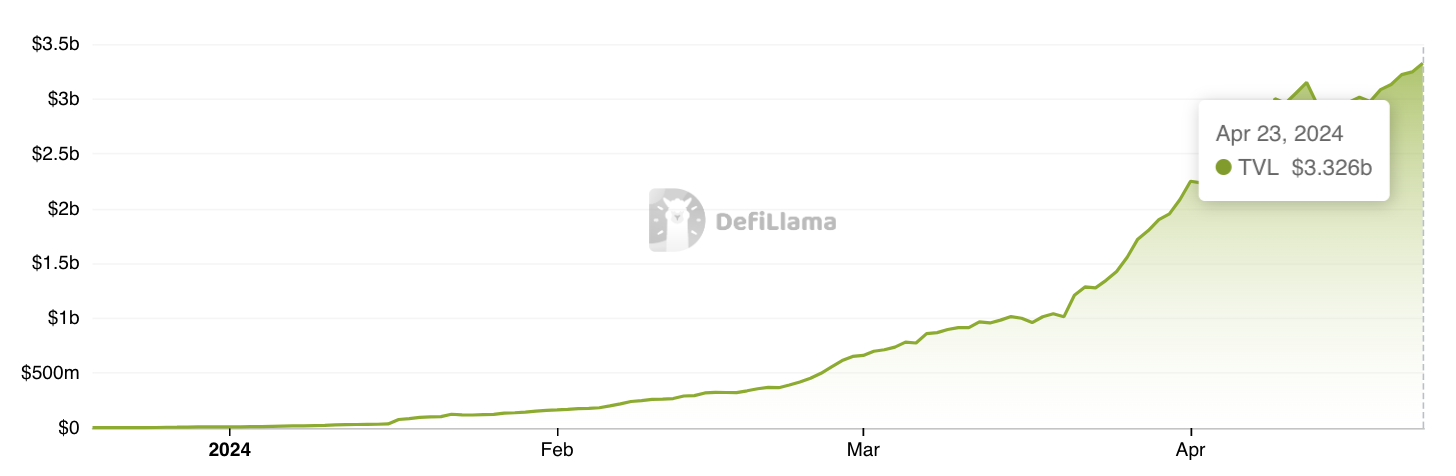

Renzo Protocol ranks as the second-largest liquid restaking protocol, boasting a total value locked (TVL) exceeding $3.3 billion, reflecting a 126% surge over the past month, according to DeFiLlama.

The depegging event underscores a growing concern for LRTs, as temporary imbalances can trigger pool depegging despite withdrawal availability.

The aftermath saw significant liquidations on leveraged protocols like Gearbox and Morpho Labs, disproportionately affecting loopers who utilize LRTs as collateral for ETH leverage.

Renzo Protocol gained attention after its token (REZ) was added to the Binance launch pool on April 23, coinciding with the announcement of its forthcoming airdrop. Season 1 of the airdrop allocated 10% of the token allocation.

In a notable trading feat, crypto trader czsamsunsb.eth amassed a profit of 121.65 ETH (approximately $396,000) within two hours of Renzo’s depegging incident. Lookonchain, an on-chain intelligence firm, highlighted the trader’s swift success in a recent post.

czsamsunsb.eth made 121.65 $ETH in just 2 hours after $EZETH(Renzo Restaked ETH) depegged!

He spent 4,099 $ETH to buy 4,221 $EZETH successfully, making 121.65 $ETH!https://t.co/niluIilTRi pic.twitter.com/hnPWt0DjZD

— Lookonchain (@lookonchain) April 24, 2024