Homium, a home equity line of credit (HELOC) tokenization protocol operating on the Avalanche blockchain, has successfully raised $10 million in a Series A funding round. The funding was led by Sorenson Impact Group and Blizzard, showcasing growing investor interest in innovative blockchain-based financial solutions.

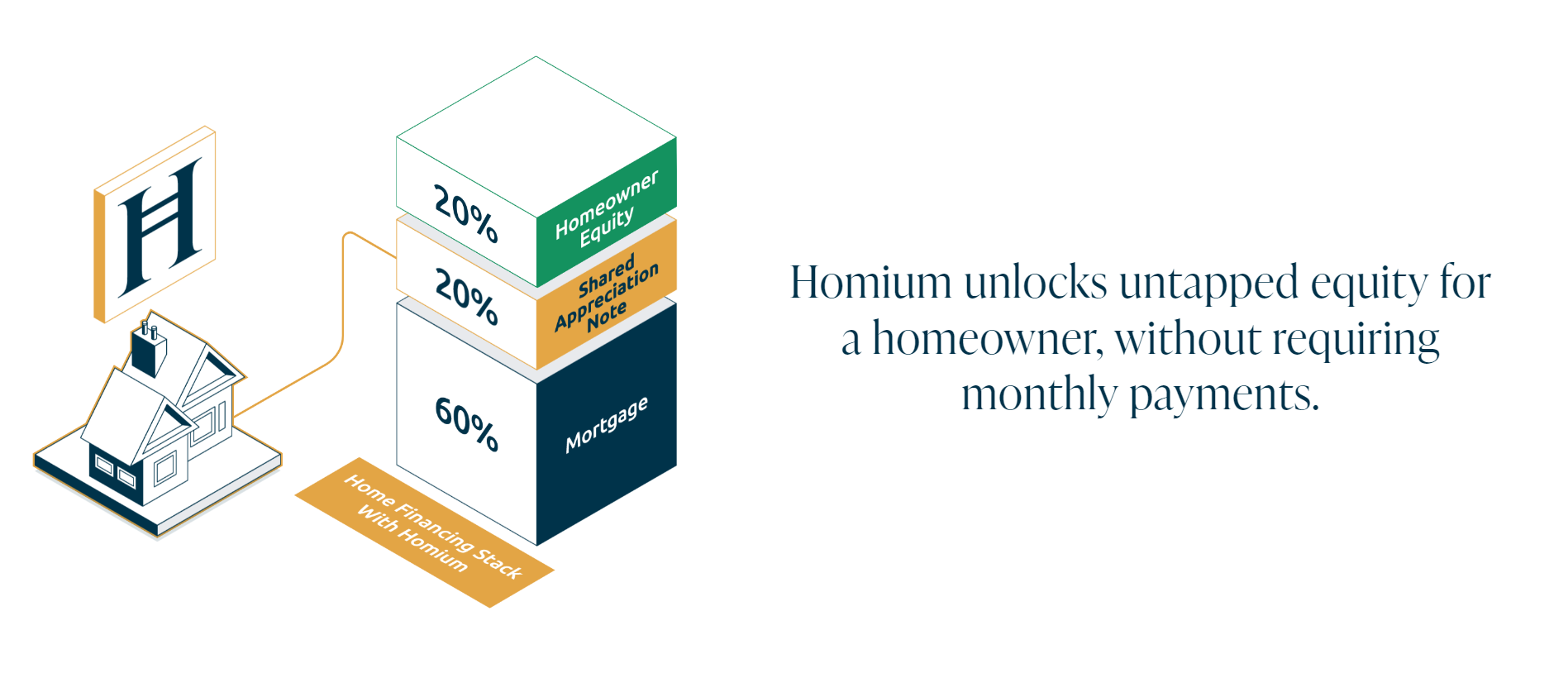

Avalanche announced the development on April 15, highlighting Homium’s unique approach to enabling homeowners to leverage their home equity without adding to their monthly debt obligations. Through shared appreciation home equity loans, homeowners can utilize their home’s future appreciation as collateral for various purposes such as maintenance, debt consolidation, or inheritance.

Homium issues tokenized home equity loans on Avalanche 🔺

The blockchain industry has seen a resurgence in focus on asset tokenization. Through shared appreciation home equity loans, @homium introduces a way for homeowners to borrow against their home equity without increasing… pic.twitter.com/X8execbAMv

— Avalanche 🔺 (@avax) April 16, 2024

Investors participating in Homium gain exposure to a tokenized asset representing the price appreciation of a pool of shared homes on the protocol. This introduces a new asset class for institutional investors, offering uncorrelated, inflation-protected returns within their portfolios.

Homium’s HELOC tokens are backed by second mortgage loans extended to owner-occupied single-family homes. These tokens, while built on distributed ledger technology, are categorized as debt securities compliant with the United States Securities and Exchange Commission’s Rule 144A, catering to private placement for institutional investors.

CEO Tommy Mercein emphasized the significance of Homium’s technology, providing real-time visibility into each loan’s status within the pool and ensuring adherence to uniform underwriting standards. This facilitates instant securitization of the notes from their inception, offering investors diversified exposure to home price appreciation by state.

Homium’s initial home tokenization loans are accessible in Colorado, demonstrating the protocol’s gradual expansion and adoption within the United States real estate market. Avalanche’s commitment of $50 million towards on-chain tokenization protocols, particularly focusing on real estate and digital collectibles since July 2023, underscores the growing potential and interest in tokenization solutions.

With financial institutions like Citi acknowledging tokenization as the next “killer use case” in the crypto space, platforms like Homium are poised to drive further innovation and adoption in decentralized finance and asset tokenization.