Pendle Finance, an Ethereum-based yield trading protocol, has been making significant waves in the DeFi space, experiencing a surge in both adoption and protocol activity. Since the beginning of the year, PENDLE has seen an impressive 502% surge to new all-time highs, reflecting its substantial growth momentum.

One key feature that sets Pendle apart is its unique approach to yield farming, which involves dividing assets into Principal Tokens and Yield Tokens. This innovative framework allows users to trade tokens while earning substantial yields, with rates reaching as high as 47% on the underlying assets.

The recent surge in Pendle’s activity can be attributed to several factors. Firstly, the increased Ethereum liquid restaking activity and airdrops from DeFi protocols like Ether.Fi have contributed to heightened interest and adoption of Pendle. Many users have been depositing their eETH tokens from Ether.Fi on Pendle Finance in anticipation of upcoming airdrops from protocols like EigenLayer.

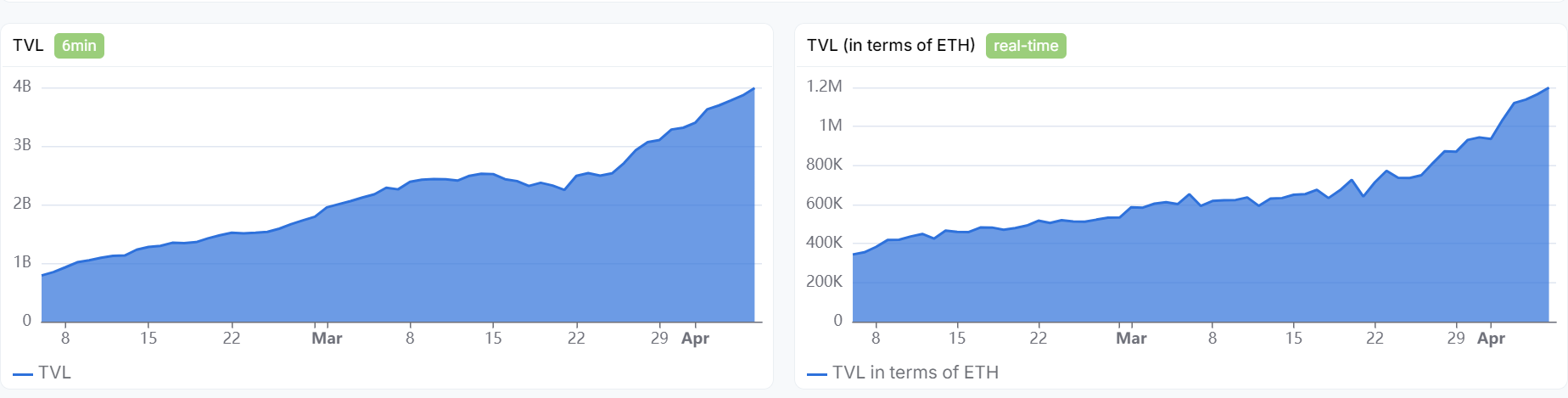

Additionally, Pendle recently raised the cap for its Ethena’s USDe pool to 400 million, further driving protocol activity. As a result, Pendle’s total value locked (TVL) has surpassed an impressive $4 billion, marking a staggering increase of over 1,500% since the beginning of the year, according to Sentio.

Furthermore, Pendle’s trading volume has soared to $10.5 billion, with most of the trading activities occurring on Ethereum. However, the platform is also gaining traction on Layer-2 networks such as Arbitrum and Mantle.

The exponential growth of Pendle has solidified its position as the largest DeFi yield protocol in the space. This remarkable rise has caught the attention of industry experts, with BitMEX’s co-founder Arthur Hayes declaring Pendle as “the future of DeFi.”

“The future of DeFi is $PENDLE. Yachtzee b*****s 😘😘😘😘😘”

Overall, Pendle Finance’s innovative approach to yield farming and its rapid growth trajectory position it as a significant player in the evolution of decentralized finance.