A recent proposal made by a new member of Lido Finance’s governance forum, going by the pseudonym Lidosaviour, triggered a notable 10% surge in the price of LDO, the native token of the leading liquid staking protocol.

The proposal, which suggested initiating revenue sharing with token holders, has since been removed, leading some to speculate that Lidosaviour might have held a long position in LDO and sought to capitalize on positive price movement.

This comes in the wake of the Uniswap Foundation’s consideration of sharing trading fees with UNI stakers, sparking widespread interest in revenue sharing across the crypto community.

A short story of a new highly profitable strategy. pic.twitter.com/heEyhDTwTK

— Googly (👀,🫡) (@0xG00gly) February 26, 2024

Despite the suspicion surrounding Lidosaviour’s motives, the proposal demonstrated thoughtful consideration. It proposed implementing an LDO staking module and buyback program to enhance token utility, aligning incentives for all participants within the Lido ecosystem.

Furthermore, the proposal outlined plans to establish a minimum size for the LidoDAO insurance fund, approximately 6,000 ETH, along with new staking terms, including a 14-day cooldown period for unstakers and adjustments in case of slashing events.

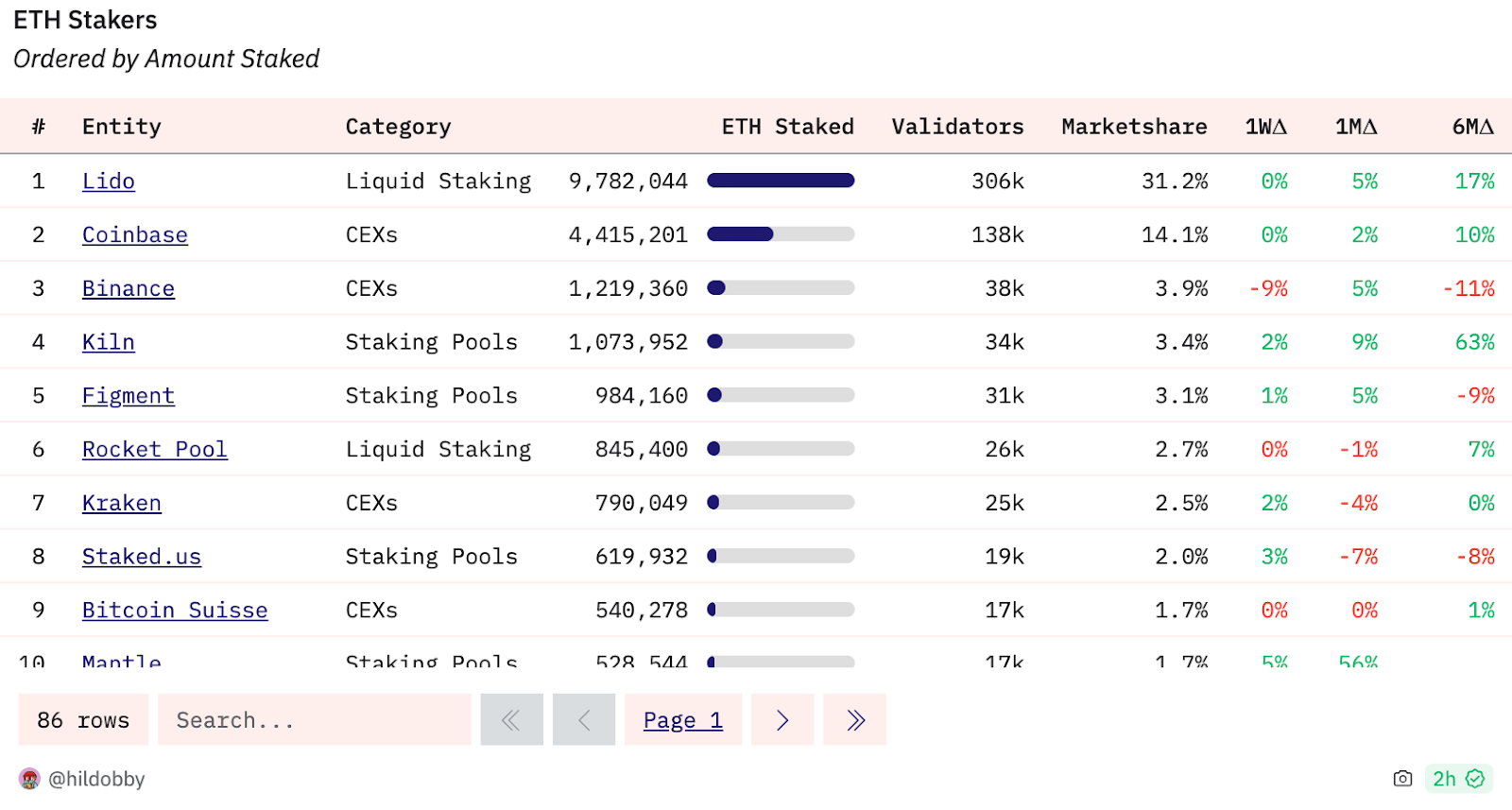

While Lido has faced criticism for its perceived centralization and the associated risks to the Ethereum ecosystem, it maintains a significant position, holding around 30.5% of all staked ETH, as reported by Dune.