Recent statistics reveal that the total value locked (TVL) in decentralized finance has surged beyond $80 billion, marking a significant resurgence not witnessed since the downfall of Terra‘s stablecoin in May 2022.

Leading the charge in 2024 in terms of TVL is Lido’s liquid staking platform, with ether-based liquid staking derivatives (LSDs) commanding a dominant position with $41 billion in TVL.

One year and nine months have transpired since Terra’s UST stablecoin suffered a peg loss, and Terra’s LUNA plummeted from $80 per unit to mere fractions of a cent. The archived records on May 1, 2022, indicate a substantial $196.6 billion in TVL, with Terra contributing $28.23 billion or 14.36% of the total TVL, notably with $16.48 billion tied to Anchor.

Those tumultuous times have become distant memories, with Terra’s downfall not only wiping out significant value from the DeFi sector but also leading to the collapse of major firms and trading entities. With the crypto winter now in the rearview mirror, the value secured in DeFi has witnessed a remarkable resurgence to $80.21 billion.

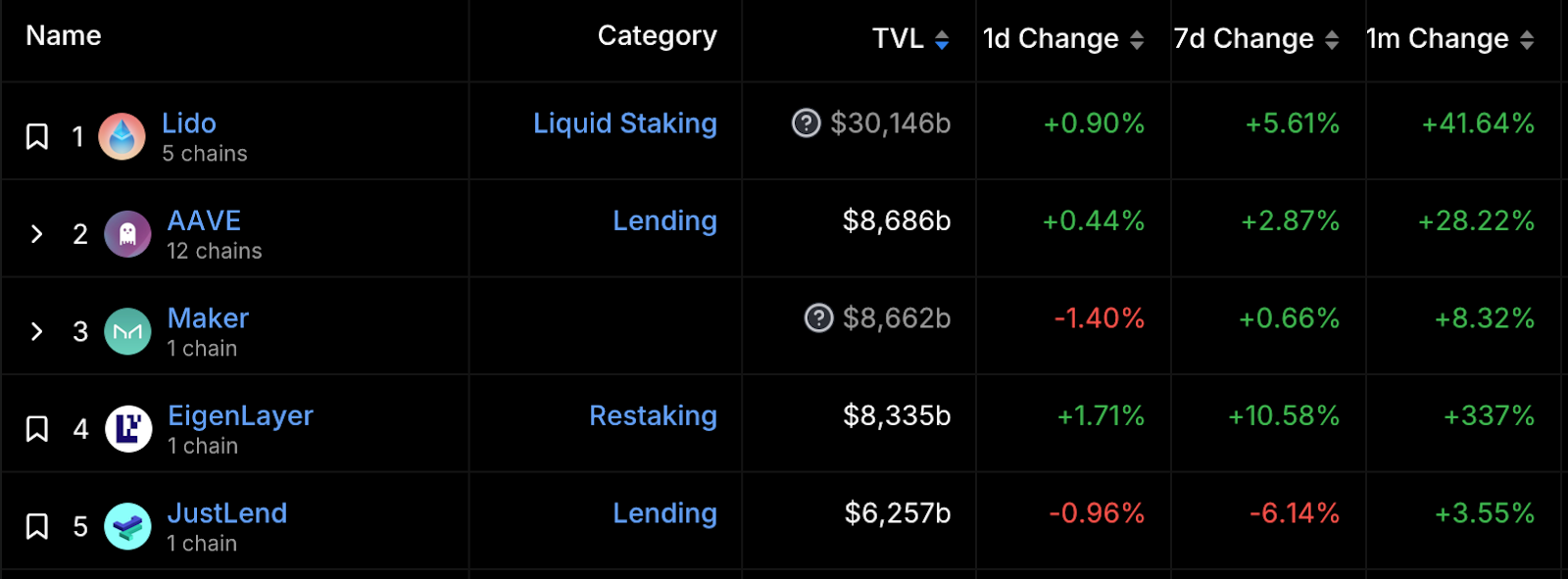

Lido emerges as the standout protocol in the DeFi landscape, boasting the largest TVL at $29.49 billion.

Following Lido in the rankings are MakerDAO with a TVL of $8.66 billion, Aave closely behind at $8.56 billion, EigenLayer with $7.95 billion, and JustLend with $6.31 billion, rounding out the top five DeFi protocol giants.

Ethereum dominates the DeFi space when it comes to wealth distribution, commanding over 60% of the TVL share. As of the latest data, a substantial sum of $46.967 billion is allocated across 979 DeFi protocols leveraging the Ethereum network.

Tron secures its position as the second-largest blockchain by TVL size, hosting $8.646 billion, representing 11.01% of the total DeFi TVL.

BNB, Arbitrum, Solana, and Bitcoin complete the leading six blockchains in terms of TVL size. Over the past 130 days, the locked value in DeFi has surged by over $42 billion. The revitalized momentum within the DeFi sector suggests a renewed sense of confidence among DeFi users, although predicting the longevity of this momentum remains uncertain.