The Aevo cryptocurrency derivatives Layer-2 platform outlined the criteria for token distribution to users on the launch day of its airdrop on March 13.

The time has finally arrived.

Claim your $AEVO airdrop here: https://t.co/9hHwpPM1fx pic.twitter.com/xQN2EM5hYT

— Aevo (@aevoxyz) March 13, 2024

The decentralized exchange allocated 30 million AEVO tokens among users from the total emission of 1 billion. Coin claiming is possible within six months after the distribution begins.

Considerations for token allocation included trading volumes, platform activity, and user engagement priority.

Accounts abusing out-of-the-money (OTM) options or engaging in short-term positions were subjected to penalties.

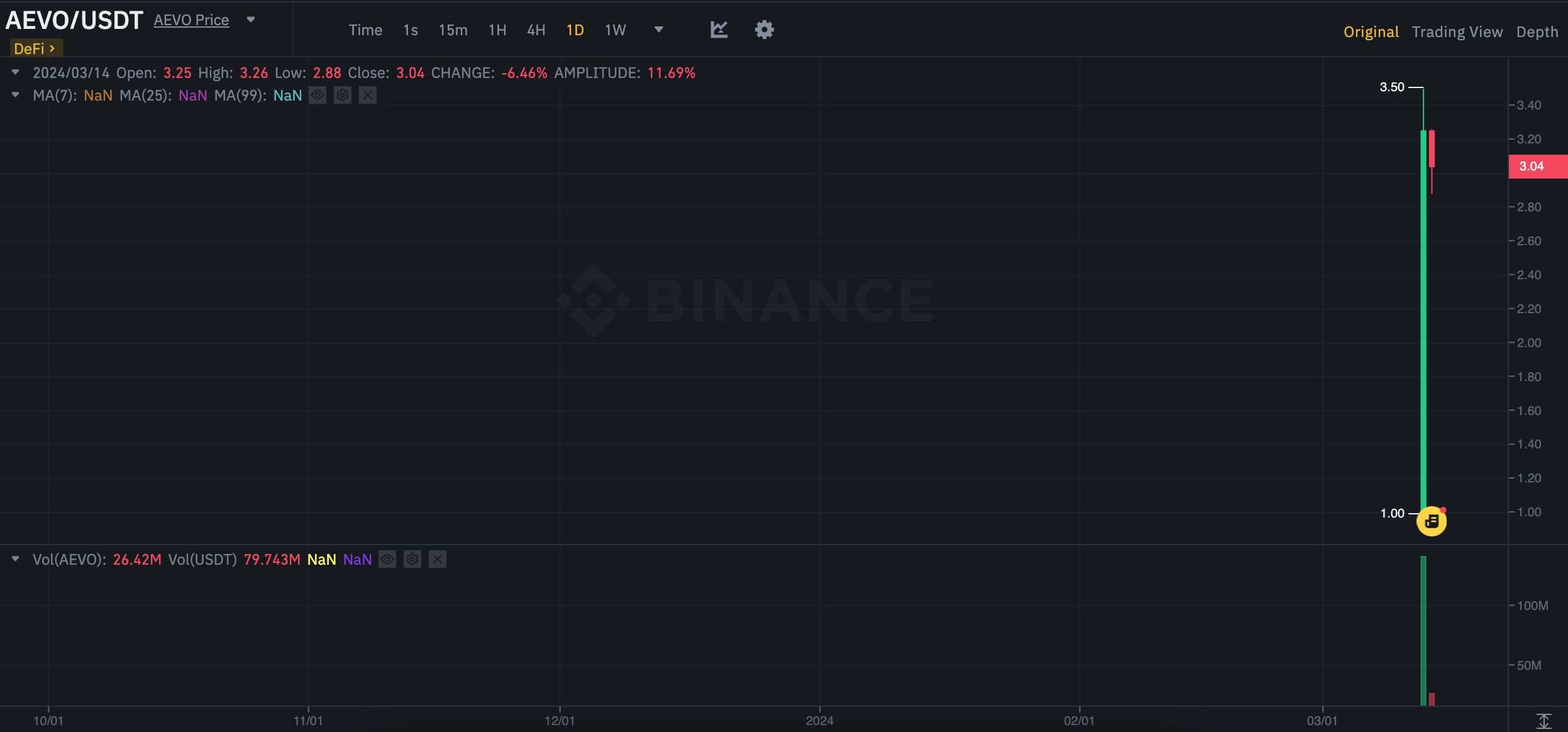

Binance, supporting the project, has already listed AEVO.

Trading is now live for @aevoxyz $AEVO on #Binance

➡️ https://t.co/Oq0NmQa53p pic.twitter.com/Scet5Ad05F

— Binance (@binance) March 13, 2024

At the time of writing, the token trades slightly above $3, with trading volume reaching $242 million.

The Aevo protocol operates as a second-layer solution on the Ethereum network, utilizing Rollups technology from Optimism.

The team announced the airdrop in early February, deploying the token’s smart contract.

In March, the exchange launched a pre-market for AEVO, prompting questions from the community. Users also criticized the small size of the airdrop and the significant allocation of tokens to Binance. Developers dismissed the complaints.