Uniswap, the leading decentralized exchange on Ethereum, has witnessed a significant surge in its native token following a proposal from the Uniswap Foundation to allocate a portion of protocol fees to UNI token stakers.

🔈 New Governance Proposal Posted 🔈

UF Governance Lead @eek637 just posted a proposal to upgrade Uniswap Protocol's governance system. Specifically, this upgrade would reward UNI holders who have staked and delegated their tokens.

— Uniswap Foundation (@UniswapFND) February 23, 2024

The announcement of this proposal has propelled UNI’s price up by more than 60%, jumping from $7.24 to $10.22 within an hour, as reported by CoinGecko. This surge has elevated its market capitalization above $8 billion. As of February 24, the price of UNI stands at $12.14.

The proposal has been met with enthusiasm from UNI holders, who have long advocated for the implementation of a ‘fee switch’ to enhance the token’s utility beyond governance.

Erin Koen, the governance lead at Uniswap Foundation, introduced the upgrade, highlighting its potential to reward UNI token holders who stake and delegate their tokens. Koen emphasized that if approved by the community, the resilience and decentralization of Uniswap Governance would be enhanced.

If approved by the community, Uniswap Governance's resilience and decentralization will increase.

Two truths: The Uniswap Protocol is immensely useful (trillions of USD in lifetime swap volume), and it is governance minimized (two adjustable parameters in v3, one in v4).

— Erin Koen (@eek637) February 23, 2024

A Snapshot vote is scheduled for March 1, followed by an on-chain vote on March 8.

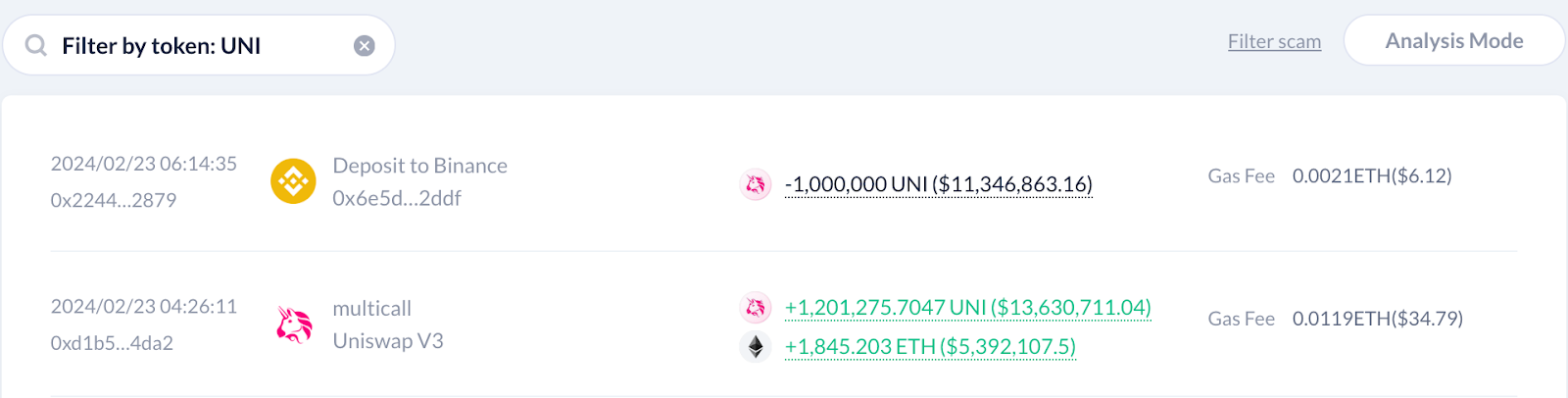

Recent on-chain data reveals that a wallet with significant UNI liquidity withdrew its tokens and transferred 1 million UNI, valued at around $7 million at the time, to Binance.

These transactions were flagged by blockchain observer Lookonchain.

A liquidity provider of $UNI removed 1.2M $UNI($8.7M) of liquidity and deposited 1M $UNI ($7.25M) to #Binance.https://t.co/DoatcRE9YR pic.twitter.com/R4Yc0DjeNl

— Lookonchain (@lookonchain) February 23, 2024

Assuming the UNI tokens have not been sold yet, the astute whale stands to gain over $4 million while avoiding impermanent loss.

With $4.9 billion in total value locked (TVL), Uniswap remains Ethereum’s premier decentralized exchange, handling over $1 billion in spot trades daily. However, like many decentralized organizations, Uniswap has experienced a decline in governance participation during the bear market.

Koen’s proposal aims to revitalize Uniswap governance by requiring delegation as a prerequisite for staking UNI and earning a share of protocol revenue. He anticipates mass re-delegation events in the short to medium term as existing delegators select new delegates to stake tokens and earn rewards.

Devin Walsh, executive director of the Uniswap Foundation, believes that this upgrade will foster a more robust governance system for Uniswap.

The UF just posted proposal which we believe will not only invigorate Uniswap governance in the short term, but also ensure the long term success and resilience of the Protocol.

If every company building on Uniswap disappeared tomorrow, it would be up to its delegates to… https://t.co/snbsypU49f

— Devin Walsh (@devinawalsh) February 23, 2024