In a significant development, executives from Circle and Coinbase have urged the U.S. Congress to grant additional powers to the Treasury Department for stricter oversight of Tether, the leading stablecoin issuer. The call for action came during a Congressional hearing where representatives emphasized concerns about Tether’s association with Cantor Fitzgerald and alleged involvement in money laundering and terrorist financing.

Caroline Hill, Director for Global Policy and Regulatory Strategy at Circle, expressed her belief that any company issuing a USD-backed stablecoin should align with democratic values. Grant Rabenn, Director of Financial Crimes Legal for Coinbase, echoed these sentiments, highlighting the vulnerabilities of offshore platforms that lack compliance robustness.

.@Coinbase's Grant Rabenn and @Circle's Caroline Hill just begged congress to crack down and issue enforcement actions on their competitors. pic.twitter.com/AzCtUA8Bxi

— Pledditor (@Pledditor) February 15, 2024

The plea for increased regulatory scrutiny against Tether comes as it dominates the stablecoin market with its USDT stablecoin, commanding a staggering $51 billion in 24-hour volume.

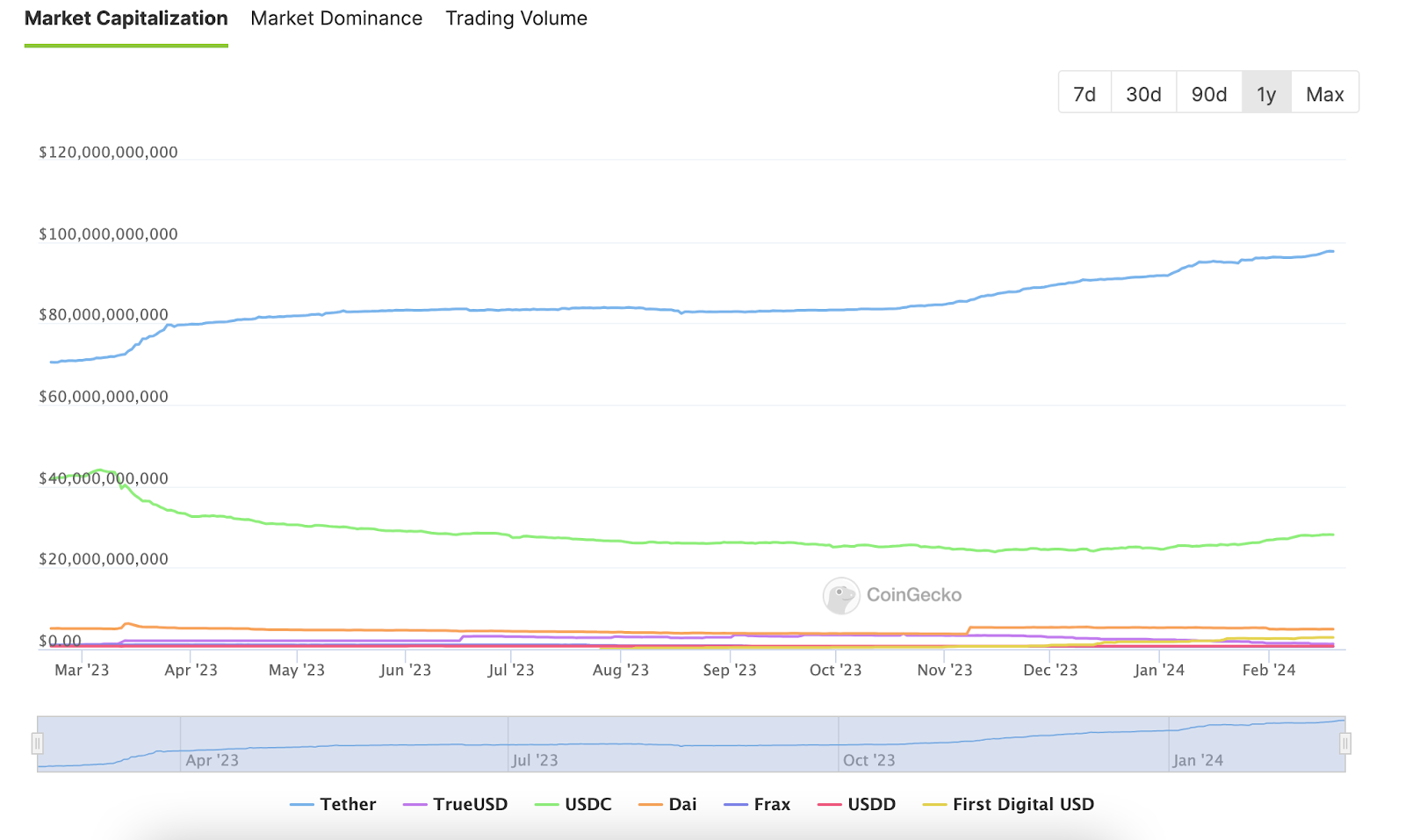

The current congressional hearing coincides with a growing disparity in market capitalization between Tether’s USDT and Circle’s USDC, which is seen as indicative of heightened attention from investors and traders. USDC, which hit a low point in mid-November 2023 at $25 billion, has rebounded to $28 billion.

In contrast, USDT has demonstrated relentless growth since December 2022, with its market capitalization soaring from $65 billion to $97 billion, as reported by CoinGecko.

Despite efforts by onshore stablecoins like USDC to adhere to regulatory standards, global investors continue to favor USDT, known for its laissez-faire approach. This preference has triggered a debate within the industry, with critics accusing Circle and Coinbase of hypocrisy for seeking regulatory intervention while striving to combat claims that crypto is primarily used for illicit activities.

Treasury department should investigate Circle for all of the times they did not blacklist illicit funds when they had ample time instead of larping as the compliant centralized stablecoin.

— ZachXBT (@zachxbt) February 16, 2024

The ongoing stablecoin wars have attracted attention from various industry stakeholders, with some questioning the motives behind Circle and Coinbase’s push for stricter regulations. The discord comes at a precarious time, as influential figures like Senator Elizabeth Warren and other U.S. politicians are advocating for increased scrutiny and regulations within the crypto industry.