Frax Finance, a decentralized finance (DeFi) lending platform, has recently approved a significant community proposal. This proposal greenlights the allocation of $250 million from Ethena Labs’ USDe to a novel liquidity pool, marking a pivotal step in the project’s Singularity Roadmap.

The approved proposal sets the stage for the establishment of an automated market operation (AMO). This operation will facilitate the minting of new FRAX tokens, leveraging overcollateralized debt. Notably, the proposal gained approval on April 5, signaling a key milestone for Frax Finance.

Ethena Labs, in an April 8 X post, highlighted the significance of this move, emphasizing that it will result in the creation of one of the most substantial liquidity pools in the DeFi sphere. Moreover, it will enable Frax to diversify its backing yield, enhancing its overall resilience.

Excited to share the approval of FRAX's singularity roadmap proposal, which includes an allocation towards a USDeFRAX POL via the Curve AMO with a $250m USDe ceiling pic.twitter.com/eM9T4Cjm22

— Ethena Labs (@ethena_labs) April 8, 2024

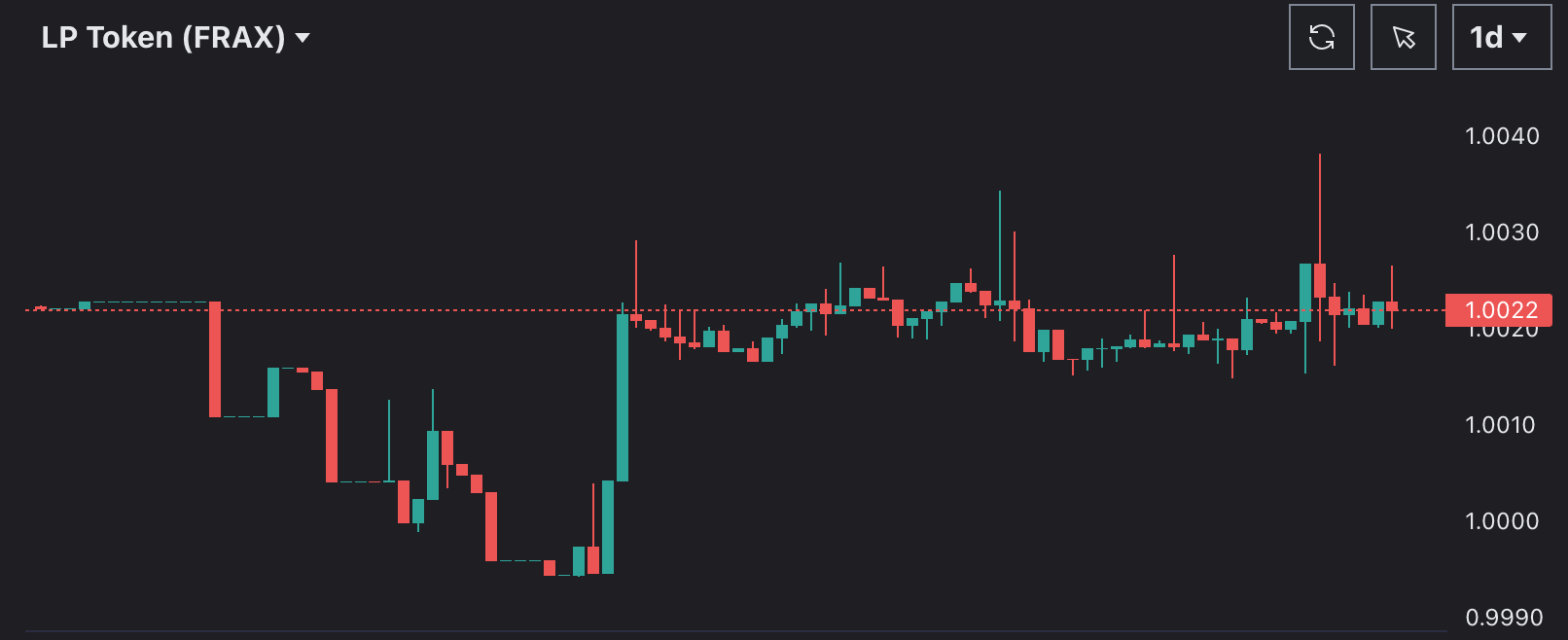

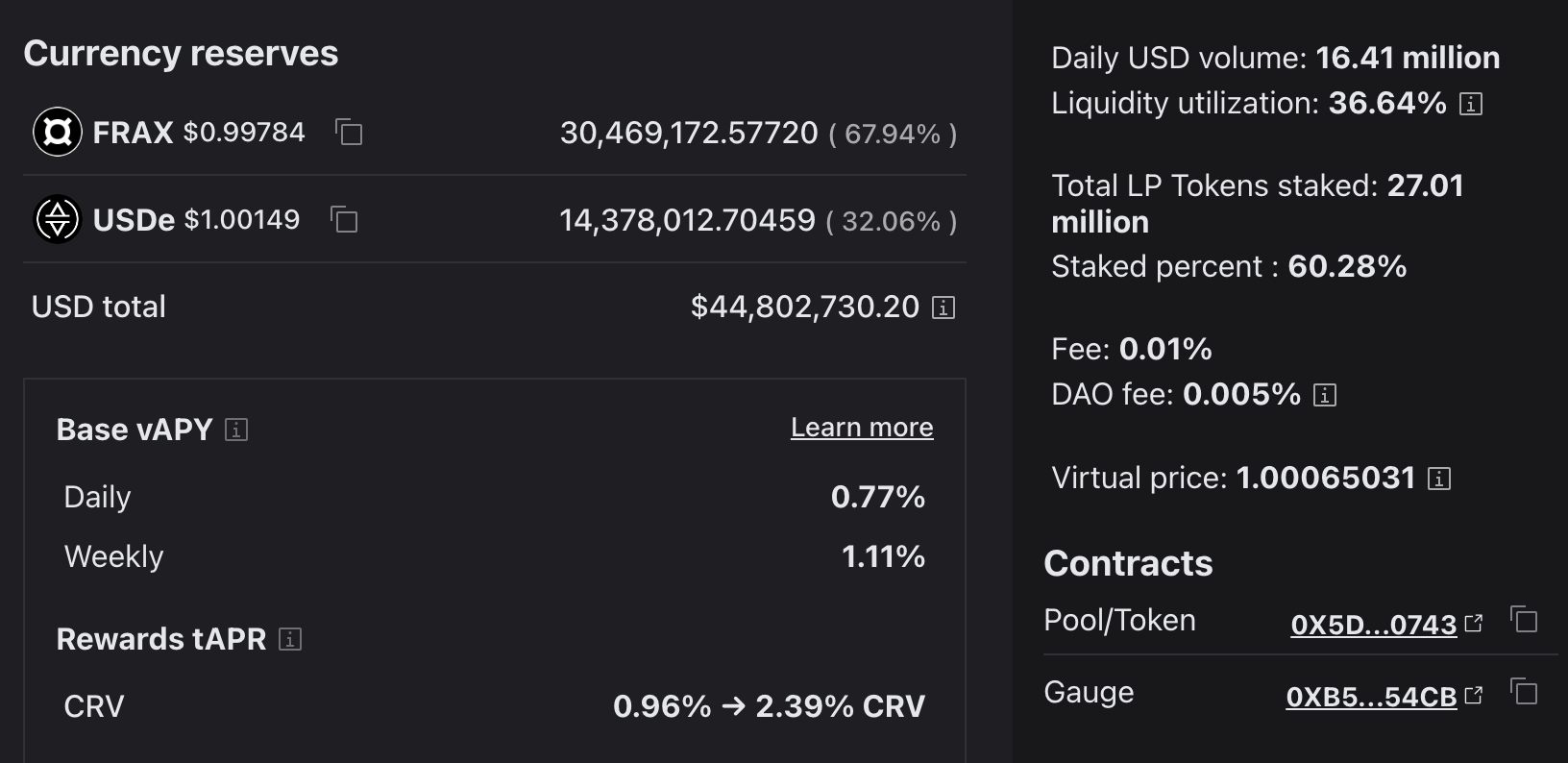

According to data from Curve Finance, the newly established Curve-based liquidity pool already boasts significant value. As of the latest available data, it holds approximately $44.8 million in liquidity, with a substantial portion allocated to FRAX coins and the USDe synthetic dollar.

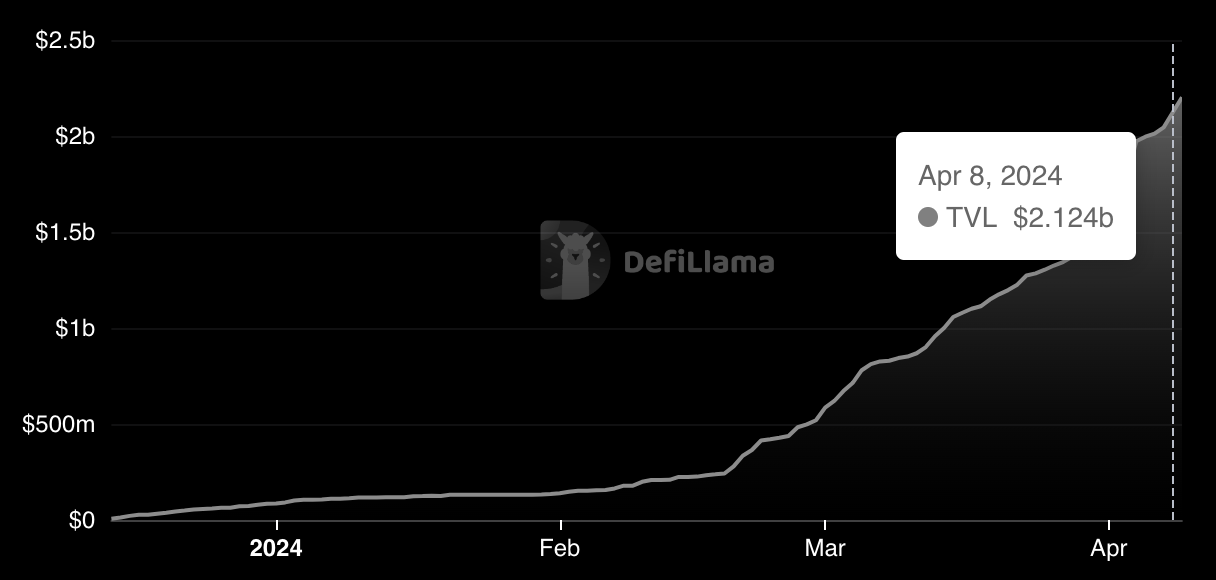

Ethena Labs has rapidly gained traction in the DeFi landscape, surpassing the $2 billion mark in total value locked (TVL) on April 6, according to DeFiLlama. This achievement comes less than two months after the launch of USDe on the mainnet in February 19, showcasing the platform’s growing prominence.

The protocol currently offers an attractive 37.1% annual percentage yield (APY) on USDe, attracting over 125,300 investors, as stated on its homepage.

In a strategic move to enhance scalability, Ethena Labs recently announced the addition of Bitcoin backing to its USDe synthetic dollar. This initiative aims to further solidify its position in the market, following its substantial growth and success.

Excited to announce that Ethena has onboarded BTC as a backing asset to USDe

This is a crucial unlock which will enable USDe to scale significantly from the current $2bn supply pic.twitter.com/FOZRWBrVZV

— Ethena Labs (@ethena_labs) April 4, 2024

Ethena Labs’ remarkable performance has garnered attention from prominent investment funds, with Delphi Ventures expressing strong conviction in the project. The platform’s potential to offer the highest dollar yield in the crypto space at scale is underscored by industry experts, positioning USDe as a contender to become one of the largest dollar-backed assets.

In summary, Frax Finance’s integration of a $250 million USDe allocation into its liquidity pool signifies a significant leap forward in the realm of DeFi liquidity. With the backing of Ethena Labs and growing community support, the project is poised for further expansion and innovation in the decentralized financial landscape.