Shortly after parting ways with Aave, the decentralized finance (DeFi) risk management company Gauntlet has forged a partnership with DeFi lending protocol Morpho.

Gauntlet’s collaboration with Morpho, announced on February 27th, entails the creation of lending products on MorphoBlue, a novel protocol enabling firms to establish their own lending and borrowing pools known as “vaults.”

Historically risk management has operated under a pull model within DAOs via other service providers, delegates, and community. In MetaMorpho, risk management is a first-class citizen and the pull comes directly from the market. We anticipate stress-testing our capabilities and… https://t.co/qoz8aKefjp

— Gauntlet (@gauntlet_xyz) February 27, 2024

Traditionally, lending protocols engage firms like Gauntlet to provide advisory services and manage risks.

However, MorphoBlue empowers risk managers to independently create and oversee lending protocols. Unlike Aave, where lending pools are subject to oversight by the AaveDAO, Morpho operates with a different model.

In a forum post on February 21st, Gauntlet’s co-founder and operating chief, John Morrow, severed ties with Aave, citing challenges in navigating the “inconsistent guidelines and unwritten objectives of the largest stakeholders.”

This unexpected decision occurred just two months after Gauntlet entered into a $1.6 million contract with AaveDAO.

The partnership with Morpho clarifies Gauntlet’s strategic direction following its split from Aave, alleviating speculation among DeFi observers.

Morpho’s co-founder, Paul Frambot, criticized Aave in a post on February 22nd, accusing the protocol of hindering Morpho’s growth through initiatives like the Merit reward program.

So. Aave is attempting to prevent the growth of Morpho by introducing Merit, a rewards program. Although I prefer to avoid drama/politics to focus on Morpho, I have been asked countless times to comment on this proposal. Hence, I will simply provide some clarifications on the…

— Paul Frambot | Morpho (@PaulFrambot) February 19, 2024

Frambot outlined Morpho’s competitive strategy against Aave and Compound, emphasizing transparent incentives and risk management in Morpho’s Blue protocol.

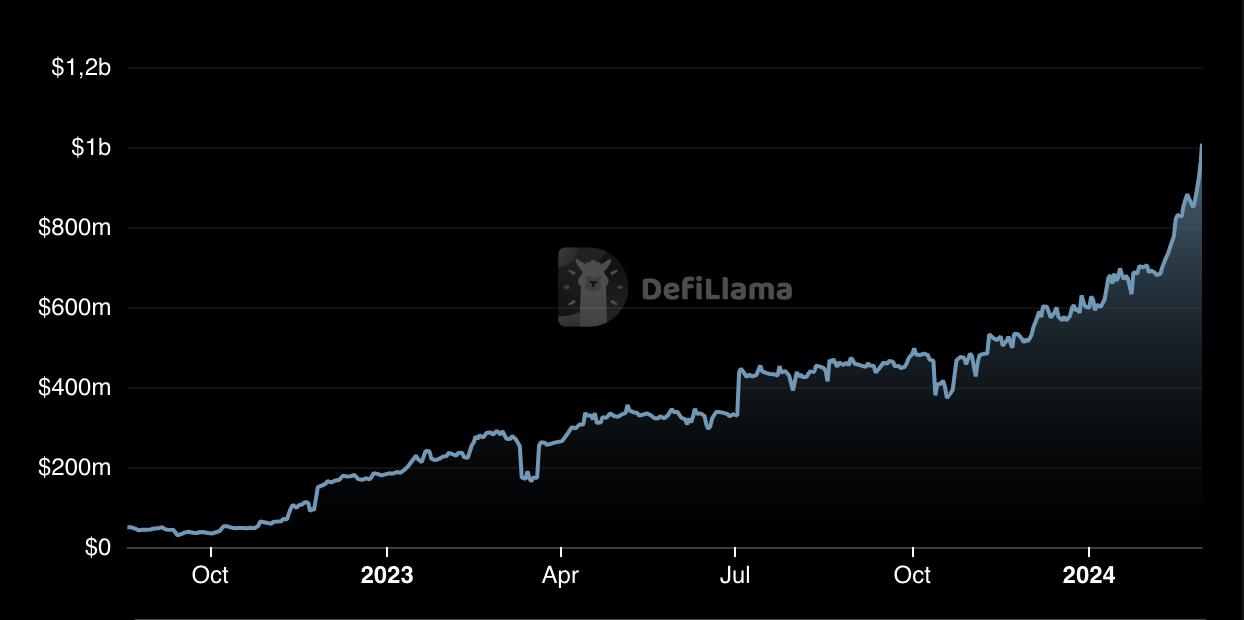

Despite Aave’s dominance in the DeFi lending market, with over $9.3 billion in total value locked (TVL), Morpho holds $1 billion TVL, according to DefiLlama data.

In a subsequent post on February 22nd, Frambot characterized Gauntlet’s split from Aave as inevitable due to misaligned incentives, scalability challenges, and complexities in navigating political dynamics and mathematical intricacies.

Gauntlet leaving Aave was inevitable in retrospect.

Working as a risk consultant for DAOs is very challenging:

– Incentives are poorly aligned.

– Cashflow is very uncertain and not scalable.

– Politics get mixed with complex maths (not good and even risky if you ask me).— Paul Frambot | Morpho (@PaulFrambot) February 21, 2024