Ether.fi, a well-funded liquid restaking platform, initiated the distribution of 60 million ETHFI tokens on Monday, valued at approximately $210 million.

The Eligibility Checker has been updated and is now LIVE!https://t.co/dWjoxJIXTK pic.twitter.com/UafFBE6AIk

— ether.fi (@ether_fi) March 18, 2024

This kickstarts a series of anticipated airdrops in the restaking sector, following a frenzy of traders and DeFi hedge funds accumulating restaking points. However, the ETHFI token experienced a sharp decline of over 25% post-launch as points farmers opted to cash out their profits. At midday Monday, the token was trading around $3.50, according to CoinGecko.

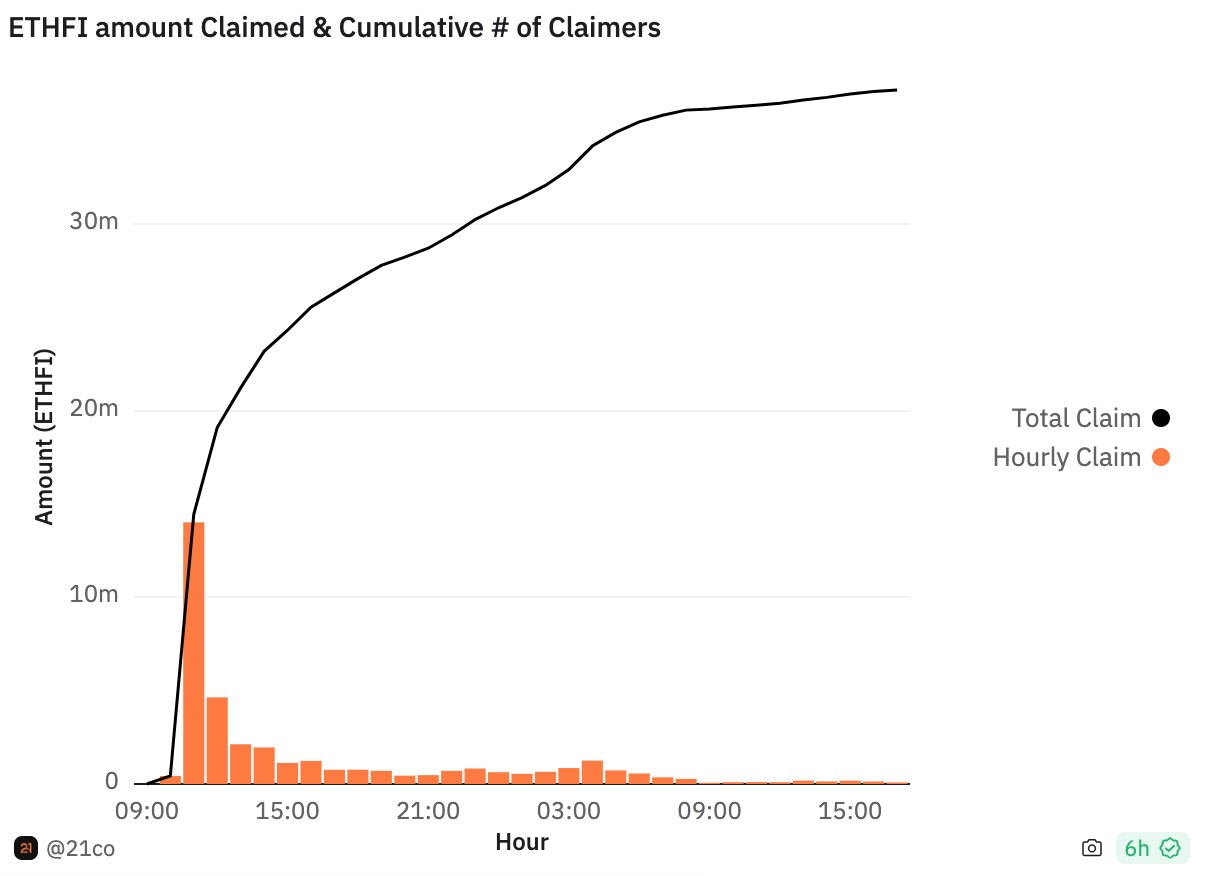

A reported 22 million out of the 60 million ETHFI tokens made available were claimed on Monday morning, according to a Dune dashboard. Notably, the Ether.fi protocol, including the airdrop, is inaccessible to residents of the United States.

In the crypto space, points have emerged as a popular mechanism for user acquisition. Protocols incentivize users with points for engaging in activities like asset movements within DeFi platforms, which are often perceived as determinants for future token airdrop allocations.

Points farming, particularly in the restaking sector, has sparked a wave of speculation and trading activities. Users are actively trading points associated with the restaking giant EigenLayer on platforms like Whales Market and leveraging their points exposure through yield tokens on DeFi applications like Pendle. Some DeFi asset managers have even begun accumulating tokens on behalf of investors.

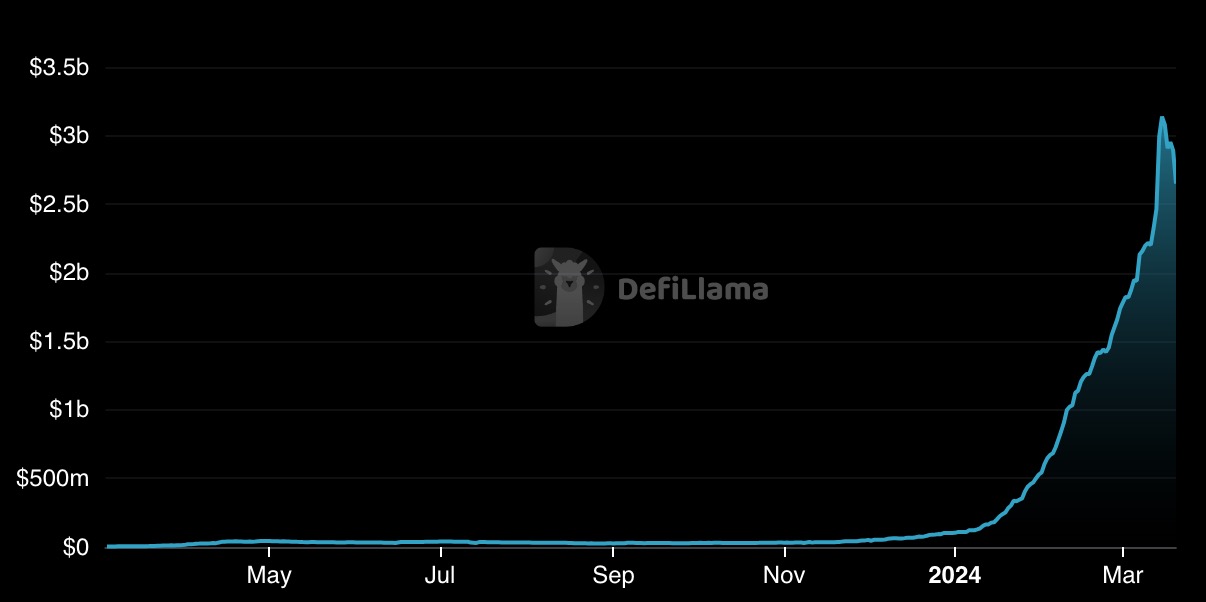

As a result of points farming, total value locked (TVL) across restaking protocols has surged dramatically in recent weeks. EigenLayer, for instance, has witnessed over $9 billion in TVL growth in the past month and a half, while Ether.fi’s TVL has quadrupled to nearly $3 billion, surpassing DeFi stalwarts like Compound and Curve.

ETHFI functions as a governance token, enabling holders to participate in decision-making processes regarding value accrual mechanisms and Ether.fi’s grants program. Approximately 11% of the token’s supply will be distributed via airdrop, with allocations earmarked for core contributors, the project’s treasury, and investors.

Ether.fi’s move follows a trend in the restaking sector to translate hype into tangible outcomes, especially as the underlying protocol, EigenLayer, is yet to launch on mainnet. Last week, the LRT project Swell announced plans to introduce a restaked rollup, an actively validated service (AVS) built on EigenLayer’s infrastructure.

While Ether.fi has hinted at future layer-2 development, the project’s current focus lies on scaling its new investment product, Liquid, and expanding the LRT project’s TVL, as confirmed by founder and CEO Mike Silagadze. Silagadze expressed relief that the airdrop process is concluded, allowing the team to concentrate on core objectives.