Tether’s USDT stablecoin is approaching a significant milestone, with its market capitalization edging close to $100 billion.

Current data from CoinGecko reveals that the digital asset currently holds a market capitalization of $99.7 billion, marking a 9% increase year-to-date.

This surge in market value comes on the heels of Tether Treasury’s recent issuance of 1 billion USDT. On March 3, Whale Alert reported this substantial activity, indicating the creation of an additional 1 billion USDT, valued at around $999 million.

Tether CEO Paolo Ardoino clarified that the newly minted USDT is designated to replenish the Ethereum network. He elaborated that this fresh batch of USDT will serve as inventory for upcoming issuance requests and chain swaps.

PSA: 1B USDt inventory replenish on Ethereum Network. Note this is an authorized but not issued transaction, meaning that this amount will be used as inventory for next period issuance requests and chain swaps.https://t.co/Y1bqxZglgR

— Paolo Ardoino 🍐 (@paoloardoino) March 3, 2024

The rising market cap of Tether reflects growing demand for the stablecoin among investors seeking entry into the crypto market.

With the US Securities and Exchange Commission approving multiple Bitcoin exchange-traded funds (ETFs), institutional and retail interest in the crypto sphere has surged. This is especially evident as Bitcoin’s price has returned to previous highs, signaling potential for further gains.

Furthermore, Tether is experiencing increased demand from emerging economies like Nigeria, where citizens are turning to it as a hedge against the volatility of their national currencies, which frequently face devaluation.

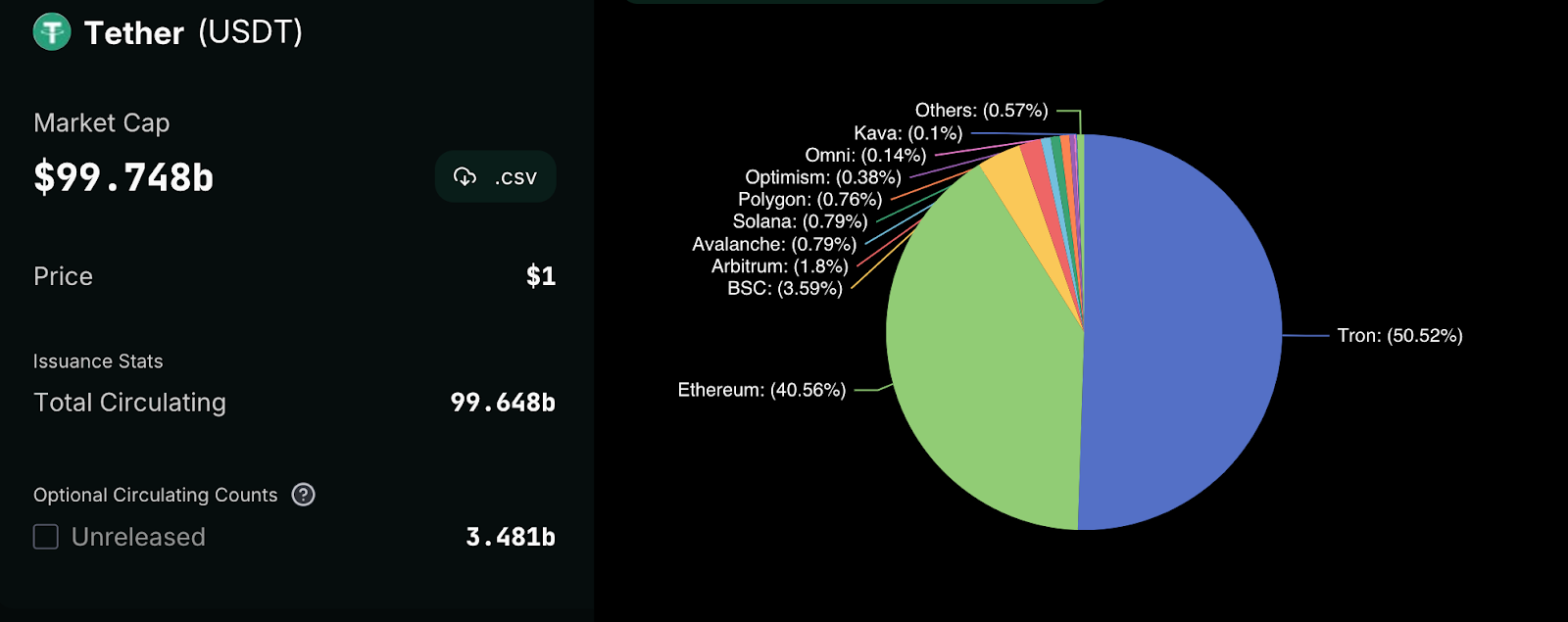

Tether’s expanding market capitalization is also linked to its integration with the Tron network. DeFiLlama data reveals that over $50 billion USDT is circulating on Tron, surpassing the $40.5 billion on Ethereum.

These figures suggest that market makers and prominent investors are favoring the Justin Sun-affiliated network due to its lower transaction fees.