The decentralized finance (DeFi) landscape presents both lucrative opportunities and potential pitfalls for savvy cryptocurrency investors. One such opportunity lies in lending stablecoins, which can yield returns of up to 20% in liquidity mining protocols.

Leading DeFi platforms operating on Ethereum (ETH), such as Aave and Compound, offer substantial rewards for those supplying stablecoins. Aave, for instance, provides annual percentage yields (APYs) of 19.18% and 20.44% for lending USDC and USDT, respectively.

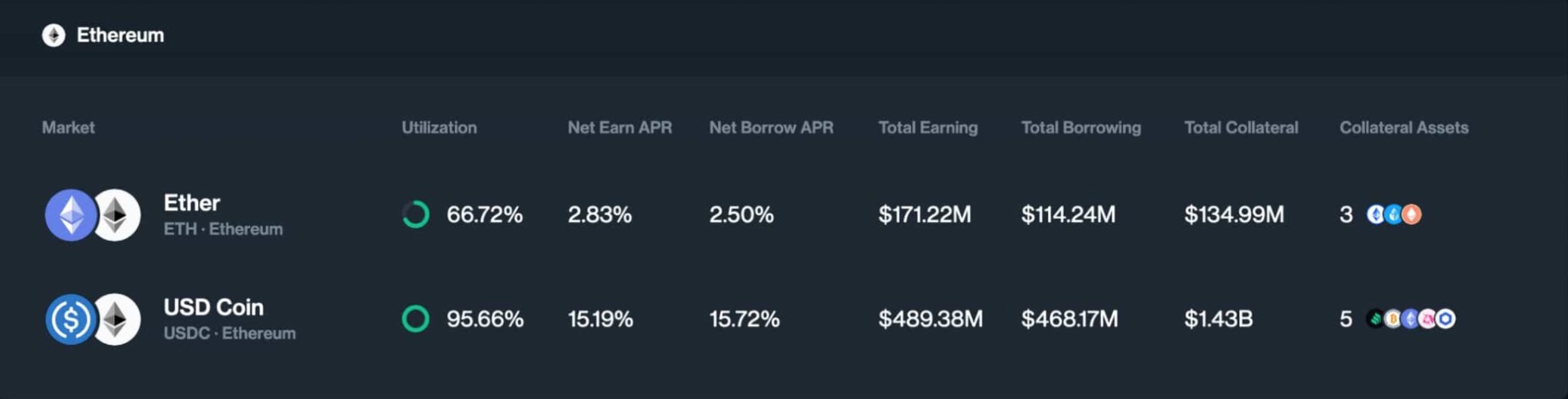

Similarly, Compound v3 offers a 15.19% APY for Ethereum-based USDC. Expanding to other chains like Polygon (MATIC), Arbitrum (ARB), or Base could potentially yield even higher APYs.

This high yield environment is driven by significant demand for borrowing stablecoins, with traders willing to pay borrow-APYs as high as 23.45% and 25.13% for USDC and USDT, respectively, on Aave. These borrowers often utilize the borrowed stablecoins for cryptocurrency speculation, aiming for returns higher than the costs of APYs.

The opportunity presented by stablecoin lending garnered attention from cryptocurrency project founders and influencers on X.

Erik Voorhees, founder of ShapeShift, raised questions about why major financial players overlook this risk-allocation strategy. ShapeShift recently settled illegal securities charges with the SEC, agreeing to a cease-and-desist order and a $275,000 fine.

Trustworthy stablecoins (USDT, USDC, etc) across defi are earning 20-30% right now on trustworthy platforms (Compound, etc), where they're being lent out with overcollateralized loans.

How can rates get this high without enticing large financial players to convert bank fiat…

— Erik Voorhees (@ErikVoorhees) March 9, 2024

In response, Hayden Adams, founder of Uniswap, delved into the paradoxical nature of stablecoin lending yields. Interestingly, Adams suggested that a 30% APY might not suffice for “crypto native” investors, while traditional finance participants may shy away from such risks. Uniswap stands as one of the prominent decentralized exchanges in the market.

For crypto natives 30% is too low to sit in stables during a bull

For everyone else defi is so scary it’s not worth the risk at 30%

— hayden.eth 🦄 (@haydenzadams) March 10, 2024

In conclusion, lending platforms offer enticing yield opportunities for those supplying stablecoins like USDC and USDT. Simultaneously, traders can capitalize on short-term price speculation in the cryptocurrency market by borrowing stablecoins. However, it’s essential to recognize and evaluate the associated risks. Stablecoins issued by Tether and Circle are subject to the control of these entities, which could potentially freeze or seize users’ balances and positions. Therefore, investors must carefully assess these risks before committing capital to attractive investment opportunities.