The Aave community is currently immersed in a voting process, deciding the next blockchain to host GHO, Aave’s native decentralized stablecoin. This pivotal decision marks the second deployment of GHO, following its initial launch on the Ethereum mainnet in July 2023.

Initiated through an innovative temperature check proposal on April 20, AAVE holders are actively participating in the selection of the ideal network for GHO’s cross-chain expansion.

The proposal, enriched by diverse network proposals and insights from risk providers, emphasizes the pivotal role of community governance in shaping GHO’s future trajectory.

Presently, the Avalanche Layer 1 blockchain leads the vote with a significant 49% support, surpassing Ethereum Layer 2 contenders Arbitrum and Optimism, alongside Scroll and Metis, with notable margins.

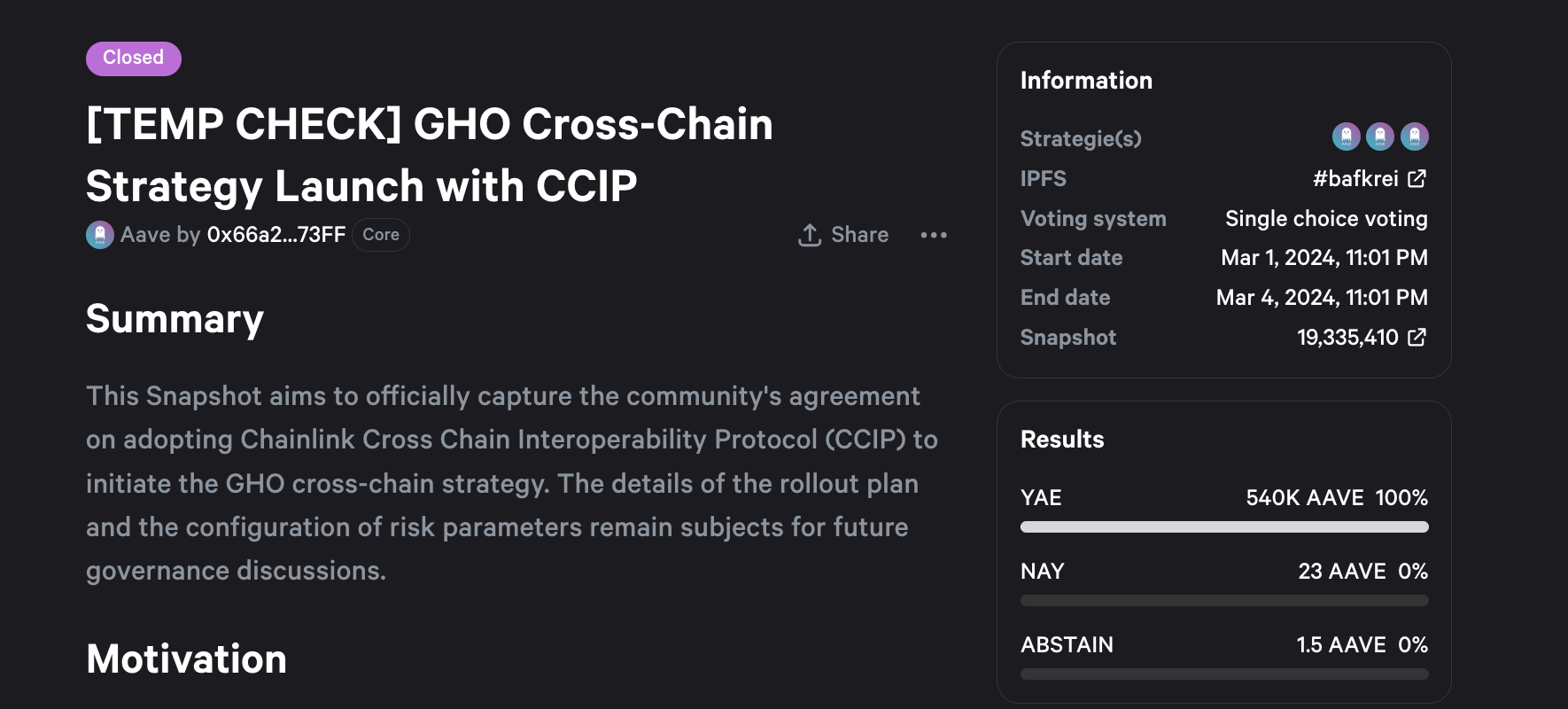

This community-driven initiative follows the Aave community’s earlier endorsement of Chainlink’s Cross Chain Interoperability Protocol (CCIP), laying the groundwork for GHO’s seamless integration across multiple chains.

Aave’s strategic decision to diversify GHO’s presence across various chains responds to the token’s recent milestone of reaching its 48 million debt ceiling. Notably, new GHO tokens are minted exclusively by Aave users leveraging collateral assets within the protocol.

Ensuring the stability of GHO’s peg remains a priority for Aave, as emphasized by Marc Zeller, prompting meticulous monitoring before considering adjustments to the token’s debt limit. Market data provided by CoinGecko indicates GHO’s consistent price range maintenance between $0.936 and $1.01 since early March.

While GHO encountered initial adoption challenges, it achieved parity with the U.S. dollar in February 2024, overcoming earlier hurdles that led to an all-time low below $0.96 in November. A “Liquidity Committee” was subsequently established, demonstrating Aave’s commitment to restoring GHO’s peg through community collaboration and innovation.