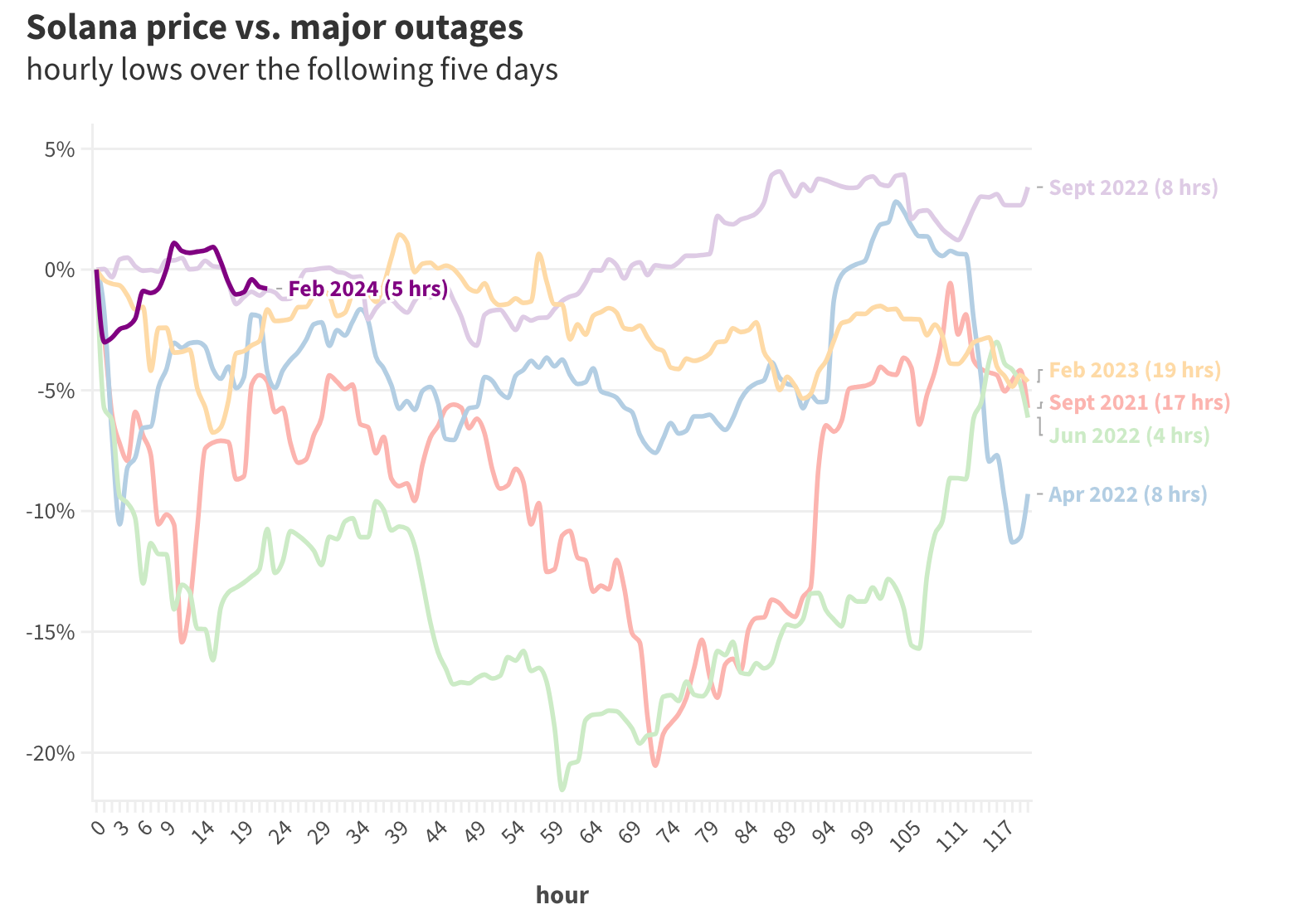

On Tuesday, Solana experienced a complete five-hour outage, effectively locking over $1.6 billion in cryptocurrency within suspended DeFi network applications. Surprisingly, those monitoring price charts may not have noticed significant disruptions.

Historical Context of Solana’s Downtime

Solana Labs reported Tuesday’s outage as the sixth major power failure on the Solana blockchain. The previous incident occurred almost a year ago when service providers, using specialized software, inadvertently flooded the network with data.

Block production on Solana mainnet beta resumed at 14:57 UTC, following a successful upgrade to v1.17.20 and a restart of the cluster by validator operators. Engineers will continue to monitor performance as network operations are restored.

The outage began at approximately 09:53 UTC, lasting 5 hours. Core contributors are working on a root cause report, which will be made available once complete.

Impact on SOL Prices Over Time

Tracking the prices during these outages suggests that the influence on SOL has diminished over time. The first three significant power failures within nine months preceded price drops of 10-15% in the subsequent twelve hours.

Developer Efforts and Market Reaction

The recent outage, seemingly the second most impactful of the six, led to a momentary 2% lead for SOL at one point as developers worked on a patch. Official disclosure is pending, but indications point to an error in code instructing native applications. Developers had identified and fixed the issue in the test network, but the production protocols delayed transferring the fix to the mainnet.

Participants globally collaborated on Discord to patch and restart the chain, a process taking approximately five hours. Despite Solana’s planned downtime strategy, the market’s relatively weak response may signify an understanding that Solana prioritizes “security” over “liveness.”

I fell asleep listening to Nick Bostrom talking about existential risk (surreal coincidence). No one bothered to call me or even add me to whatever slack or discord channel was debugging the issue, not even for moral support. By the time I woke up, the network was up already.

— toly 🇺🇸 (@aeyakovenko) February 6, 2024

Market Trust in Solana’s Development Structure

While Bitcoin and Ethereum prioritize processing transactions at any cost, Solana’s approach aligns with chains like Tendermint, emphasizing network safety over continuous operation during consensus disruption. Market trust in Solana’s development structure likely contributes to its ability to handle such incidents.

In conclusion, popular blockchains frequently face disruptions, with examples including Polygon, XRP, Avalanche, Stellar, and even Ethereum experiencing significant failures akin to Solana. This recent Solana failure serves as a reminder of the blockchain space’s experimental nature, requiring occasional quick resets.