In just two days, users withdrew over $200 million from the lending protocol Marginfi on the Solana blockchain. This exodus followed the sudden resignation of the platform’s CEO and allegations of misconduct from its competitors. On April 10, Edgar Pavlovsky announced his departure and the termination of all collaboration with Marginfi, including its analytical division, citing disagreements with the team regarding the project’s development.

I resigned from mrgn today. From working on marginfi, from the research arm, from it all.

It's a world class team — it really is — but I don't agree with the way things have been done internally or externally. I've said it many times and I'll say it again, but those of us who…

— edgar ◼️ (@edgarpavlovsky) April 10, 2024

Pavlovsky acknowledged the world-class expertise of the Marginfi team but expressed disagreement with the internal and external affairs of the company. Additionally, in a now-deleted tweet responding to inquiries about the launch timeline for the MRGN governance token, he stated his preference to “renounce any tokens,” sparking a strongly negative community reaction.

In response, the Marginfi team reassured users that Pavlovsky’s departure would not affect the platform’s offerings, and development efforts would continue. However, the company has not yet announced when MRGN will be launched.

It is with mixed emotions that we confirm @edgarpavlovsky’s resignation from @mrgngroup, contributing to marginfi.

We want to assure the community that the core contributors, the company, and our investors are actively engaged to ensure a smooth transition.

As of this…

— marginfi ◼️ (@marginfi) April 10, 2024

Pavlovsky’s departure followed disputes with users and accusations from competing projects that Marginfi failed to meet its own standards. The SolBlaze protocol team alleges that Marginfi was unable to issue additional BLZE tokens to its users, resulting in eight days of interest payment delays to BLZE depositors.

After a further investigation by marginfi's engineering team, they have found that the BLZE emissions on bSOL and BLZE deposits were not running for around 8 days. The marginfi team plans to reimburse users for the emissions that they did not receive over the last 8 days.

— 🔥🪂 SolBlaze.org | Stake with us! (@solblaze_org) April 11, 2024

Marginfi co-founder Macbrennan Pitt refuted the allegations, stating that the platform consistently paid BLZE creditors and borrowers amounts exceeding requirements. He attributed recent emission delays to blockchain congestion, which occurred only in the last three days.

In turn, the founder of the Solend protocol claimed that Marginfi engaged in unfair competition tactics, spreading inaccurate information about Solend’s total value locked (TVL) and attacking the project’s price oracles.

last july, marginfi attempted to blackball solend with peers, which we found out through backchannels. they spread falsehoods:

– "all solend TVL is alameda" (in fact, alameda had no deposits)

– "solend v2 has no TVL, it's all in v1" (in fact, v2 was an in-place upgrade) pic.twitter.com/4uBxyEDU8e— Rooter (@0xrooter) April 11, 2024

Notably, Solend announced an airdrop for users depositing funds withdrawn from Marginfi into its protocol.

Solend will airdrop to users who withdraw from marginfi and deposit into Solend.

— Solend (@solendprotocol) April 10, 2024

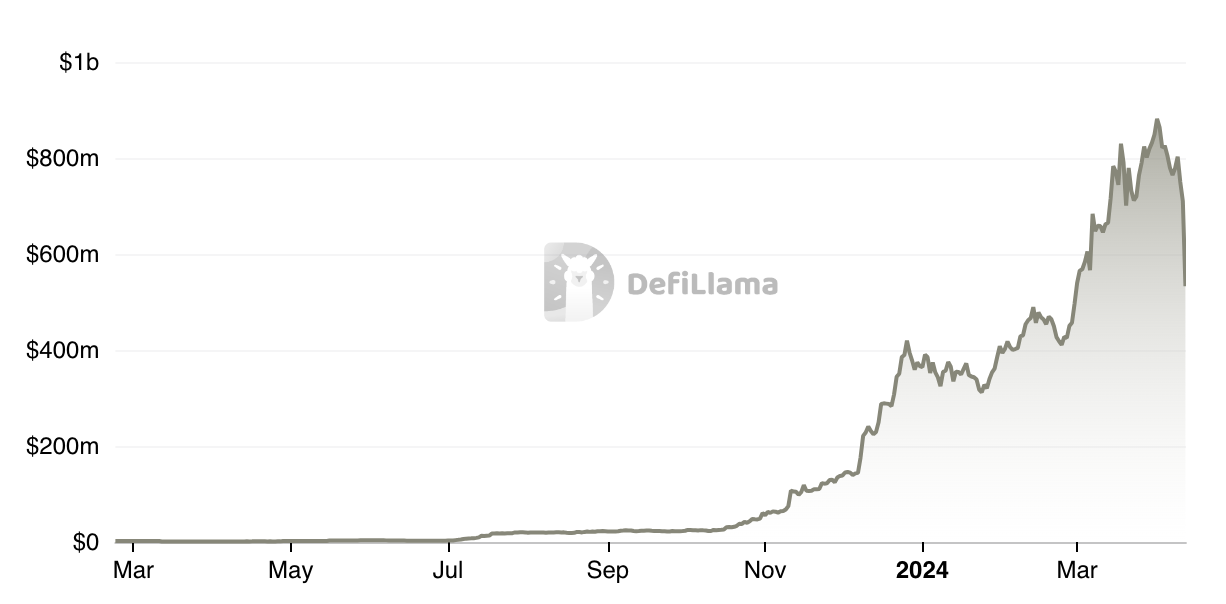

Consequently, Marginfi’s TVL decreased to $531 million at the time of writing, according to DeFiLlama data.