Ethena, a decentralized finance (DeFi) protocol renowned for its $1.3 billion USDe token, has announced plans to introduce its governance token through an airdrop scheduled for April 2nd, as outlined in a recent blog post.

The protocol intends to distribute 750 million ENA tokens, constituting 5% of the total token supply. To qualify for the token airdrop, users must participate in a campaign to earn “shards,” with the deadline set for April 1st. Individuals who unstake, unlock, or sell all their USDe before this cutoff date will not be eligible for the airdrop.

We are excited to announce the first step in decentralizing the Ethena protocol with the launch of: $ENA pic.twitter.com/Xs7vvfmEEP

— Ethena Labs (@ethena_labs) March 27, 2024

Claiming of the tokens will commence the following day, coinciding with ENA’s listing on centralized exchanges, according to the blog post. Subsequently, Ethena plans to initiate a new campaign featuring fresh incentives for the subsequent phase of the airdrop.

Ethena’s USDe token, often termed as the “synthetic dollar,” provides investors with consistent yields by utilizing ether (ETH) liquid staking tokens like Lido’s stETH as collateral, paired with an equivalent value of short ETH perpetual futures positions on derivatives exchanges to maintain a target price of approximately $1. This strategy, known as a “cash and carry” trade, leverages derivatives funding rates to generate yield.

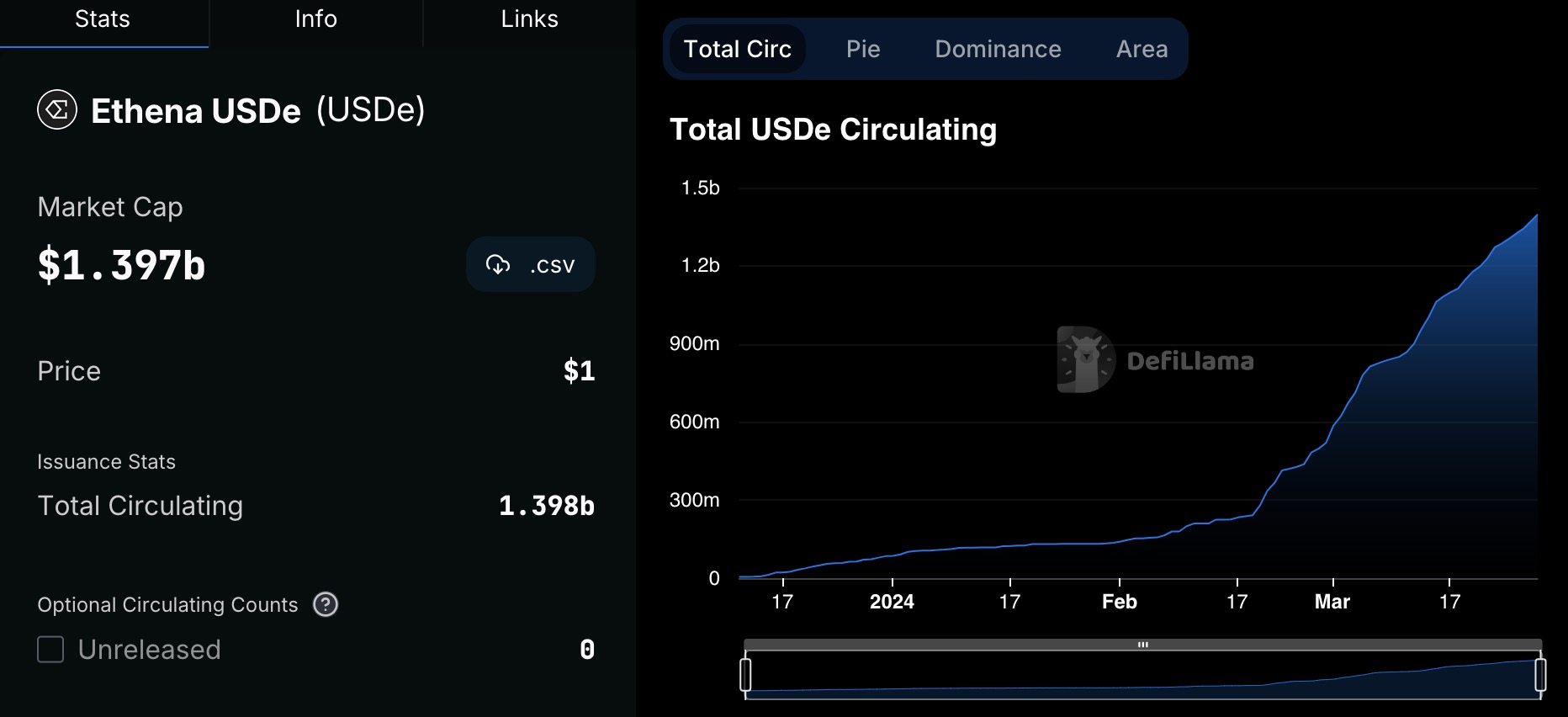

The USDe token within the protocol has experienced significant growth recently, surging from $85 million at the beginning of the year to over $1.3 billion, as per DeFiLlama data.

This surge is attributed to its attractive yield in the midst of buoyant crypto markets, coupled with anticipation surrounding the forthcoming airdrop.