Aave has introduced its latest alignment reward program, Merit, which commenced today with an airdrop of 280 wETH to wETH borrowers.

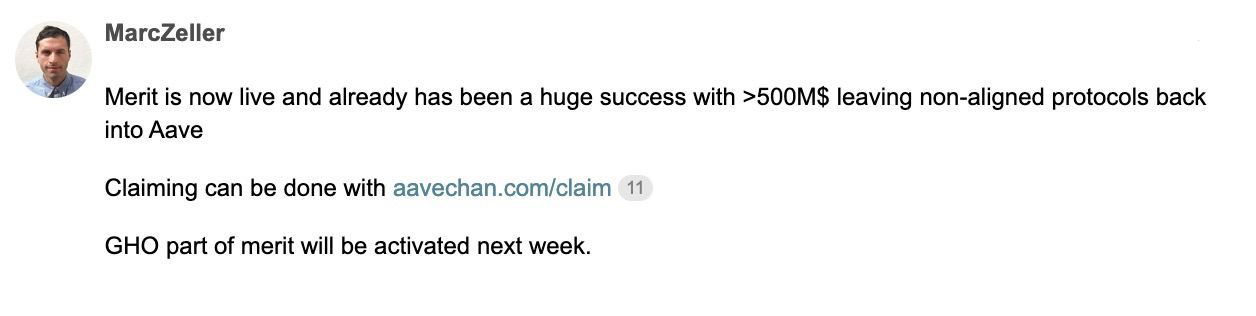

Next week, GHO borrowers and stakers can anticipate earning rewards through another airdrop.

As outlined in a press release, an initial $2.1 million in wETH and $2.9 million in GHO will be allocated over a 90-day period, with a proposal for extension scheduled for presentation to the Aave DAO in April.

Merit aims to incentivize actions beneficial to the Aave DAO, introducing a novel dynamic to the competitive landscape of the DeFi sector. It implements a booster-based reward mechanism allowing users to accumulate points gradually.

To maintain integrity, the system’s calculations remain confidential to deter manipulation. However, typical actions that may earn rewards include depositing liquid staked tokens, borrowing wETH and GHO, or holding stGHO (staked GHO).

Conversely, actions involving “non-aligned” protocols will face penalties, potentially resulting in severe dilution of up to -100%. Presently, Morpho Aave Optimizers v2 and v3 are the only protocols categorized as non-aligned.

Marc Zeller, the founder of ACI, justified this decision in a forum post, asserting that Morpho optimizers offer minimal yield improvements while siphoning potential revenue amounting to millions annually from the Aave protocol.

However, Paul Frambot, co-founder and CEO of Morpho Labs, disputed this claim, highlighting liquidity and revenue contributions to the Aave DAO as benefits of Morpho’s integration.

So. Aave is attempting to prevent the growth of Morpho by introducing Merit, a rewards program. Although I prefer to avoid drama/politics to focus on Morpho, I have been asked countless times to comment on this proposal. Hence, I will simply provide some clarifications on the…

— Paul Frambot | Morpho (@PaulFrambot) February 19, 2024

The introduction of Merit coincides with Gauntlet, one of Aave’s risk stewards, departing to assume a role as Risk Curator at Morpho Labs.

Despite these developments, Aave retains its status as one of the leading lending protocols in DeFi, boasting a total value locked (TVL) of $10.29 billion, according to DeFiLlama.

Meanwhile, Morpho, established in August last year, commands a TVL of $1.78 billion.