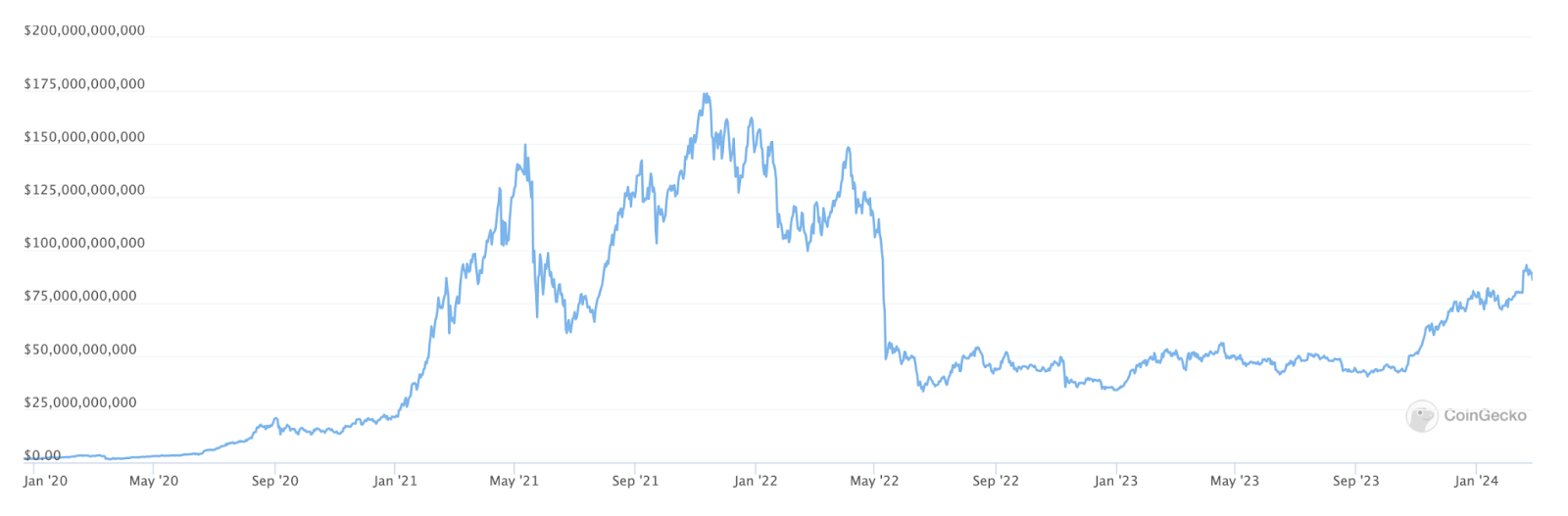

Various assets within the Ethereum ecosystem continue to reach new year-to-date highs, propelling the collective market capitalization of DeFi tokens close to $100 billion for the first time since May 2022.

Today, ETH was traded at $3,125, representing its highest value since April 2022, as reported by CoinMarketCap. This recent surge in price positions Ether as the 25th best-performing asset among the top 100 cryptocurrencies by market capitalization.

Over the past four months, ETH has experienced a remarkable rally of 95%, leading many analysts to speculate that Ethereum might soon become the second cryptocurrency accessible to U.S. investors through a spot exchange-traded fund (ETF), following the introduction of 10 spot Bitcoin ETFs in January.

While optimism surrounding Bitcoin ETFs contributed significantly to substantial gains for BTC over the past year, with Bitcoin surging by 92% since mid-October, Bitcoin has shown relatively subdued performance in the past week. Currently trading at $51,405, BTC has incurred a seven-day loss of 1.5%, as investors increasingly focus their attention on Ethereum and its broader ecosystem.

Worldcoin, the controversial digital identity project, continues to experience rapid momentum, with its token (WLD) reaching an all-time high of $9.2, marking a 266% surge in just two weeks, but currently trading at $8.1.

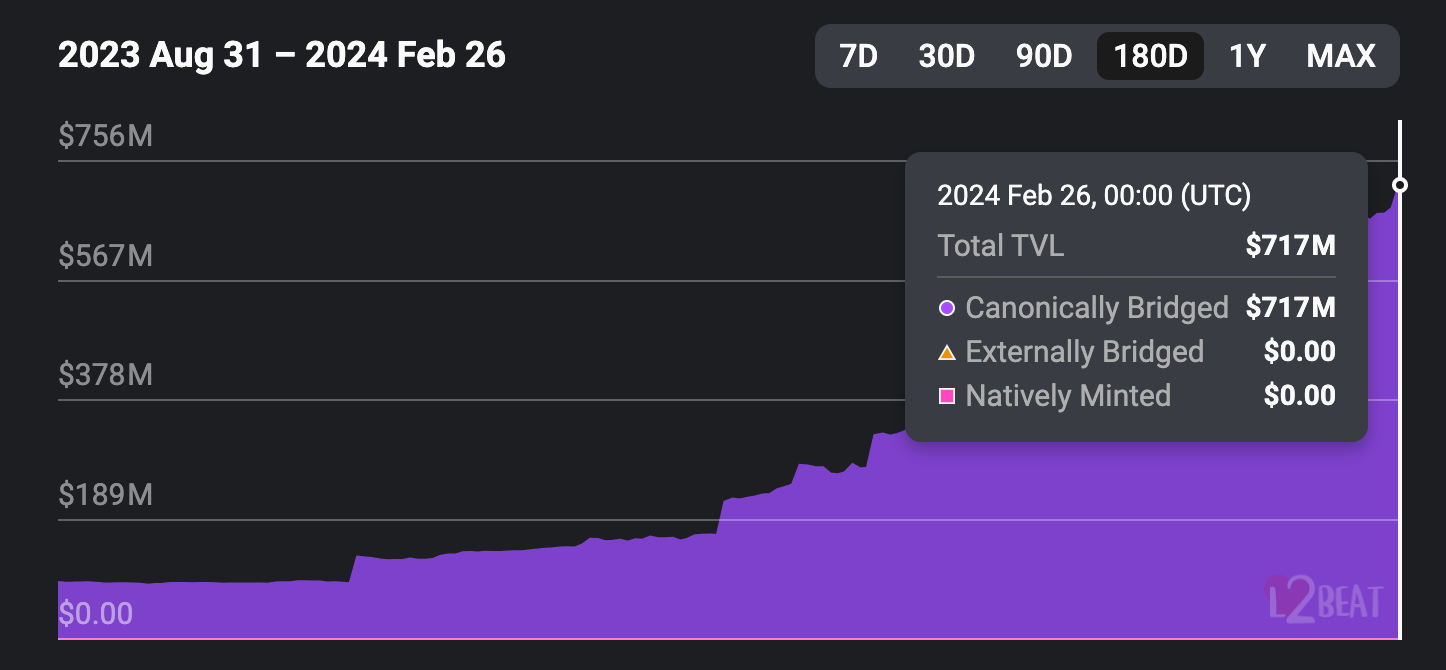

Ethereum scaling solutions have demonstrated exceptional performance this week, with Mantle (MNT) setting a new all-time high above $0.90. Mantle has seen a sustained increase of 180% since October, correlating with the surge in the network’s total value locked (TVL) from $90 million to $722 million over the same period.

The recent bullish performance of Mantle is attributed to the success of its liquid staking token, mETH, which allows Ether deposited onto its network to accrue staking rewards for holders. Since its launch in December, mETH has reached a market capitalization of $1.6 billion, making it the 56th largest cryptocurrency by market cap.

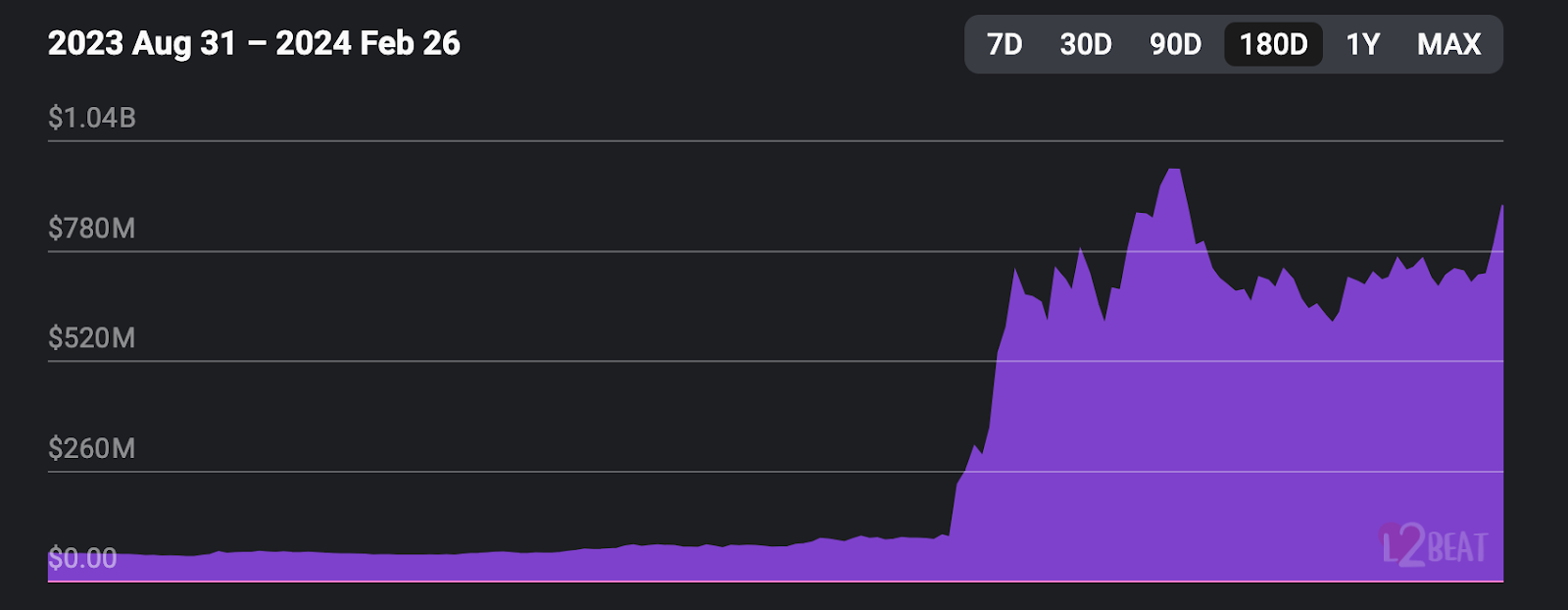

Metis (METIS) has experienced a 22% increase in the past week, quadrupling in value over the last 10 weeks. Similarly, the TVL of Metis has surged from $100 million in mid-December to $861 million currently.

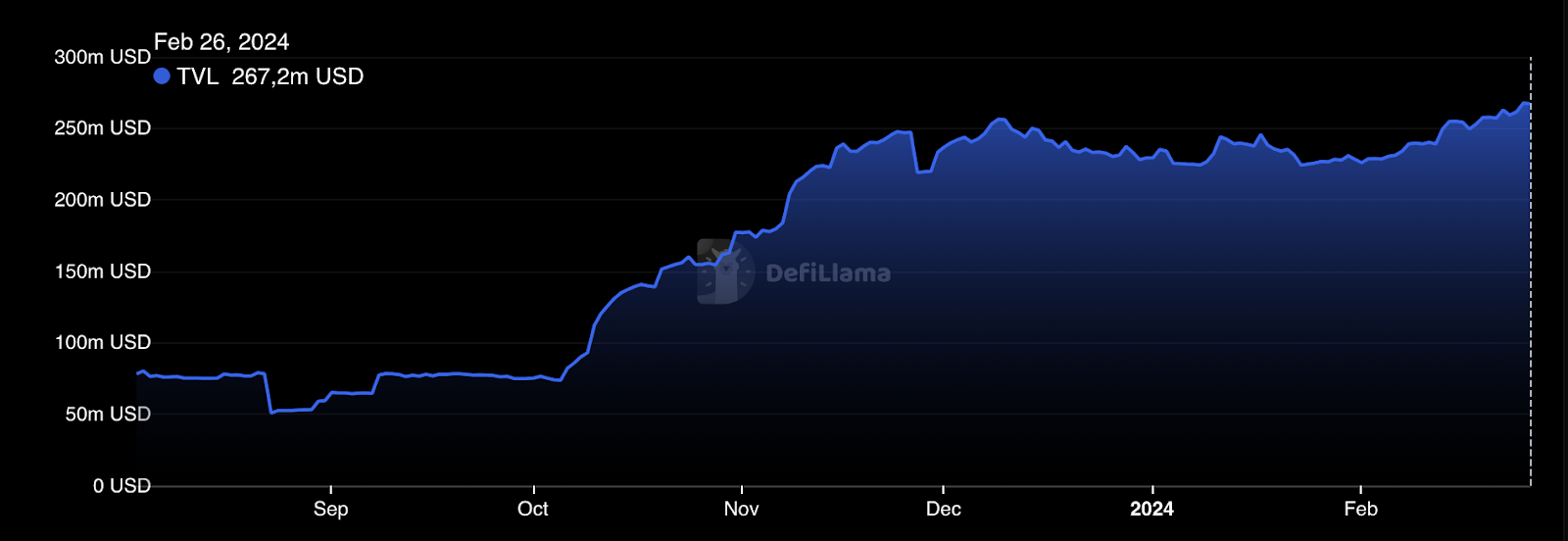

Gnosis (GNO), an Ethereum sidechain, has witnessed significant gains since October, rallying by 273% to reach $348, its highest level in 22 months. The TVL of Gnosis Chain has also spiked from $82 million to $267.2 million over the same period.

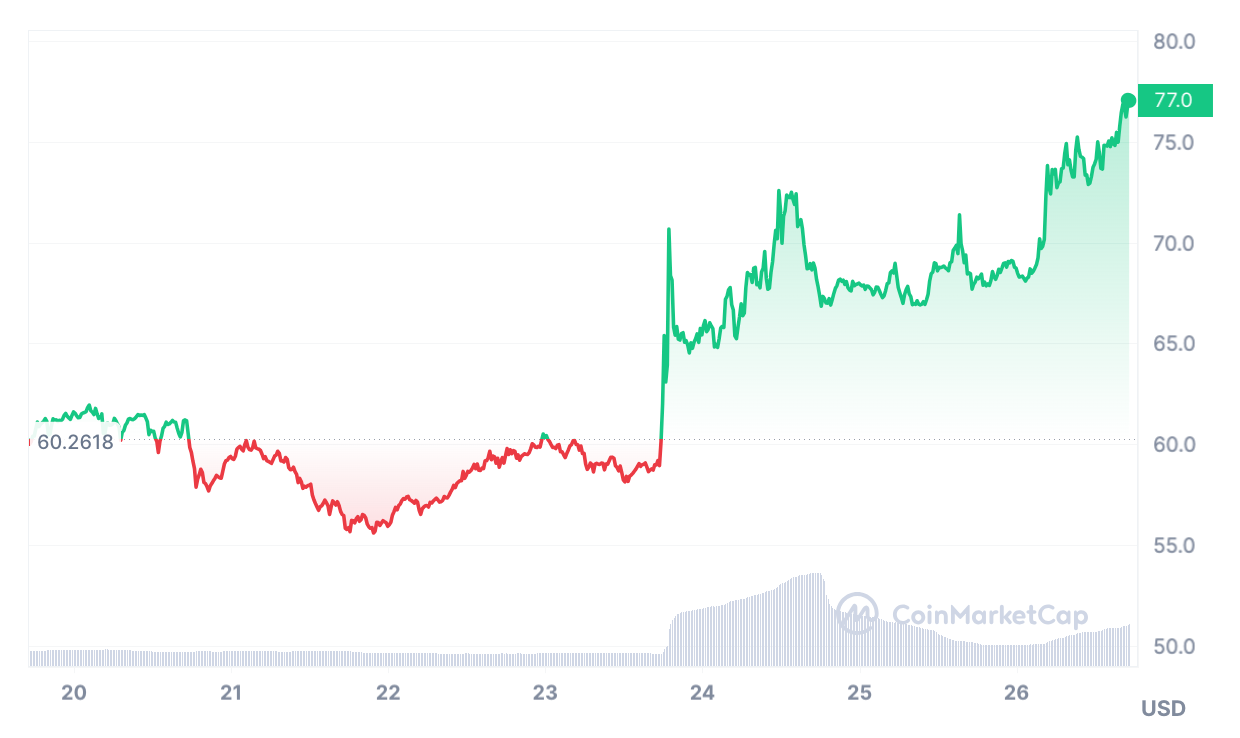

Compound (COMP) and Convex (CVX), two prominent DeFi dApps on Ethereum, have also emerged as top performers this week. COMP is testing $77, its highest level since July, while CVX is trading at $4.80 for the first time in nearly 10 months.

The recent bullish market sentiment has propelled DeFi assets to their highest level since May 2022, with DeFi tokens collectively commanding a market cap of $97.5 billion. Additionally, the TVL in DeFi protocols has reached a nearly 22-month high, currently standing at $83.2 billion, excluding liquid staking projects.

Ether’s gains, combined with the rise of liquid staking, have significantly contributed to the strong performance of the DeFi sector in recent times. StETH, Lido’s liquid staking token, represents 31.2% of DeFi’s market cap, indicating a robust presence within the ecosystem. Considering liquid staking tokens, DeFi TVL would surpass $131 billion, with stETH constituting almost a quarter of the total.