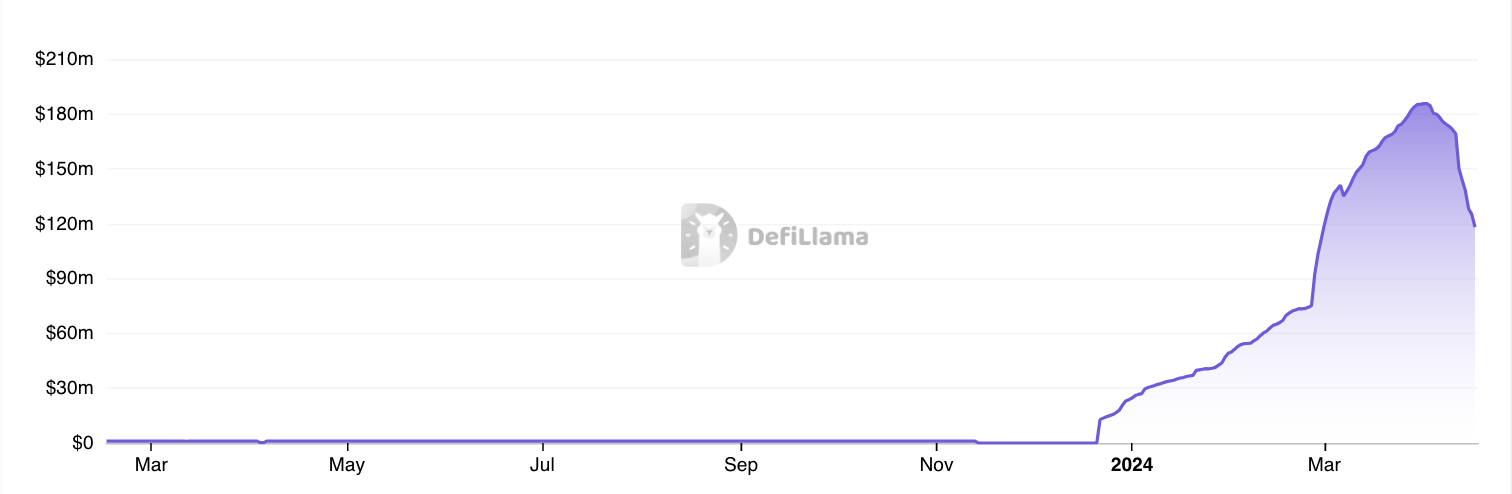

According to DeFiLlama data, the total value locked (TVL) of the Parcl protocol has dropped by about 40% in the past two weeks. Analysts note that users of the real estate betting platform withdrew approximately $74 million since the distribution of native tokens on April 3, 2024.

The digital platform developers conducted an airdrop of Parcl (PRCL) tokens for active protocol users. As per DeFiLlama, the TVL of funds as of the morning of April 3, 2024, was $184.5 million. However, by April 17, this value had decreased to $118.06 million.

According to CoinMarketCap, after the distribution of 80 million PRCL tokens at an initial price of $0.8255, the digital token entered the market. The price of the digital token quickly dropped to a minimum of $0.45. Currently, the virtual asset is trading at $0.47.

The mass withdrawal of funds observed from Parcl is not unique to the network. Similar movements have been seen in other Solana-based protocols in recent weeks. Additionally, the digital asset Wormhole (W) saw a 56.4% price decrease after its free distribution and listing on April 3. The TNSR token of the Tensor NFT platform also lost about 50% in value over a similar time period.

However, Solana-based project developers continue to conduct free asset distributions. The management of the decentralized exchange Drift announced that it will launch and distribute 100 million DRIFT governance tokens. The creators of another DEX, Zeta Markets, made a similar announcement a week earlier.

In recent weeks, Solana has experienced significant congestion, likely due to spam transactions. This occurs when trading bots attempt to prioritize their transactions over those of regular users. Solana developers are actively working on implementing updates to address these issues. It is worth noting that the price of the Solana cryptocurrency (SOL) has dropped by almost 19% over the past 7 days.