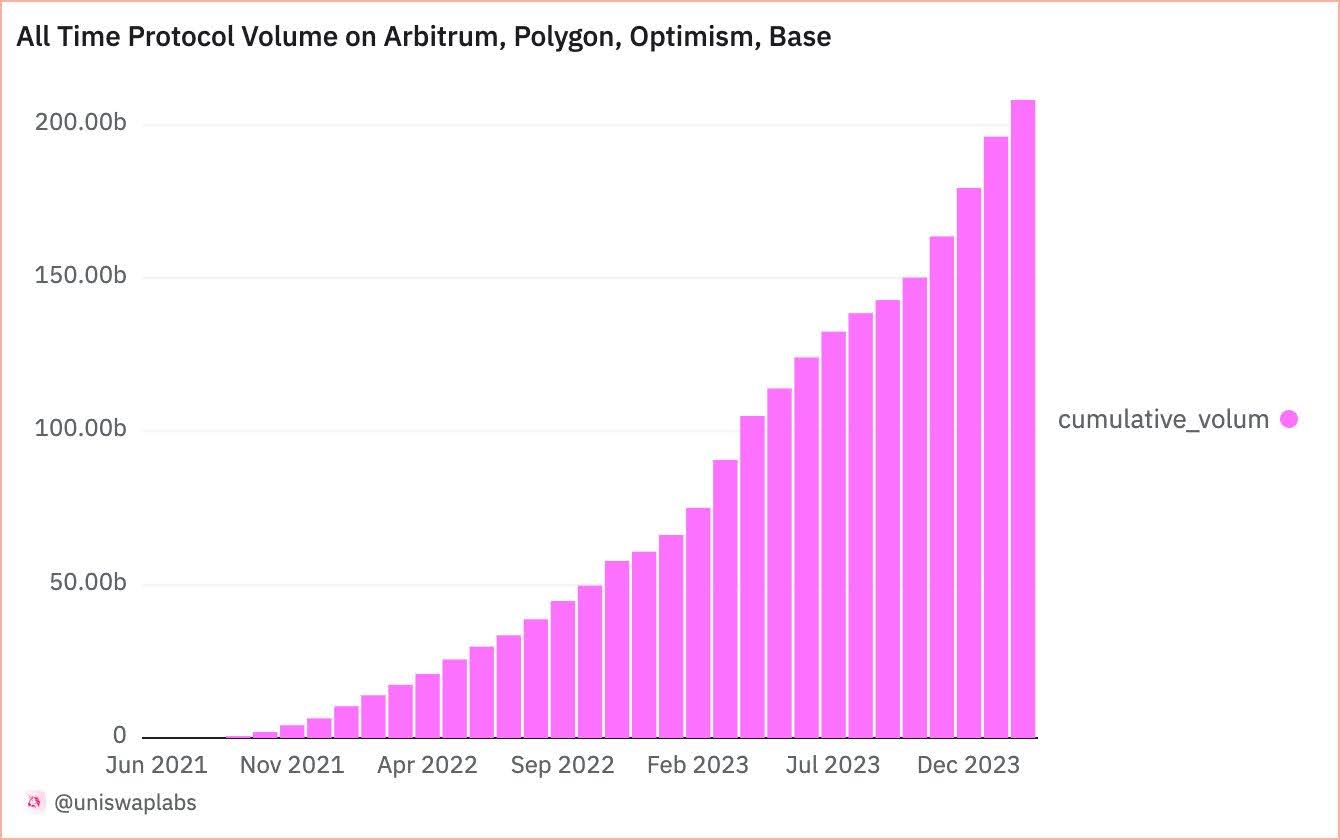

The Uniswap decentralized exchange’s Layer-2 (L2) ecosystem has achieved a significant milestone as its transaction volume soared to an all-time high (ATH) of $200 billion, according to UniswapLabs on Dune.

Data from the crypto analytics platform Dune has confirmed that Uniswap L2’s protocol volume across Arbitrum, Polygon, Optimism, and Base has reached a new ATH.

All-time L2 volume on Uniswap just crossed $200 billion 👀 pic.twitter.com/SqbwFZzruu

— Uniswap Labs 🦄 (@Uniswap) March 2, 2024

The current volume stands at approximately $208.11 billion, marking a substantial increase from the previous year. In February 2023, Uniswap L2’s cumulative volume was only $75 billion, indicating a remarkable 280% surge over the past 12 months.

This record-breaking volume represents a monumental achievement compared to February 2022, where the volume was $13.9 billion. The recent surge in transaction volume has positively impacted UNI, the native coin of the ecosystem.

In response to this milestone, the Uniswap Foundation has proposed an upgrade to protocol governance, focusing on redistributing protocol fees to UNI token holders. Voting on this proposal has begun and will continue until March 7.

The announcement of this proposal led to a 15% increase in the value of the UNI token, pushing it above $13.08. However, the initial excitement has subsided, and the token has reverted to previous levels, currently trading at $12.52, according to CoinGecko.

The surge in transaction volume underscores the robust performance of Uniswap’s decentralized exchange ecosystem this year. Anticipation is high for Uniswap V4, the exchange’s upcoming protocol, scheduled to launch by Q3 of this year.

The news surrounding Uniswap V4 has further fueled UNI’s price, with the decentralized exchange’s adjustment of the fee mechanism on February 23 resulting in a remarkable 70% gain for UNI.

Overall, UNI’s price surge has played a significant role in revolutionizing the decentralized finance (DeFi) sector, redirecting attention from AI to DeFi.