StarkWare, the company responsible for the scaling solution Starknet, has announced revisions to its token lockup schedule for early contributors and investors in response to criticism.

Important update:

After listening to feedback from ecosystem friends and collaborators, we are changing the lockup schedule for StarkWare’s early contributors and investors to make it more gradual.

We value this community and want to earn its trust by building great tech that…

— StarkWare (@StarkWareLtd) February 22, 2024

Earlier this month, the Starknet Foundation initiated the distribution of the STRK token, with approximately 49.9% of the total token supply allocated to “core contributors” and “investors.” Initially, these tokens were subject to a four-year lock-up period, with a one-year cliff set to expire on April 15 of this year.

However, the project faced significant backlash, particularly regarding its vesting approach, which was perceived to disproportionately favor insiders.

In light of these concerns, StarkWare has opted to amend the unlocking timelines for STRK tokens, opting for a more gradual release process.

Eli Ben-Sasson, co-founder and CEO of StarkWare, explained the decision in a post on X, stating that their team listened to concerns regarding the long-term alignment of StarkWare with the Starknet ecosystem and proposed a more gradual release schedule.

He further emphasized the company’s commitment to earning the community’s trust through actions, not just words, and expressed gratitude for the support of their investors in this decision.

We

1. listened to concerns re. long-term alignment of @StarkWareLtd w/ Starknet ecosystem.

2. proposed a more gradual release schedule

3. believe trust is earned with actions, not just words

4. thank investors for their support on this@StarkWareLtd ❤️ @Starknet https://t.co/WZsiZsn3yM— Eli Ben-Sasson (@EliBenSasson) February 22, 2024

Under the updated schedule, only 64 million tokens, or 0.64% of the total supply, will unlock on April 15, compared to the initial plan of 1.34 billion tokens. Subsequently, the unlocking will occur monthly at a rate of 0.64% until March 15, 2025.

After the first year, the unlocking pace will increase to 1.27% monthly for the following 24 months until March 15, 2027.

This revised schedule will result in only 580 million tokens being unlocked by the end of this year, significantly fewer than the originally planned 2 billion tokens.

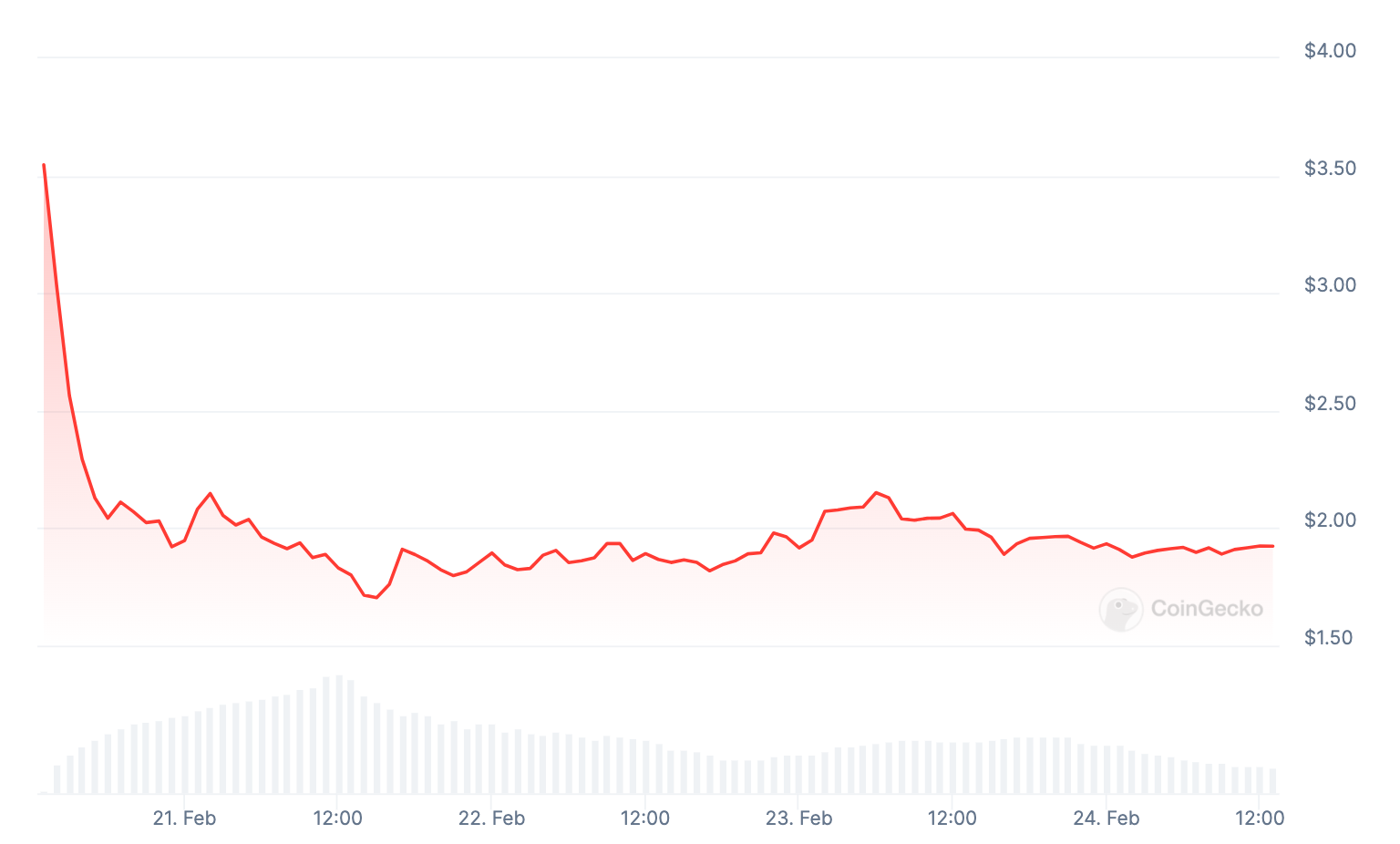

At present, the STRK token is trading at $1.96, according to CoinGecko.