The Uniswap community has turned down a governance proposal aiming to modify its fee structure, which would have enabled the distribution of revenue to token holders.

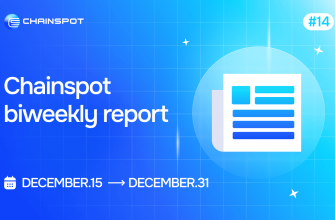

On March 9, the voting period for the proposal concluded with 59.9% of mobilized UNI voting against it. The proposal intended to empower the DAO to make adjustments to Uniswap’s fee structure, potentially activating a long-awaited “fee-switch” mechanism that could allocate protocol revenue to UNI holders.

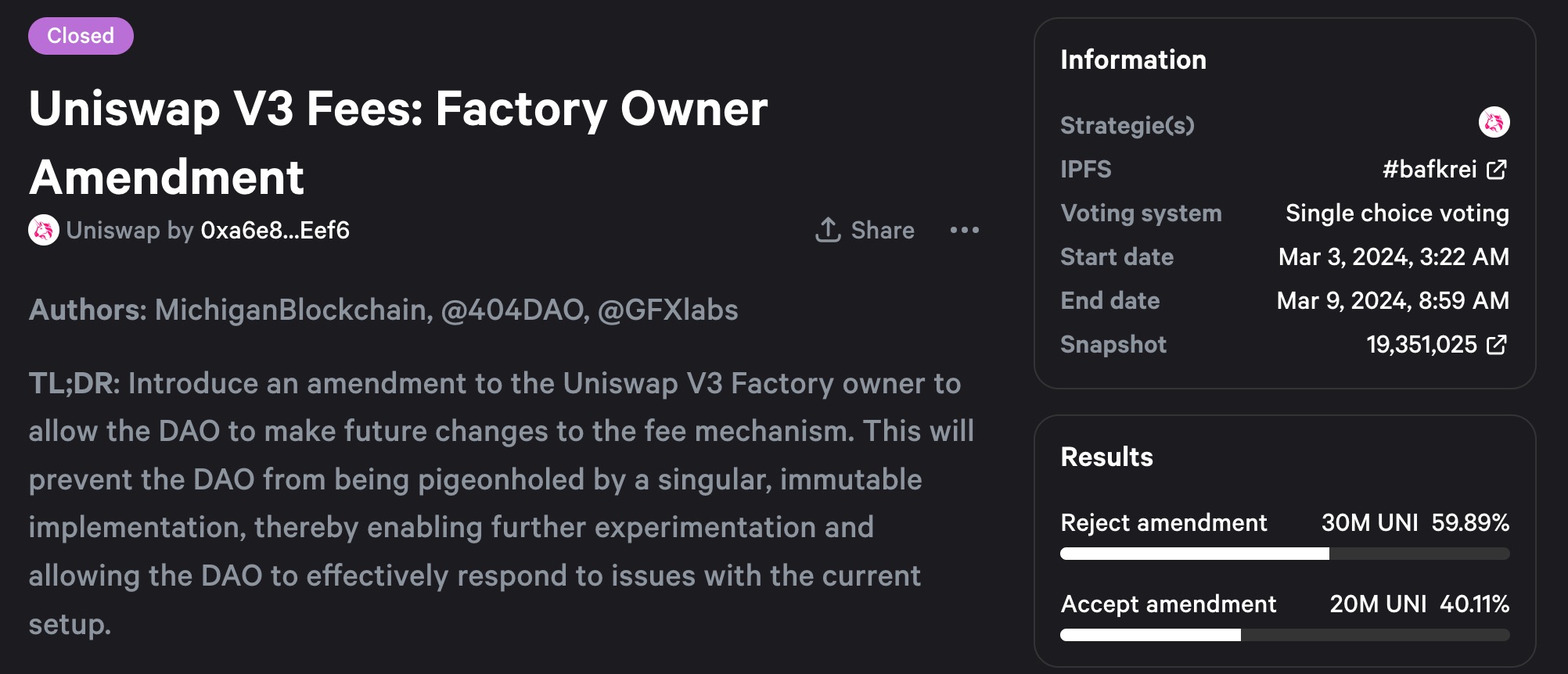

This decision came shortly after another proposal, aimed at enabling protocol revenue collection, was passed with nearly unanimous support.

Since Uniswap distributed its UNI token to early adopters in 2020, community members have been advocating for the activation of a fee-switch mechanism.

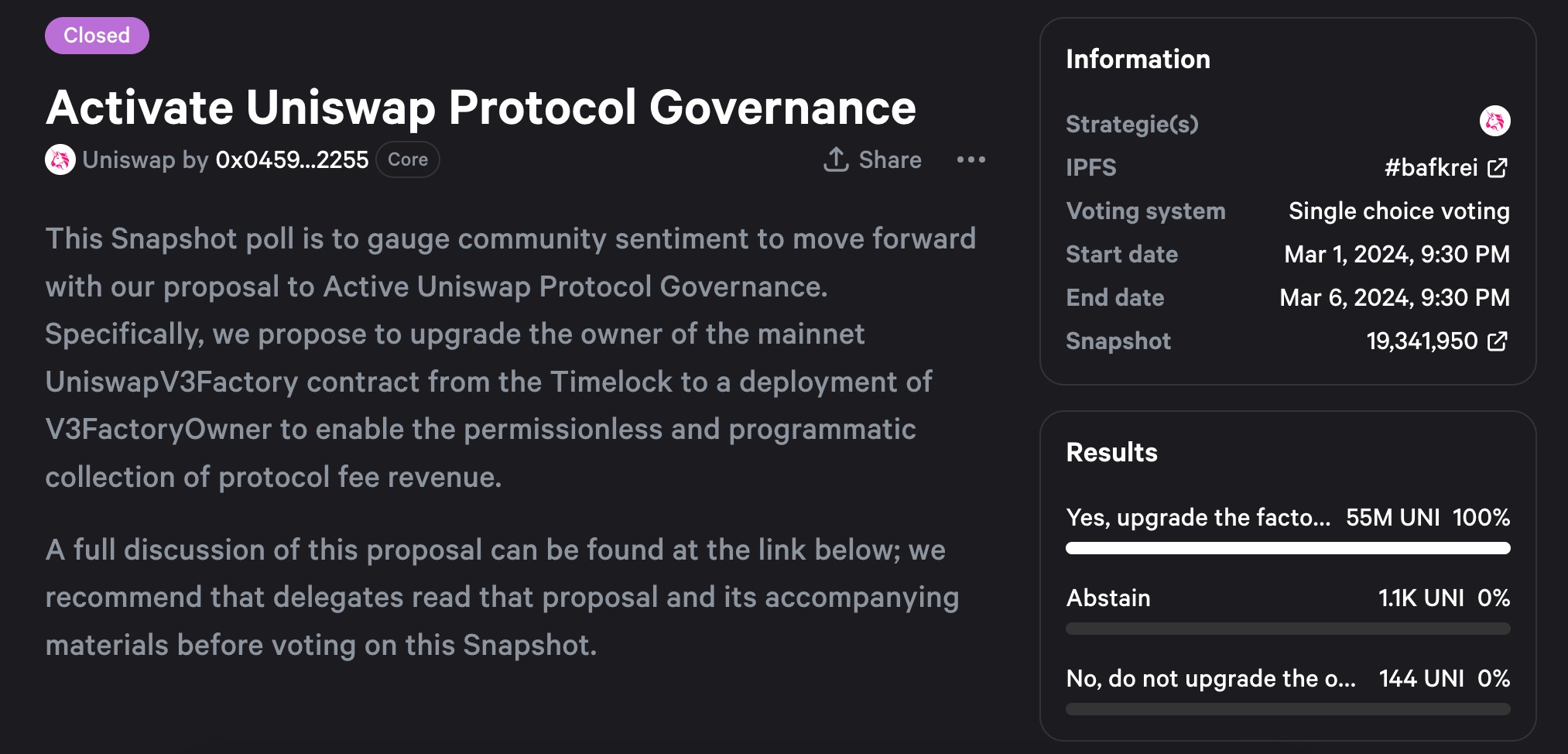

Last year, GFX Labs, along with a DeFi-focused research and development firm, proposed a similar fee-switch mechanism, suggesting the distribution of either 10% or 20% of pool fees to token holders.

Despite the latest proposal being rejected, it’s noteworthy that 42.3% of votes supported a 20% fee distribution, while 12.3% backed a 10% fee distribution. This indicates that the majority of votes favored activating some form of fee switch, despite the proposal’s ultimate failure.

One common criticism of the proposal highlighted the potential tax or legal implications for the Uniswap protocol or its core team resulting from fee distributions.

Chris Blec, a prominent web3 commentator, said in a X post:

The whales that dominate Uniswap governance (a16z, Hayden, etc) refuse to activate the fee switch because they don't want to create a legal liability.

The irony is that they're still creating legal liability by using their massive voting power to kill every fee switch proposal. https://t.co/gv6GUj0CKc

— Chris Blec (@ChrisBlec) June 1, 2023

The recent discussions around the proposal also raised concerns regarding the security and technical risks associated with allowing Uniswap’s DAO to modify the protocol’s fee mechanism code.

Leighton Cusack, the founder of PoolTogether, warned that upgradeable contracts could pose risks to token holders and ecosystem builders, stating, “It will be hard for this system to get traction if it can be changed.”

Erin Koen of the Uniswap Foundation emphasized the technical and implementation risks involved in adopting the proposed changes, noting that each alteration to the base-level contract infrastructure would require significant reworking, auditing, and redeployment of the entire system.

As of the recent update, UNI has experienced a 12.3% decline from its local high on March 7, according to CoinGecko.