USDP, like traditional stablecoins, is designed to maintain a steady value equal to one U.S. dollar, offering traders a reliable refuge from the volatile nature of cryptocurrencies. However, a recent unexpected price surge highlighted by PeckShield has stirred apprehensions.

#PeckShieldAlert #Liquidation An address (0x09a5…a87f) was liquidated ~529K $USDC after $USDP (Pax Dollar) surged to $1.18 pic.twitter.com/UbWxx8kZU4

— PeckShieldAlert (@PeckShieldAlert) April 17, 2024

The stablecoin experienced an unusual spike, reaching $1.4414 at 16:10 UTC yesterday before swiftly dropping back to its usual $1 valuation four hours later, according to CoinMarketCap. Although this deviation went unnoticed by many, it had significant repercussions on a trader’s loan position, leading to liquidation.

The liquidation event took place on the decentralized finance (defi) platform Aave, where the trader had utilized USDP as collateral to secure a loan denominated in USDC. Notably, in the defi landscape, loans are collateralized by various assets, with mechanisms in place to handle abrupt market changes.

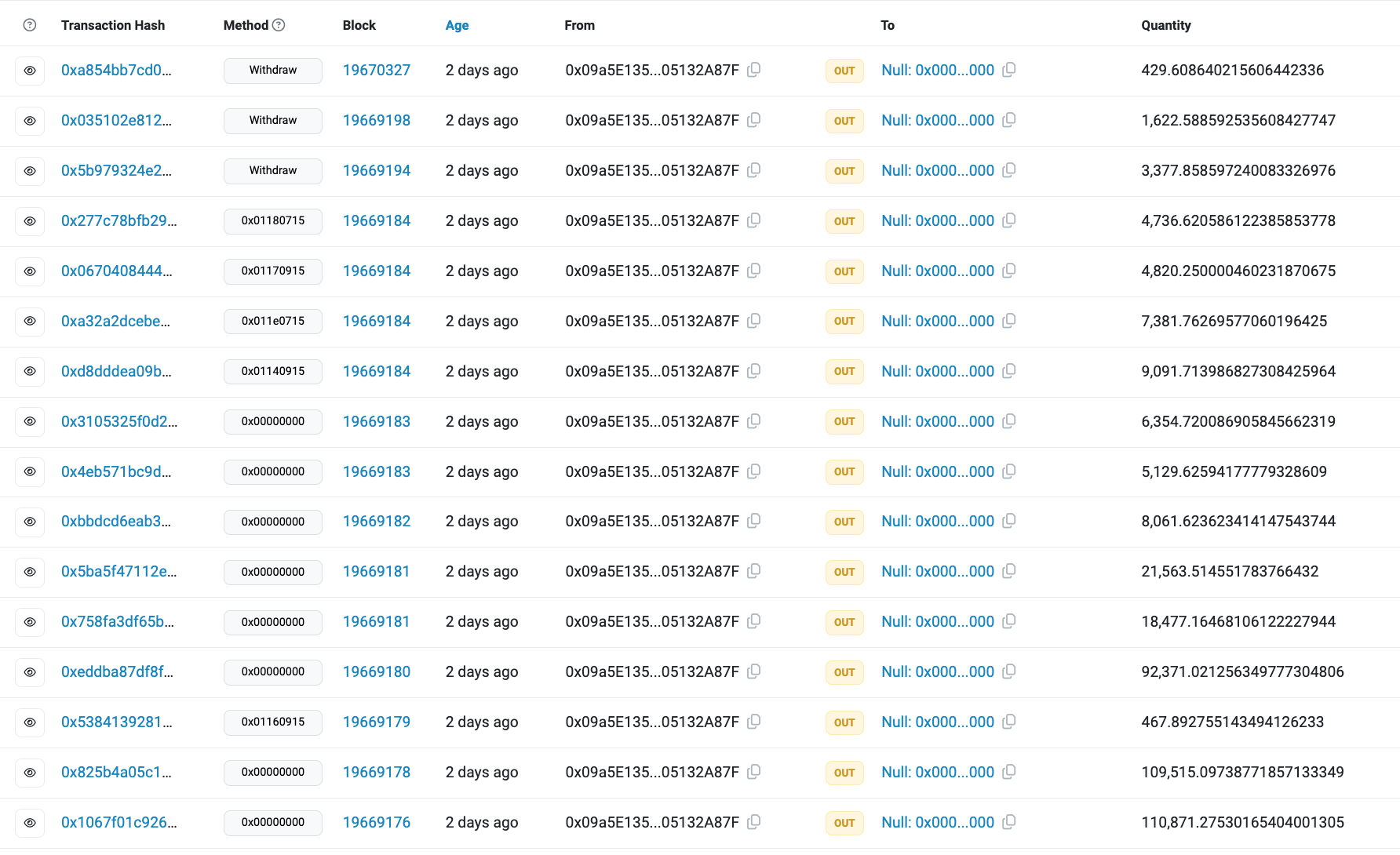

On-chain data confirms that the trader incurred a loss of 529,000 USDC across sixteen transactions from 16:16 to 20:09 UTC, aligning with the period during which USDP lost its peg. The transaction labels indicate that Aave’s risk management algorithms automatically initiated the liquidation process.

The platform likely anticipated a potential correction or a return to the stablecoin’s normal pegged rate amid the price surge. This foresight could have prompted preemptive liquidation to minimize potential losses, particularly if the borrower’s loan-to-value (LTV) ratio became unfavorable.

USDP, issued by Paxos, has encountered challenges recently, characterized by intermittent depegs. A 2023 study by SP Global revealed that USDP experiences the highest deviations from the U.S. dollar among leading stablecoins, with 7,581 minor depeg events recorded in the 24 months leading up to June 2023.