A contentious proposal put forth by the SushiSwap team to overhaul the decentralized exchange’s treasury structure appears poised for implementation despite widespread opposition on social media.

The proposal, introduced on March 26, seeks to transition SushiSwap into a “Labs model” to streamline operations and expedite protocol development. However, it includes a controversial tokenomics overhaul that involves transferring approximately 25 million SUSHI tokens, valued at around $42.5 million, from the decentralized autonomous organization (DAO)-controlled Sushi Treasury to Sushi Labs.

Under the proposed changes, Sushi Labs would receive a grant of 25 million SUSHI tokens, incorporating assets from various sources such as the Arbitrum airdrop, business development, partner grants, Kanpai 2.0, Sushi 2.0, rewards, stablecoins, and ‘Sushi House’ funds. This move would introduce a singular mint of tokens to bolster liquidity and fortify the Treasury with a 1.5% APR.

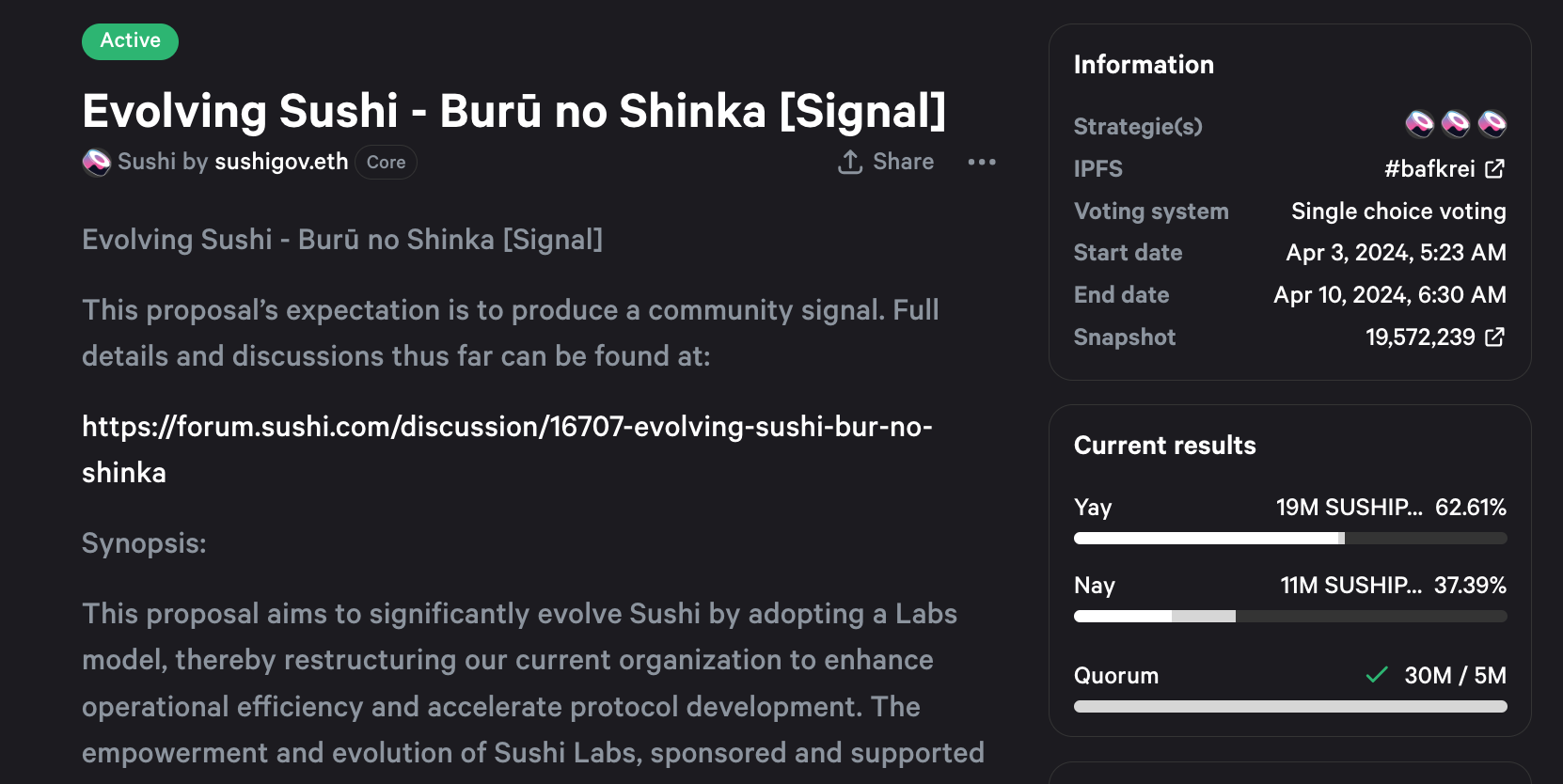

With the current maximum supply of 250 million SUSHI tokens, the proposal has stirred significant debate within the community. Voting commenced on April 3 and is scheduled to conclude on April 10, with around 29 million SUSHI tokens pledged so far, surpassing the required quorum.

Initially, voting was evenly split between supporters and opponents, but recent developments have tilted the balance in favor of the proposal. Notably, the Sushi Labs team, as proponents of the proposal, pledged 5.5 million tokens in favor. However, criticisms have surfaced, with accusations of self-voting and manipulation tactics.

Former SushiSwap contributor Naïm Boubziz alleged that the team voted for themselves using the protocol’s multisignature wallet and borrowed money to increase their voting power temporarily.

#Sushsiwap : Lol .

Sushiswap voted for themselves with the Ops multisig wallet.

Does this seem clearer to you now? https://t.co/NHtOQOXtt9 pic.twitter.com/OlDPSJ0BfN

— Naïm Boubziz (@BrutalTrade) April 8, 2024

In response, Sushi “Head Chef” Jared Grey defended the team’s actions, citing legal counsel’s advice and the need to counter potential hostile takeovers.

There are no lies. After consulting our legal counsel, I directed the operations team to execute the YAY vote with the OPs wallet and its holdings due to the threat of a hostile takeover. You're sharing screenshots of statements made by team members from chats where you are not…

— Jared Grey (@jaredgrey) April 8, 2024

The controversy surrounding the proposal adds to SushiSwap’s tumultuous history, marked by power struggles and internal conflicts since its launch in 2020. Despite initial success, the protocol faced challenges, including a reported rug-pull attempt by its founder, “Chef Nomi,” leading to ongoing turmoil within the community.

At present, SUSHI token trades at $1.70, marking a significant decline from its all-time high in March 2021.