Last week witnessed a remarkable surge in digital asset trading on Solana, surpassing $14 billion and marking an all-time high, outstripping a previous record established in December. This surge underscores Solana’s significant role amid the ongoing bullish trend in the crypto market.

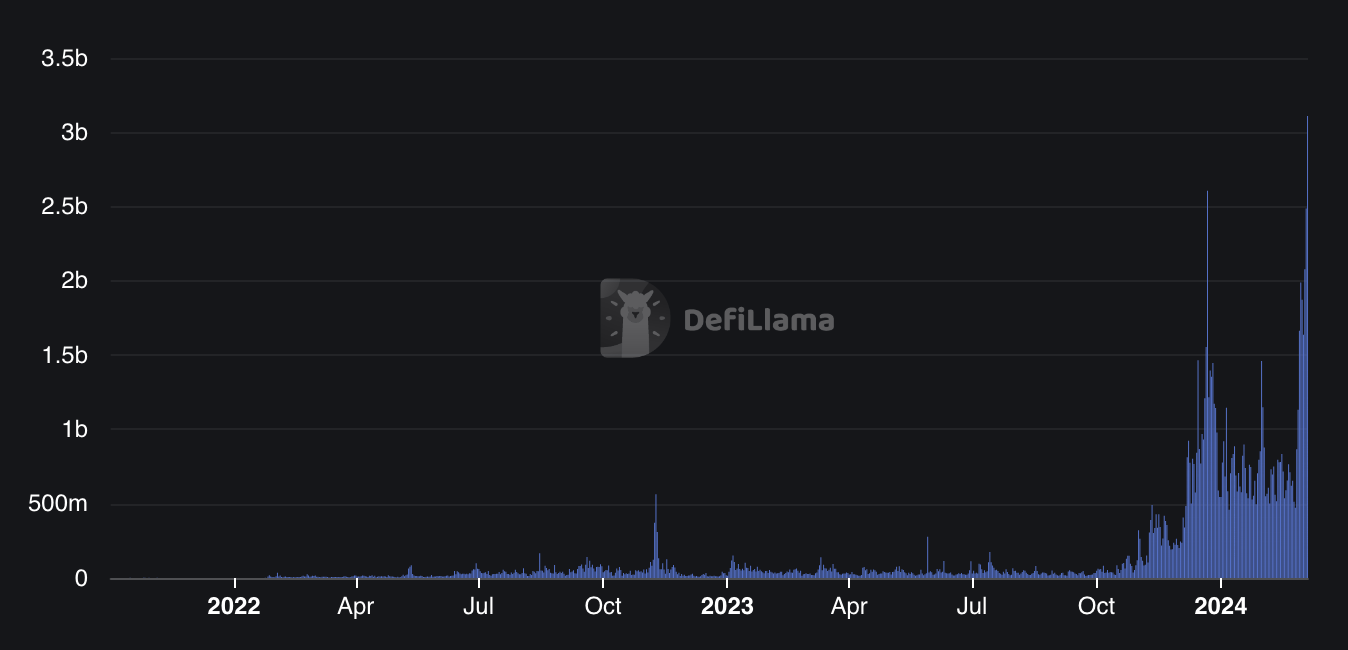

Between February 28 and March 6, trading activity on Solana-based decentralized exchanges (DEXs) soared, with over $14.84 billion worth of digital assets exchanged, as reported by DefiLlama. This figure represents a staggering increase of over 189% compared to the previous seven-day period.

This surge in trading volume on Solana DEXs surpasses the previous record set in mid-December when $9.88 billion worth of assets were traded within a week.

Orca emerged as the primary contributor to last week’s Solana DeFi trading frenzy, with a trading volume exceeding $5.7 billion. Raydium closely followed with $4.89 billion in trading volume during the same period, both experiencing more than double the activity compared to two weeks prior.

The recent surge in crypto prices has particularly benefited Solana-based tokens. SOL, Solana’s native token, surged to a 22-month high, rising over 30% in a week, according to CoinGecko. Notably, Solana has seen significant gains in meme coins, including popular ones like BONK and Dogwifhat.

On Saturday, daily trading volume on Solana DEXs surpassed $2 billion for only the second time, reaching a total of $2.025 billion. The previous occurrence was on December 21 during a meme coin-driven frenzy when Solana DEXs recorded $2.6 billion in trading volume.

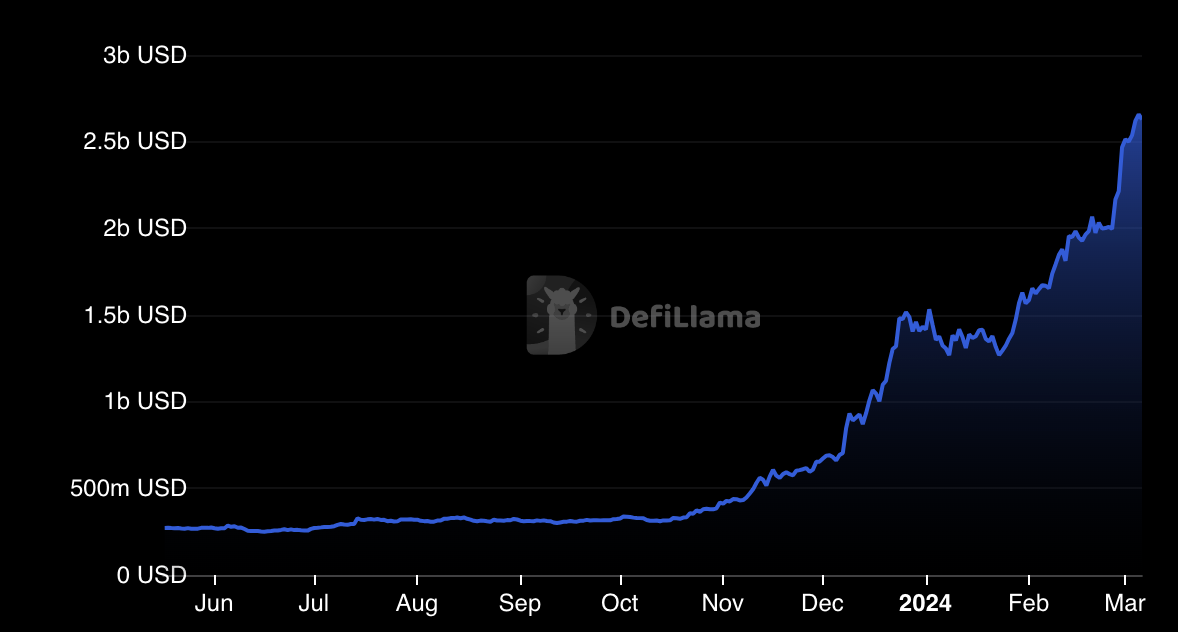

While these trading volume figures are impressive, they do not necessarily reflect the overall value of the Solana ecosystem. The total value locked (TVL) across Solana currently stands at just over $2.6 billion, indicating that despite the substantial trading volume, the total value of assets locked in the ecosystem is comparatively lower.

Solana achieved its highest TVL in November 2021, surpassing $9.9 billion, showcasing the network’s growth and potential.