Up to $24 million worth of tokenized staked Solana (stSOL) has become unintentionally locked on the liquid-staking platform Lido due to a malfunctioning smart contract.

The liquid-staking service provided by Lido on Solana, which offered users a 5% yield for staking any amount of SOL, was discontinued in October 2023 due to unsustainable financials and low fees.

Since February, users have been left with the only option of manually unstaking their Solana tokens via Solana’s command line interface (CLI), as the user-friendly front end for unstaking was sunset.

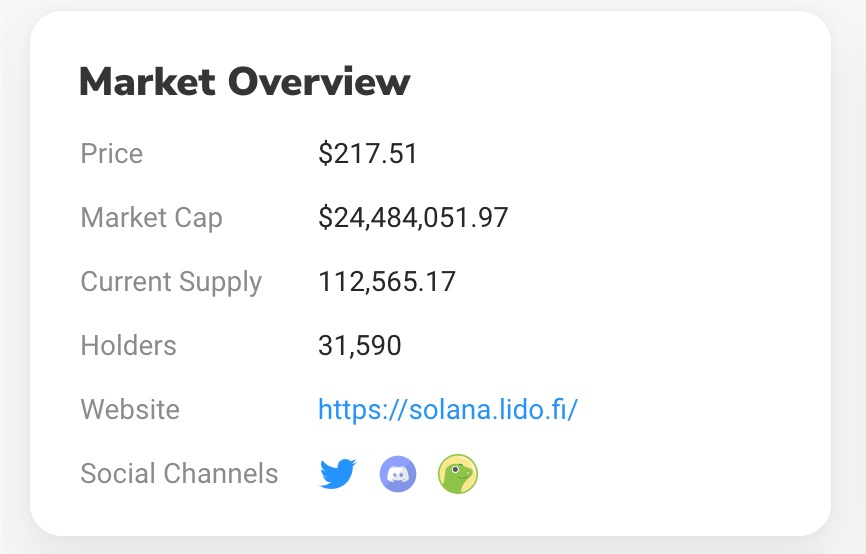

However, many users have found the CLI process too complex, leading to frustrations voiced on Lido’s Discord channel in March. Solscan data reveals that approximately $24 million worth of stSOL remains in circulation across 31,588 holders.

Some users have reported encountering difficulties with the unstaking process despite following instructions provided by Lido.

the solana channel of the lido discord is a mess

stSOL holders trying to unstake completely lost and abandoned, CLI tooling broken.

there is over $24m of SOL stuck in stSOL.

i know stSOL is depreciated, but i don't think this the right way to treat your users @LidoFinance

— j | sanctum (@eggpanned) March 29, 2024

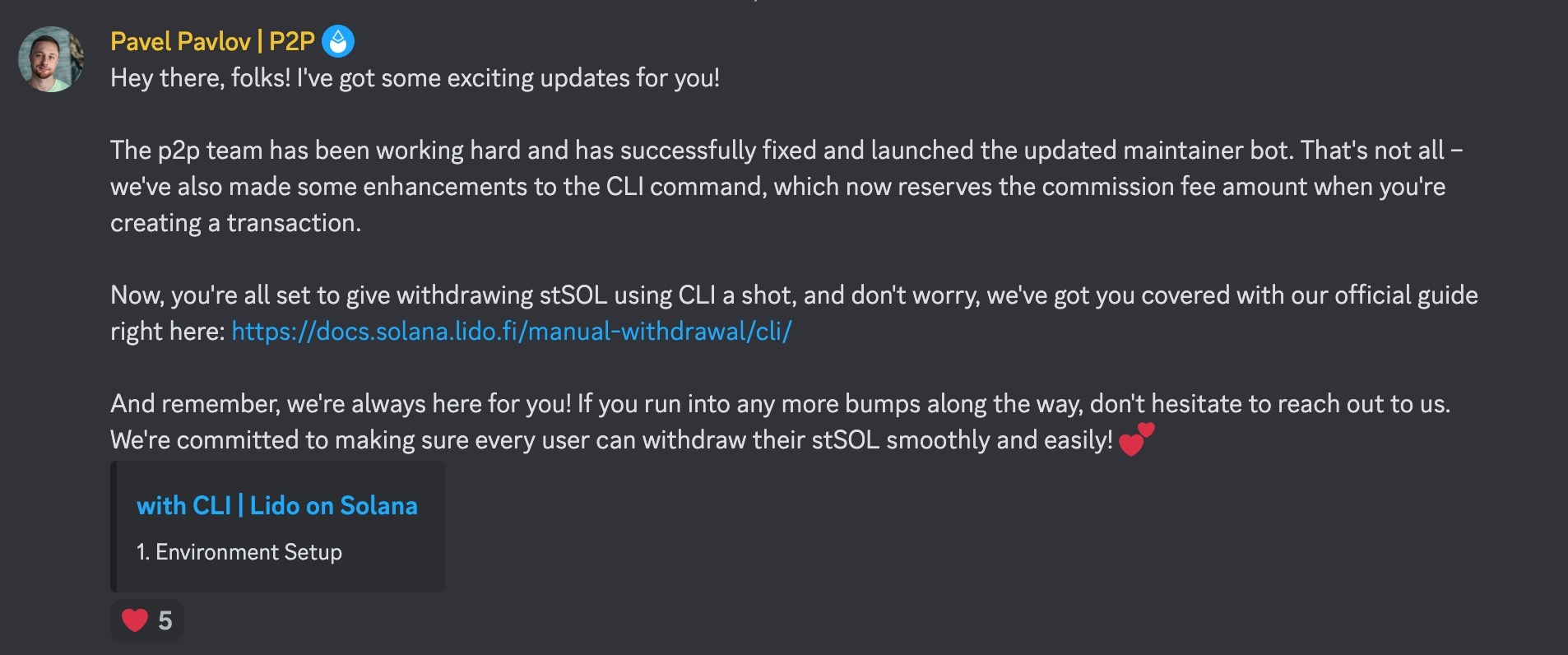

In a Discord message on March 30, Pavel Pavlov, a product manager at P2P Validator — the team formerly associated with Lido on Solana — disclosed that the withdrawal function’s smart contract had an issue related to alterations in the Rent-Exempt Split logic.

Pavlov explained that while the issue has been identified, P2P Validator has limited influence in the situation and is reaching out to the Lido DAO to potentially change the smart contract.

An update on the Lido Solana Discord page confirmed that the p2p team had fixed and launched an updated maintainer bot, allowing stSOL withdrawals using the CLI. However, changing the smart contract is complex and time-consuming, and the team is exploring multiple avenues for resolution without providing specific timelines.

In the meantime, some users have suggested using on-chain stability protocol Sanctum or Jupiter to swap stSOL for SOL or other liquid staking tokens as a potential workaround.