Thorchain has witnessed a notable surge in traders seeking zero-interest loans after the cross-chain liquidity protocol removed its collateral limit.

With the collateral cap lifted, the protocol now holds $120 million in ETH and BTC collateral, a significant increase from the previous $36 million.

On March 8, Thorchain announced the burning of 60 million of its native RUNE tokens, valued at $500 million, unlocking an additional $160 million in collateral capacity for ETH and BTC. This move led to approximately 2,000 BTC and 36,000 ETH becoming available for loans.

60m $RUNE was burned from the Standby Reserve, creating 20m RUNE ($140m) in space for lending collateral.

There is now room for ~2000 #Bitcoin or 36k ETH in THORChain lending. No liquidations, no interest.

Details on Medium: https://t.co/yLCdz13oyL pic.twitter.com/aNePxXpvLV

— THORChain (@THORChain) March 8, 2024

According to NineRealms, an institutional liquidity protocol for Thorchain, investors have deposited 1,005 BTC (equivalent to $67.3 million), up from 400 BTC on March 8. Additionally, there is now 15,279 ETH (approximately $53 million) locked up for loans, representing a 400% surge.

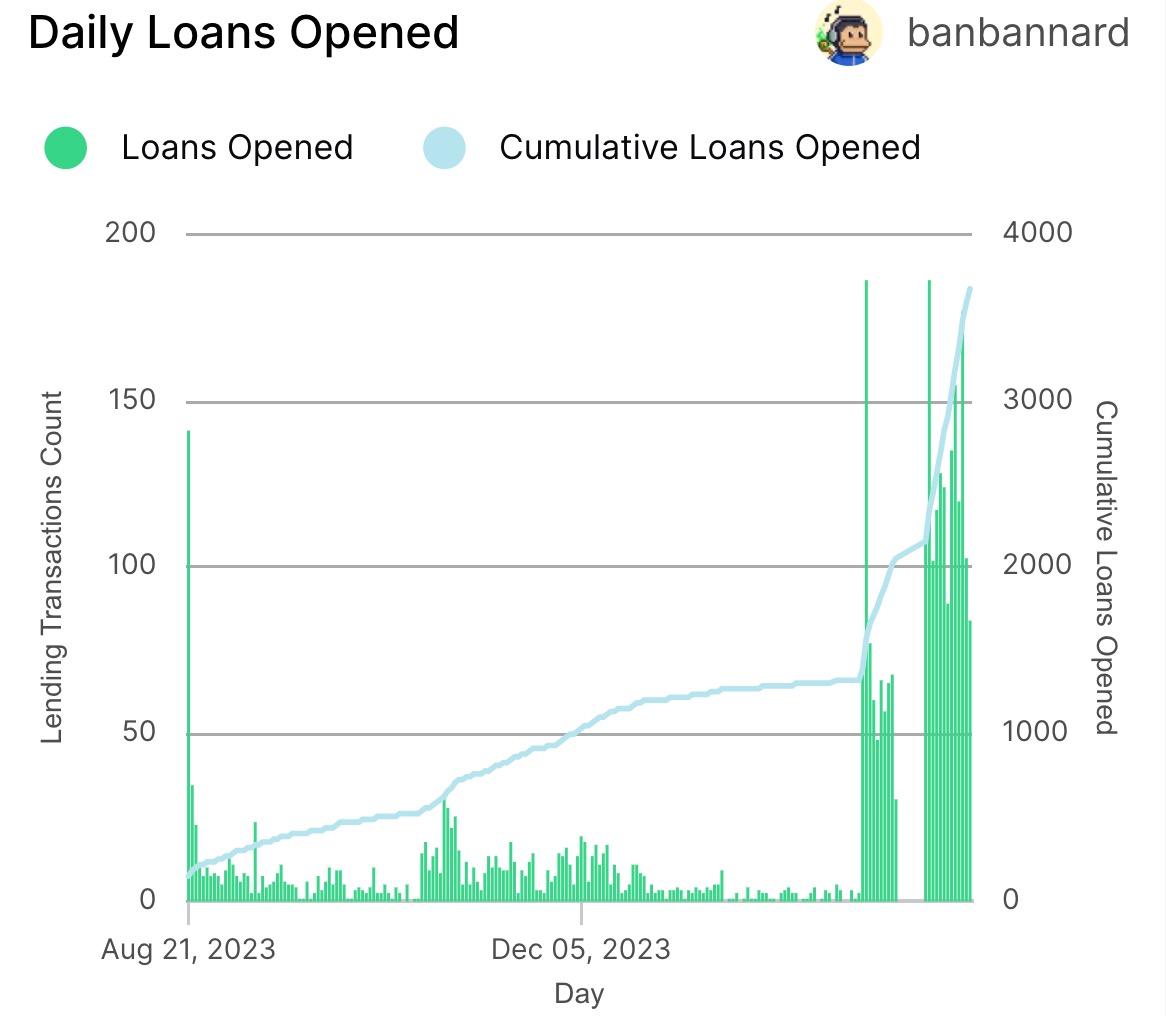

Activity across Thorchain, including trades, investments, borrowing, and lending, has seen a significant uptick. While loan volumes peaked immediately after the March 8 announcement, daily loans opened have consistently surged, reaching triple digits in ten of the past eleven days. Thorchain’s volume has also seen an increase this month, with its total value locked (TVL) surpassing $500 million on March 12.

Thorchain offers interest-free loans against major crypto assets like Bitcoin and Ether, without the risk of liquidations or fixed expiration dates. As part of the recent upgrade, collateralization ratios for BTC and ETH were reduced to 200%, allowing users to borrow up to half the value of their assets.

When a loan is initiated on Thorchain, the collateral asset is exchanged for RUNE, while the difference between the collateral value and the loan value is burned. Conversely, when loans are repaid, RUNE is minted and exchanged back for the original collateral asset, which is then returned to the borrower.

Thorchain’s attractiveness for loans has caught the attention of prominent crypto investor Fred Krueger, who is leveraging the platform to acquire more Bitcoin using a loan on his existing BTC holdings.

I'm doing a small scale test of borrowing BTC against my BTC using https://t.co/E1ytGwReYq

So far, I am liking what I am seeing.

— Fred Krueger (@dotkrueger) March 17, 2024

Despite some backlash from so-called Bitcoin maximalists, Krueger remains positive about his experience with Thorchain.

While Thorchain’s model differs from traditional lenders like BlockFi and Celsius, operating in the centralized finance (CeFi) sector, it still faces potential risks, including the possibility of excessive minting of RUNE tokens if a large number of borrowers seek to redeem their collateral simultaneously. Nevertheless, the allure of zero-interest loans against BTC and ETH seems to outweigh these concerns, driving increased adoption on the platform.

Thorchain’s transparent and decentralized nature, coupled with its stringent collateralization requirements, distinguishes it from its CeFi counterparts. However, the protocol remains vigilant against potential exploits and vulnerabilities as it continues to grow in popularity.