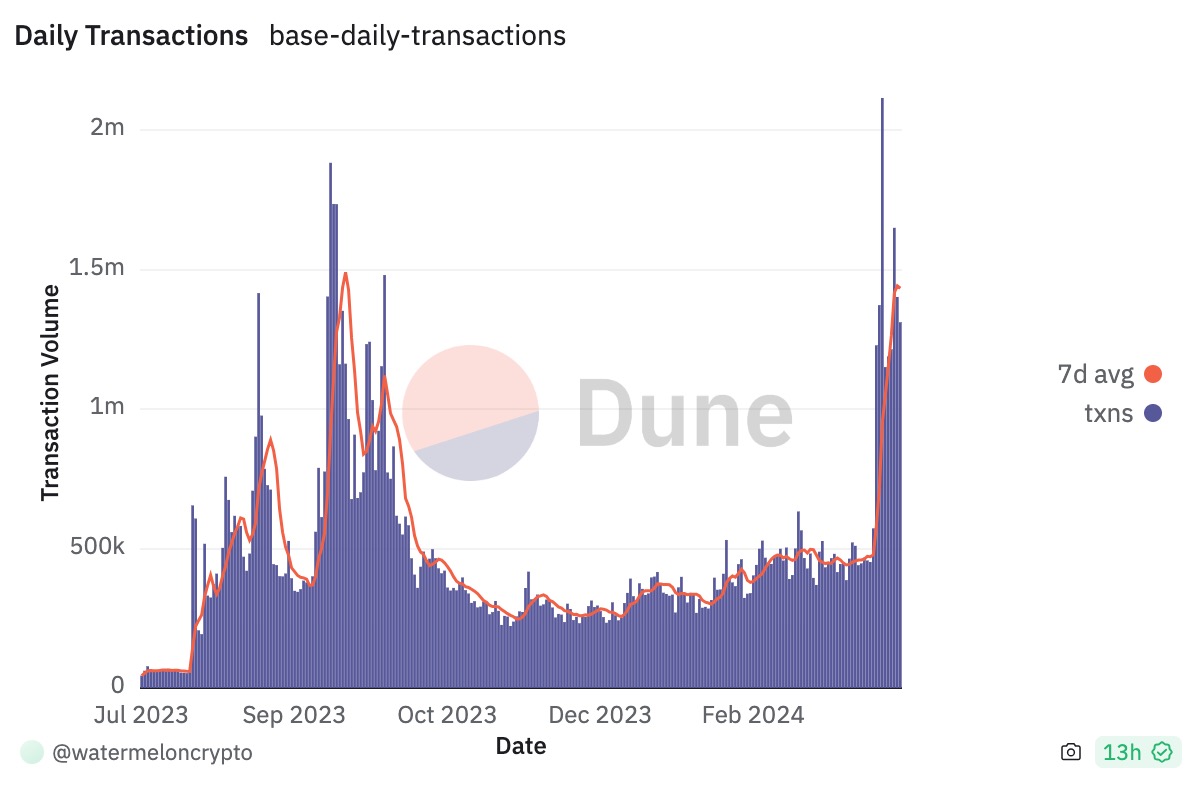

Activity on Base, the Layer 2 network built by Coinbase on Ethereum, has experienced a significant uptick, processing over one million transactions daily for the past week, according to Dune.

This surge in activity is attributed to memecoin traders and bots, who are less sensitive to transaction fees, according to Michael Silberling, a data analyst at Optimism Labs.

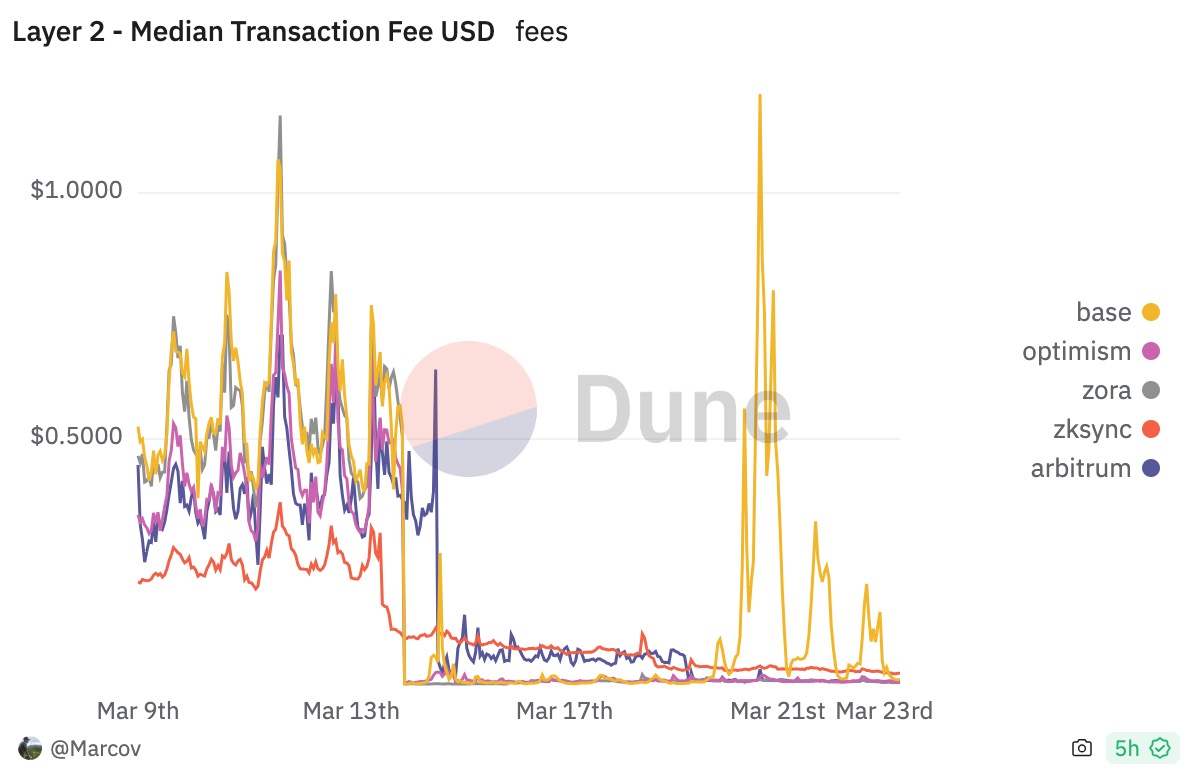

Past midnight UTC, and we can look back on the first major OP Chain fee spike Post-4844:

– Base saw a rush of activity from transactors that were ~seemingly not fee sensitive.

– When L2 congestion pricing kicked in, activity didn't start to decline until L2 gas hit 4 gwei (!?!) pic.twitter.com/DxfB8LSPcP— Michael Silberling (@MSilb7) March 21, 2024

The rush of activity coincided with the deployment of Ethereum’s Dencun upgrade on March 13, which substantially reduced transaction costs on Layer 2 networks. Despite the overall reduction in fees, the increased activity led to a spike in transaction costs on Base, according to Dune.

Meanwhile, the total value locked (TVL) on Base has nearly doubled over the past month, reaching $900 million as of March 22, according to DeFiLlama.

Aerodrome, the leading decentralized exchange on the network, has seen its TVL surge by 180% to $340 million during this period, following an investment from the Base Ecosystem Fund led by Coinbase Ventures.

The Base Ecosystem Fund, led by @cbventures, was launched to invest in the next generation of onchain projects building on @base.

We're excited to announce that the Base Ecosystem Fund has market acquired a $AERO position. Together we'll build the future of @base. pic.twitter.com/9b01vw28tg

— Aerodrome (@aerodromefi) February 26, 2024

Trading volumes on decentralized exchanges (DEXs) have also surged, hitting a record $394 million on March 19. Memecoins like DEGEN and NORMIE are driving most of this activity, as indicated by data from DexScreener.

With the growing momentum, discussions about a potential ‘Base season’ are gaining traction among enthusiasts, suggesting a potential shift in focus towards Base for speculative activities.

Probably time to run back much of the gambling we just did on Solana but on Base this time

— Sisyphus (@0xSisyphus) March 19, 2024