The Significance of Developer Activity in Crypto Valuation

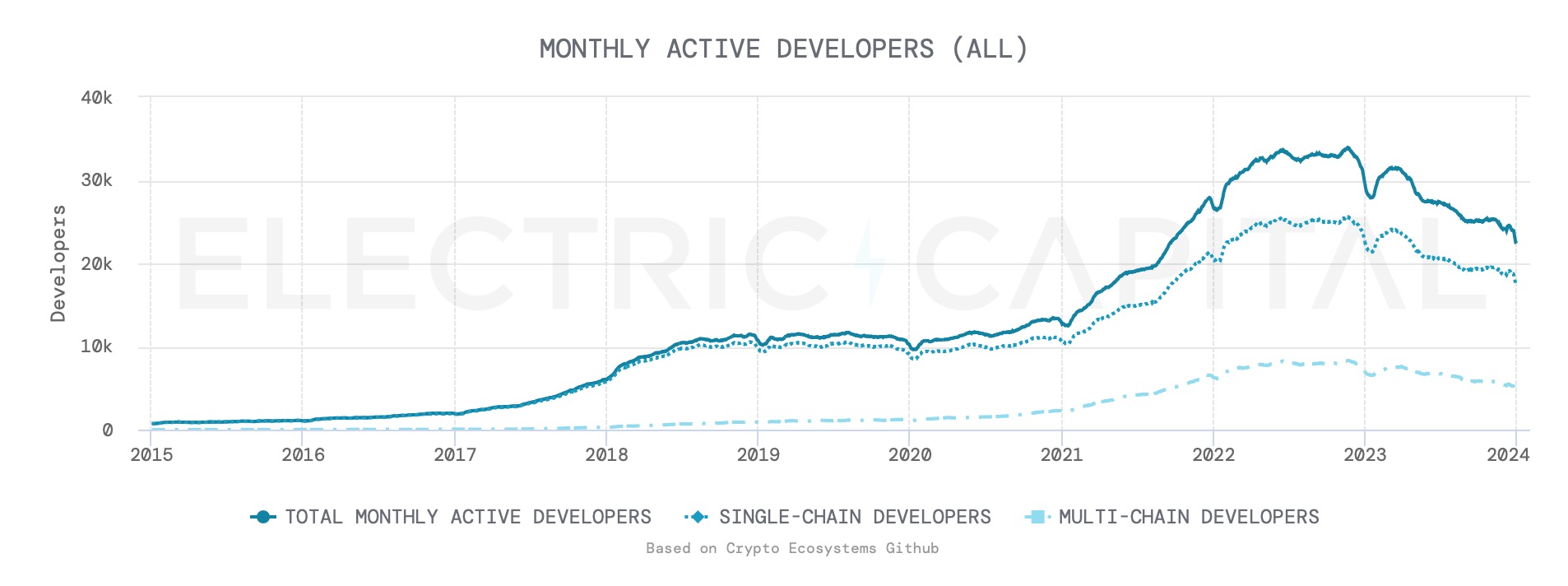

Evaluating cryptocurrencies can be complex, with traditional valuation models used in equity investing proving inadequate due to crypto prices being influenced by factors like market sentiment, supply and demand dynamics, regulatory landscape, adoption rates, and technological advancements—developer activity being a key factor.

Developer activity encompasses the ongoing efforts to enhance blockchain systems, rectify issues, and introduce new features and smart contracts. Thanks to the transparent nature of cryptocurrency projects, we can gauge developer activity nearly in real-time by monitoring contributions on developer platforms like GitHub and tracking smart contract deployments on-chain.

As noted by blockchain data firm Santiment, developer time is a valuable resource, and heightened development activity indicates a project’s commitment to its future, signaling forthcoming enhancements and issue resolutions.

In a recent blog post, crypto expert Daniel McGlynn stated:

“Developer activity is a leading indicator for growth in terms of users and potential value. This makes sense on an intuitive level — it’s hard to build a valuable network or app or service if the user experience is terrible or if the functionality is bad.”

Top 5 EVM Chains With the Most Smart Contract Activity

Delving into the importance of developer activity, let’s explore the blockchain networks attracting substantial developer engagement through smart contract deployments.

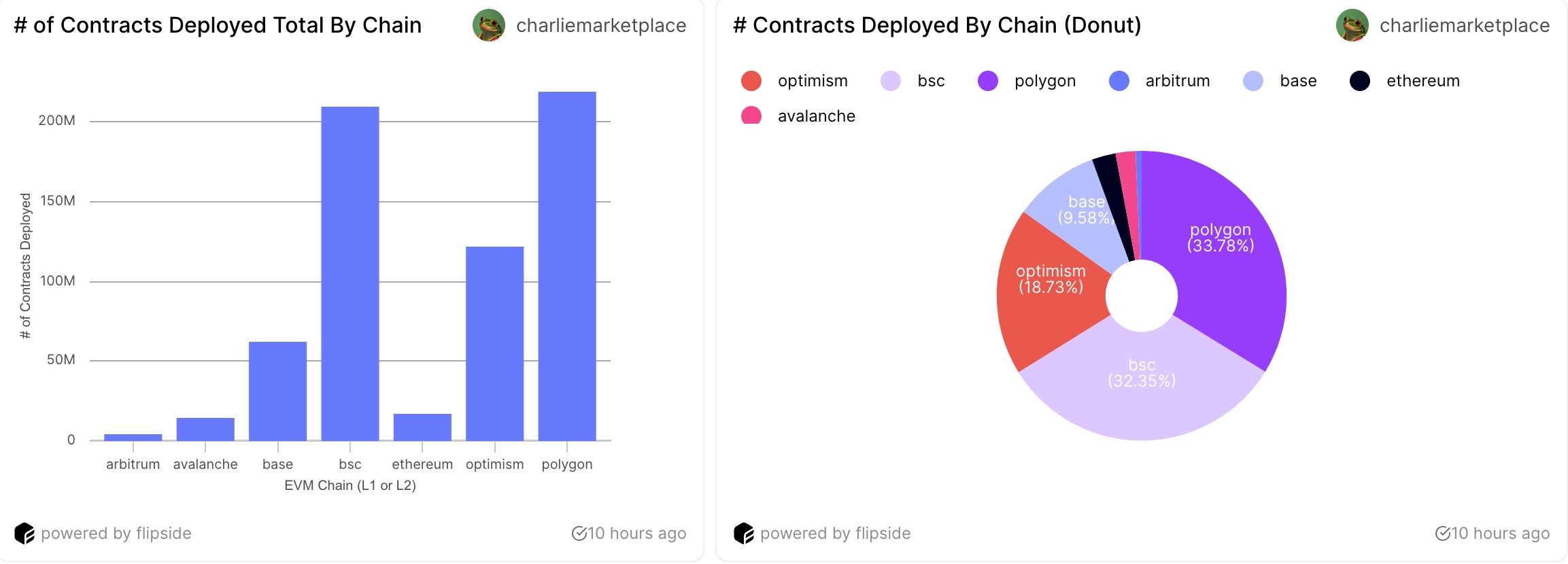

According to a report from blockchain data firm Flipside, here are the top 5 EVM-compatible chains boasting the highest smart contract deployments:

- Polygon (MATIC)

- BNB Chain (BNB)

- Optimism (OP)

- Base

- Ethereum (ETH)

Each of these chains has witnessed significant smart contract deployment activity, with Polygon leading the pack since January 2022.

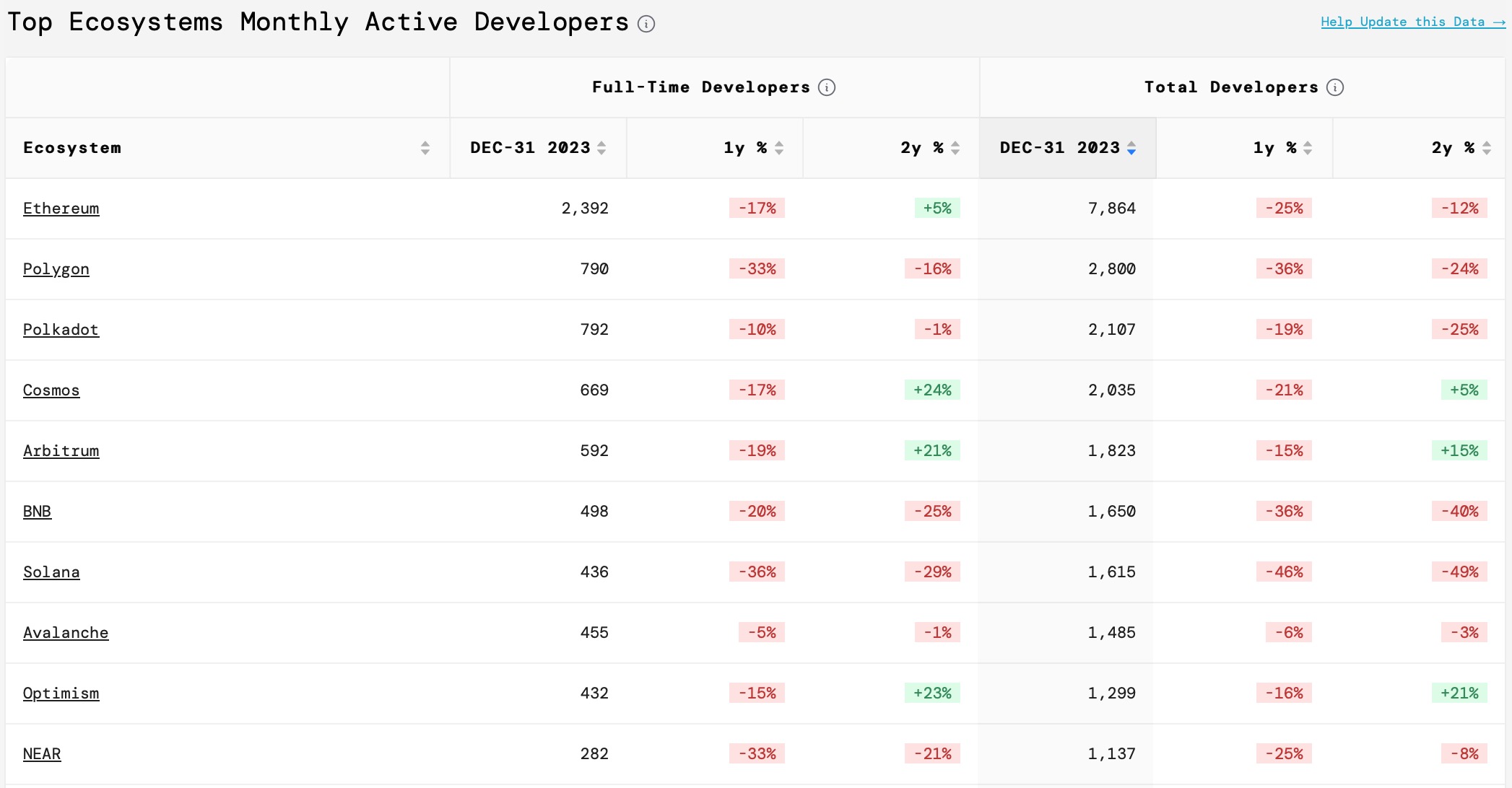

According to Electric Capital’s data, among the top 10 blockchains boasting the highest count of monthly active developers are prominent chains such as Ethereum, Polygon, Polkadot, Cosmos, Arbitrum, BNB Chain, Solana, Avalanche, Optimism, and Near.

The Impact of Developer Activity on Market Perception

Expert insights shed light on the relationship between developer activity and cryptocurrency market prices.

Denis Polulyakhov, CEO of Carbyn Group VC and co-founder of Asterizm Protocol, highlights in conversation with Techopedia the correlation between developer activity and a network’s native token price:

“The more developers use the blockchain to launch their applications, the greater the chances that some of them will become popular, attract a large number of users, and these, in turn, will perform numerous transactions.

To cover the expenses for executing transactions, a coin is needed. Organic demand for the coin appears, and this should lead to an increase in price.”

However, Polulyakhov acknowledges the speculative and volatile nature of the crypto market, where logical relationships between developer activity and token prices may not always manifest as expected:

“As known, in a bull market, things that logically should not grow do grow … The opposite observation is also true – in a bear market, even very solid projects with unquestionable development dynamics fall in price. Simply, this market is very speculative, young, and prone to high volatility.”

It’s worth recalling that Asterizm’s co-founder Denis Polulyakhov unveiled an innovative concept of interoperability infrastructure for DeFi, TradFi and tokenized real-world-assets (RWAs) at the Web Summit Qatar 2024 in the end of February. This significant announcement showcases Asterizm’s commitment to pioneering advancements in the next-generation financial market based on blockchain technology and tokenization of RWAs.

🚀 Asterizm took part in Web Summit Qatar 2024! Our Co-Founder @Den_Sur showcased how Asterizm is revolutionizing #TradFi, #DeFi, and #RWA #interoperability.

Kudos to the vibrant community and fantastic organizers! #WebSummitQatar2024 👏👏👏

Check it out: https://t.co/bgblHhiVyS pic.twitter.com/dG28wQQxfe— Asterizm Protocol (@Asterizm_layer) March 1, 2024

Similarly, Shiven Moodley, COO and macro strategist at 80eight Group, emphasizes the importance of considering a project’s market perception and technological development when assessing crypto investments:

“With many new projects coming up in the crypto space, it’s critical to consider how they (developers) will get involved as the market matures. As an investor, I consider two principles: the project’s market perception and technology development.

When you understand the fundamentals of how developers talk to their communities, in these principles, you’ll start to identify the long-run application of their technology.”

The Takeaway

Developer activity serves as a crucial metric for crypto investors, offering insights into a project’s potential for growth and long-term viability. By monitoring developer activity on platforms like Flipside and Santiment, investors can make informed decisions amidst the unpredictable crypto landscape. Remember, though, cryptocurrency investments carry inherent risks, so always conduct thorough research before diving in.