MakerDAO, the decentralized lending platform and issuer of the DAI stablecoin, has greenlit an executive proposal that introduces several modifications to the protocol.

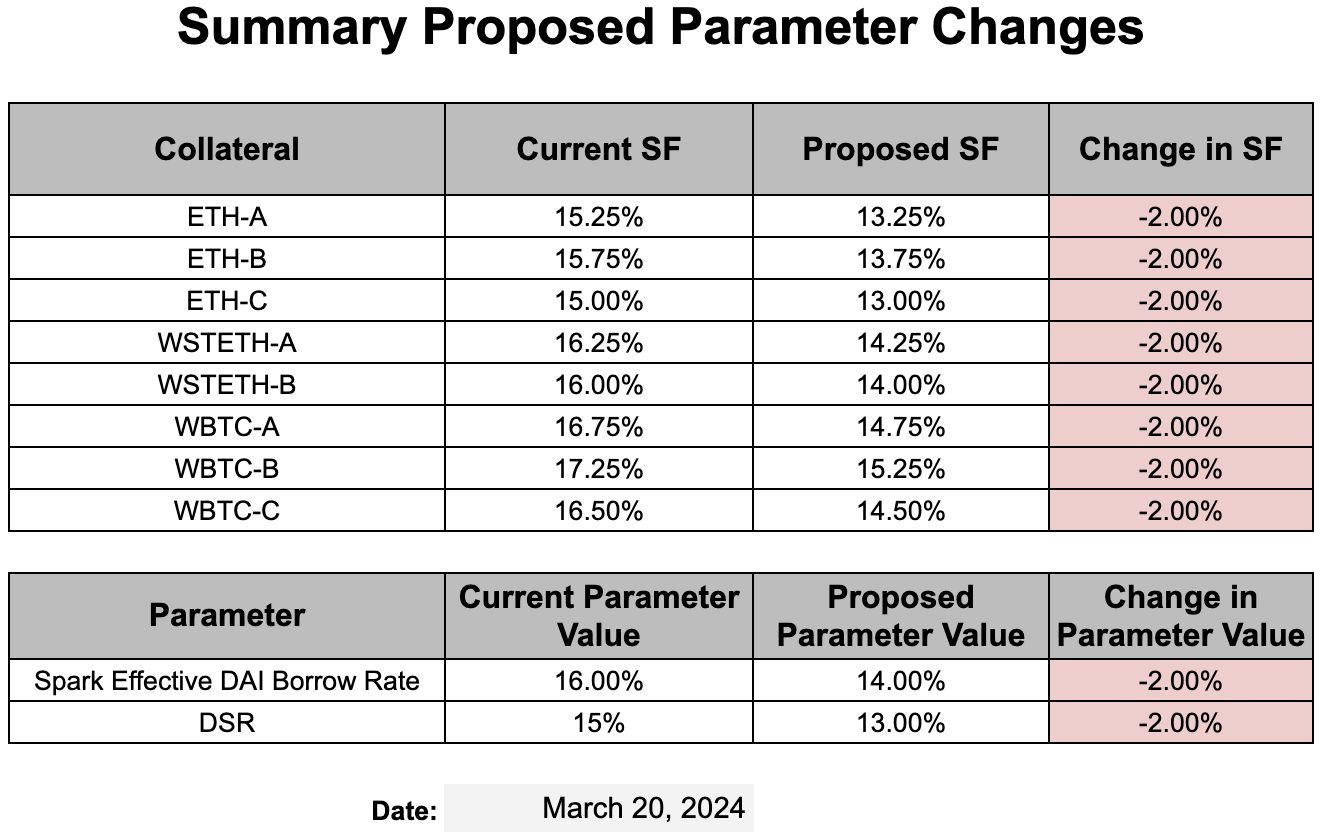

The changes encompass a reduction of stability fees by 2 percentage points for assets such as ETH, stETH, BTC, and WBTC. Additionally, the debt ceiling for SparkLend is set to increase to $2.5 billion from $1 billion, with $100 million allocated to DAI liquidity pools on Morpho through Spark. Moreover, the DAI savings rate will decrease to 13% from 15%, among other adjustments.

The decision to lower stability fees follows less than a month after MakerDAO’s vote on March 10, where fees were raised by 140% to counteract a surge in DAI demand.

“Maker stakeholders should understand that further changes are likely to be introduced in the near future, which is highly dependent on the development of market dynamics, including prices, leverage demand and external rate environment including CeFi funding rates and DeFi effective borrowing rates,” stated BA Labs, the entity behind the proposal.

The approved proposal also includes an expansion of SparkLend’s debt ceiling to $2.5 billion from $1.5 billion, aiming to accommodate the current $614 million borrowed on Spark, according to DeFiLlama.

In alignment with their strategic vision, MakerDAO is dedicating $100 million DAI towards the establishment of the Spark DAI Morpho Vault. This new DAI market will provide investors with access to Ethena’s USDe and sUSDe stablecoins, furthering MakerDAO’s initiatives.