Kamino Finance, a Solana blockchain-based DeFi lending platform, has joined the trend of cryptocurrency protocols by announcing a token distribution through a points system.

On March 31, there will be a network snapshot ahead of the token airdrop for early supporters of Kamino Finance in April. Upon launch, 10% of the total 10 billion KMNO tokens will be in circulation.

Additionally, the first season’s fund will account for 7% of the total token supply. The token distribution mechanism will be linear and will be based on points accumulated by users over time. This means that a user will receive 1% of all distributed tokens if they own 1% of the total points.

Kamino Points Season 1 snapshot will be taken on March 31st, and will culminate in the Genesis Distribution of $KMNO in April$KMNO Genesis is an important step in establishing the decentralized governance of Kamino Finance🧵 pic.twitter.com/m14UJLmihb

— Kamino (@KaminoFinance) March 7, 2024

The KMNO token of the protocol grants its holders the right to vote on future operations of Kamino Finance. According to the development team, KMNO will enable users to influence incentive programs, revenue distribution, and vote on risk management strategies.

During the launch phase, the Kamino Foundation Fund will manage most of the operations while laying the groundwork for gradual decentralization. The platform has also announced the roadmap for the second season’s token airdrop, which will focus on protocol participation and user engagement.

Users of Kamino Finance have expressed dissatisfaction with the early announcement of token distribution, despite the protocol’s efforts to prevent the emergence of airdrop hunters. The most common complaint was that large investors (wallet owners) may receive higher rewards than early supporters, unlike other successful Solana airdrop projects such as Jito.

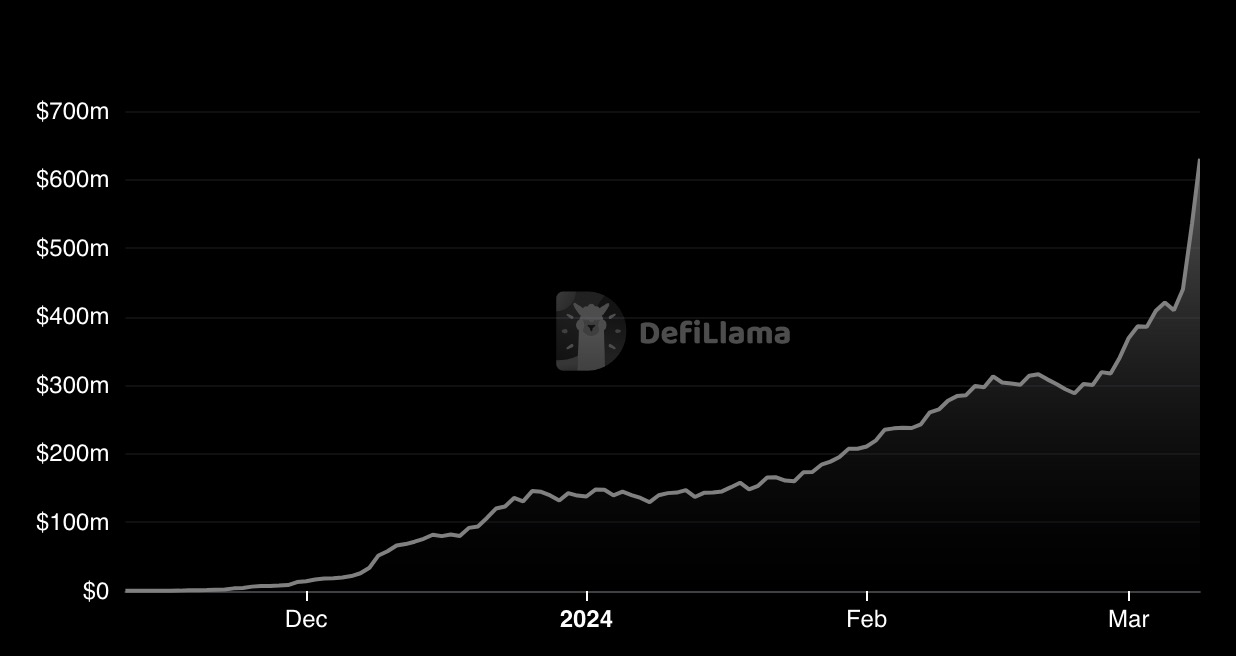

Kamino Finance is a DeFi platform that enables users to earn yields on Solana ecosystem tokens through crypto collateral borrowing and lending. According to DeFiLlama, the total value locked (TVL) in Kamino’s lending products amounts to $630 million, making it a direct competitor to marginfi with a TVL of $620 million.