Blockchain security auditor Hacken has announced the tokenization of a portion of its equity capital.

According to the press release, holders of the native Hacken token (HAI) will have the opportunity to exchange their assets for Hacken Equity Shares (HES). As a result, Hacken has become the first cryptocurrency company whose community members can own a portion of the real business, as stated by the organization.

🔥 It's Official: $HES Now Live!

Step into a new investment dimension with Hacken Equity Shares (HES)

Available on #Ethereum, #BSC, and #VeChain, $HES is your ticket to pioneering RWA tokenization

Each $HES equals 0.1% of Hacken Entity, marking your direct stake in our growth pic.twitter.com/DRSRWzuANj

— Hacken🇺🇦 (@hackenclub) March 13, 2024

The tokenized equity capital represents 10% or 100 HES, according to the release. These assets have been issued on the Ethereum blockchain as tokenized shares.

The ratio of HES to HAI is 1:1 million. The company noted that tokenized shares are available at various fiat prices due to high volatility.

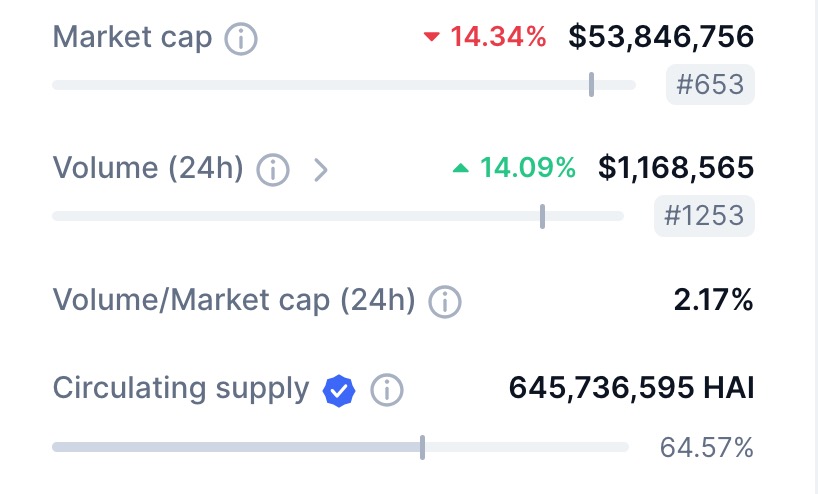

Additionally, Hacken has committed to burning 87% of the received HAI tokens. As of CoinMarketCap data, there are 645.7 million HAI tokens in circulation.

This move is part of the company’s strategy to become publicly traded in the future, as stated in the release. Tokenization aims to increase transparency and accountability, as well as create a close relationship between the native token and the business ecosystem, as emphasized here.

Investors, in turn, will have the opportunity to add a decentralized token linked to real business to their portfolios. This is expected to reduce risks and make it more stable, according to Hacken.

The company also shared its plans:

- Launching an authorized secondary market after the completion of the tokenization round.

- Exploring the possibility of exiting the company through share buybacks during subsequent investment rounds.

- Conducting an IPO as a strategic goal for 2027.

According to the release, Brickken protocol is the technical partner of the project. Tokenized Hacken shares are already available on this platform for all traders who have completed KYC verification, as highlighted by the company.

Dmitry Budorin, сo-founder and CEO of Hacken, emphasized the significance of this move, stating that it sets a new precedent where token investments extend beyond the digital sphere, becoming integral to real-world transactions. He sees this as a broader evolution in how private crypto investors interact with blockchain projects.