Recent research indicates a substantial surge in decentralized finance (DeFi) total value locked (TVL) during the first quarter of 2024, nearly doubling compared to the previous quarter. This growth is partly attributed to Ethereum liquid restaking initiatives, as reported by various sources.

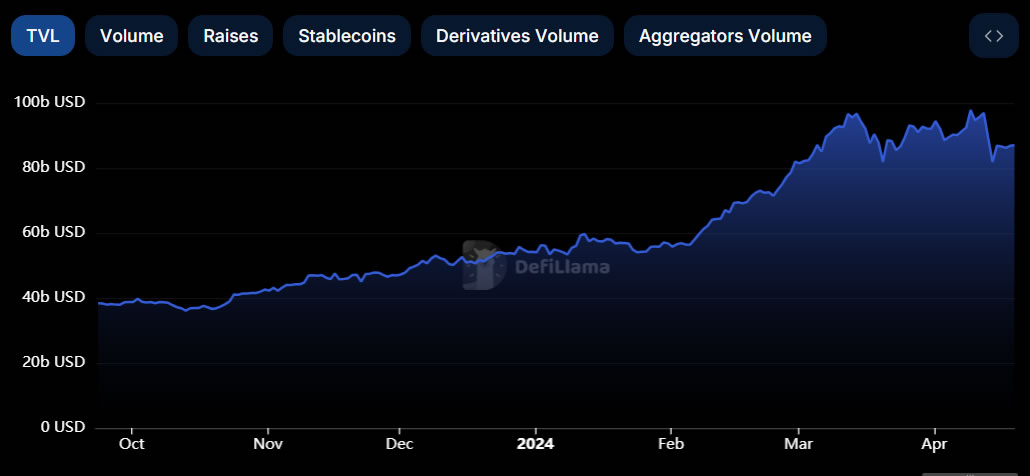

According to DeFiLlama, DeFi TVL rose significantly from a low of $36 billion in Q4 2023 to nearly $97 billion in Q1 2024. This represents an 81% increase since the beginning of the year, peaking at a two-year high of $98 billion.

Messari’s data, however, reported a slightly higher TVL of $101 billion on April 18, attributing the growth to asset price appreciation and liquid restaking activities, particularly noting Ethereum’s TVL growth of almost 71%.

In Q1 2024, the trend of DeFi went in one direction, up ⬆️

DeFi TVL increased by 65.6% QoQ to reach $101 billion, this uptick was primarily driven by asset price appreciation and liquid restaking.

Explore the full report on the State of DeFi ⬇️ https://t.co/6ZoyFJTv6w pic.twitter.com/awOtGZV5u1

— Messari (@MessariCrypto) April 18, 2024

A joint report by Web3 infrastructure platform QuickNode and institutional crypto data platform Artemis highlighted the role of staking, liquid staking, restaking, and liquid restaking in driving DeFi’s recent explosive growth. Liquid staking TVL reached a record high of $63 billion, primarily propelled by Ethereum’s liquid staking protocol Lido, which commands a 62% market share in the liquid staking ecosystem.

The popularity of liquid restaking protocols such as EigenLayer surged significantly during the first quarter, with EigenLayer TVL experiencing a staggering 990% increase to reach $12 billion by the quarter’s end. EigenLayer enables multiple staking of ETH for enhanced yields.

Despite a recent market retreat leading to an 11% decline in DeFi TVL to $86.6 billion, there’s optimism fueled by a substantial 291% quarter-on-quarter rise in user activity. This surge has sparked hopes for a potential second “DeFi Summer,” indicating growth and a transformative shift in the DeFi landscape despite regulatory challenges such as those posed by the SEC.