Following a hack that resulted in a loss of $11.6 million on March 28, Prisma Finance has outlined a strategy to resume the Prisma protocol’s operations safely. This plan involves seeking consensus through a vote to unpause the protocol and re-enable borrowing capabilities.

On April 3, Frank Olson, a core contributor to Prisma Finance, proposed a method to cautiously unpause the Prisma protocol, allowing users to deposit liquid staking tokens (LSTs) and liquid restaking tokens (LRTs) and borrow overcollateralized stablecoins.

New Snapshot Vote: [PIP-036] 🌈

As we progress towards unpausing Prisma, the next step involves this Snapshot vote. This will bring us closer to re-enabling the ability for our users to deposit LSTs & LRTs and borrow our overcollateralized stablecoins.

Your participation is… pic.twitter.com/pG81WpFVN3

— Prisma Finance (@PrismaFi) April 4, 2024

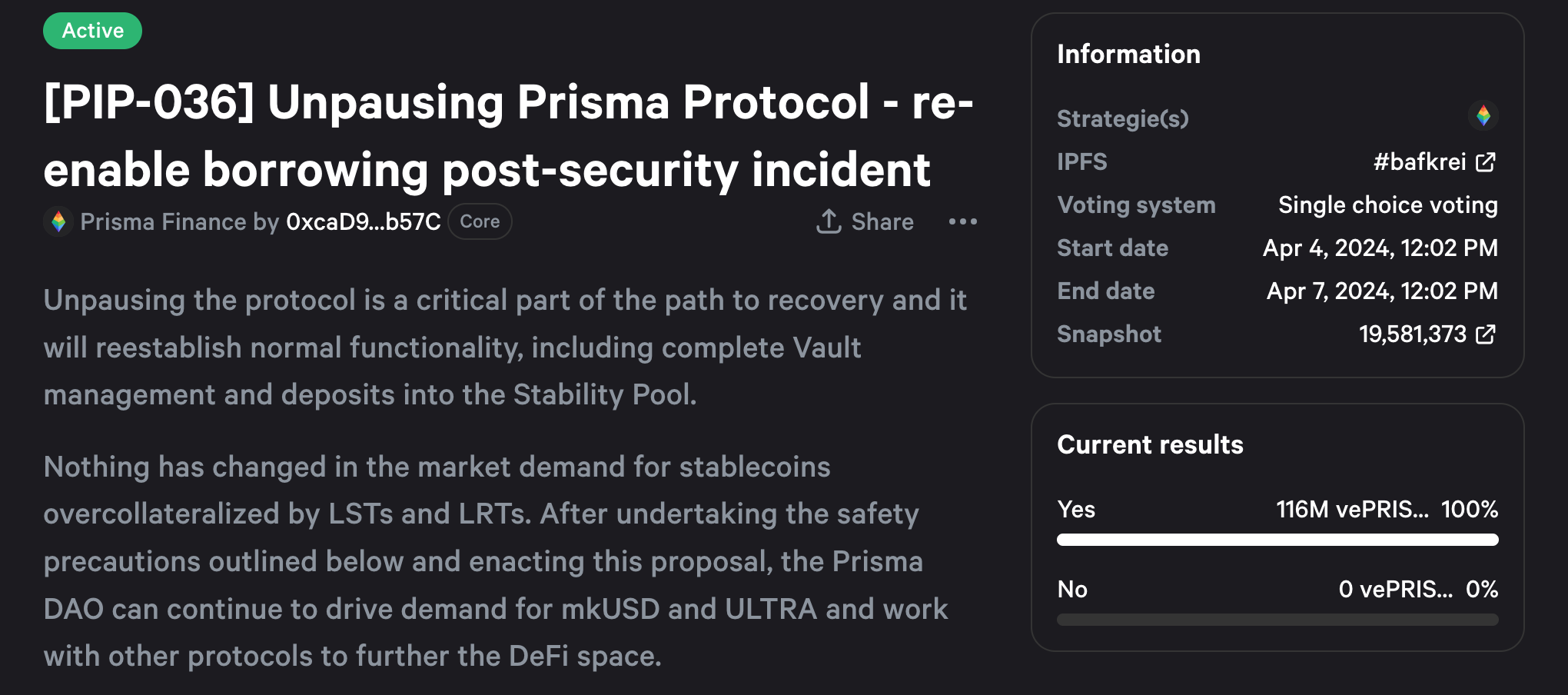

Subsequently, the Prisma Finance DAO initiated a four-day governance vote starting the following day, scheduled to conclude on April 7. According to Olson, resuming the protocol’s operations is crucial for the recovery process and will restore normal functionality, including complete Vault management and deposits into the Stability Pool.

At present, the proposal to re-enable borrowing on Prisma has received unanimous “Yes” votes from participating members of the DAO, indicating robust community backing. However, the final decision will be made after the voting period ends.

Users have been advised to revoke delegate approvals for open positions, as unpausing the protocol could potentially result in fund losses. It was previously reported that 14 accounts had yet to revoke the affected smart contract, posing a risk of cumulative loss amounting to $540,000.

Olson highlighted Prisma’s ongoing efforts to enhance security measures, including continuous auditing services, bug bounty programs, and security enhancements.

In a separate development, non-fungible token (NFT) game Munchables has devised a plan to prevent a recurrence of a recent incident where it lost and subsequently recovered nearly $63 million due to the actions of a rogue in-house developer. This plan involves collaborating with investment firm Manifold Trading, market maker Selini Capital, and blockchain investigator ZachXBT as new multisig signers to ensure the safety of users’ funds.

We’re on the final steps with the lockdrop refunds.

As part of our next phase, we have restructured the team completely.

We have brought in established and trusted entities to help upgrade the security of the project's funds and smart contracts.

— Munchables (@_munchables_) April 1, 2024

Additionally, Munchables intends to allocate ETH and future MUNCH donations to those involved in the recovery process, acknowledging their role in safeguarding user assets.