The decentralized finance (DeFi) sector is currently witnessing a surge in popularity, evidenced by the total value of tokens (TVL) deposited on DeFi-focused blockchains hitting a remarkable milestone of $60 billion.

Factors Driving DeFi Growth

This recent milestone, reported by data provider DeFi Llama, represents the highest TVL level observed since August 2022. The significant uptick in TVL can be linked to the recent rally in Bitcoin prices, largely fueled by the introduction of spot bitcoin exchange-traded funds (ETFs) in the United States.

Market Dynamics and Daily Trading Volumes

From January 2021, where DeFi deposits stood at $17.3 billion, to December of the same year, where they surged to nearly $178 billion, there has been a notable trajectory, although a subsequent dip below $40 billion occurred in December 2022, according to data from DeFi Llama.

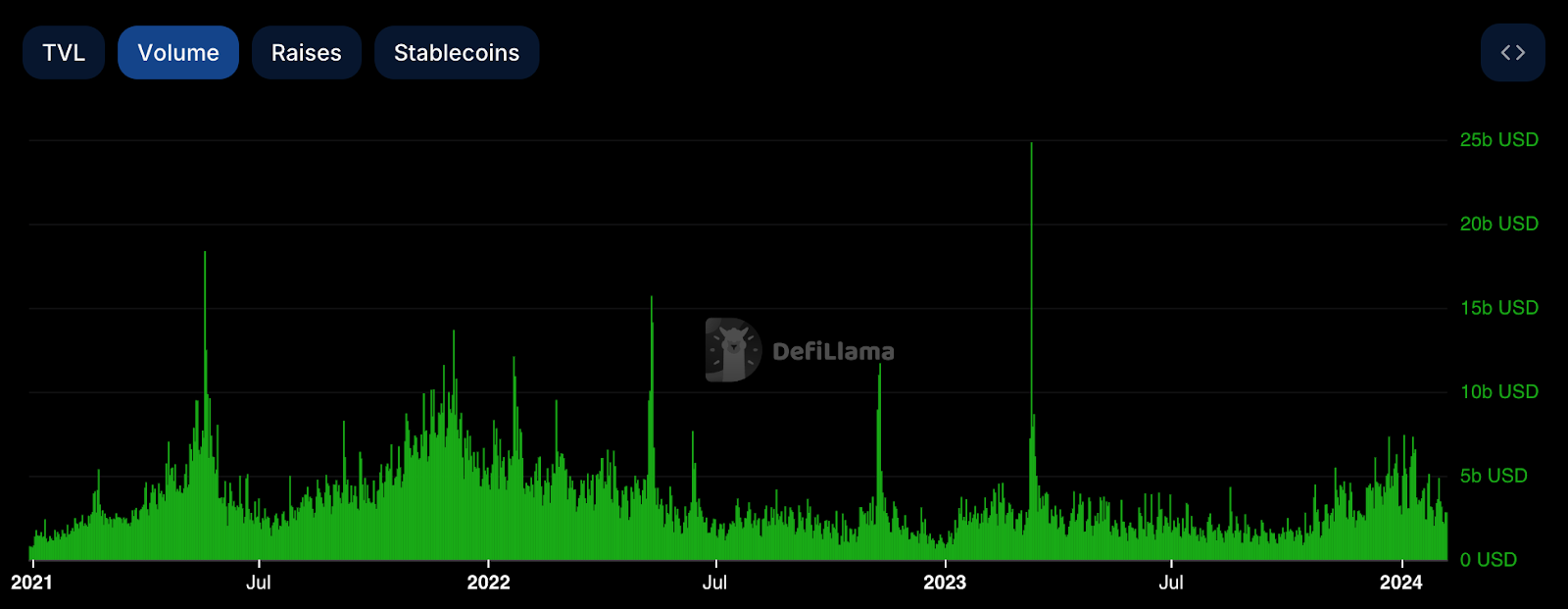

Moreover, daily trading volumes on DeFi protocols have seen a remarkable increase, peaking at $7.3 billion in early January, marking the highest levels since March 2023.

Rise of DeFi Tokens and Investor Appeal

CoinGecko data reveals that the market capitalization of DeFi-linked crypto tokens has also experienced growth, rising from $72 billion to $77 billion since the start of December.

The anticipation of lower interest rates in the United States has added to the allure of DeFi protocols, where investors can deposit their crypto tokens and earn yields, often surpassing rates offered by traditional institutions such as the U.S. Treasury.

Analyst Insights and Market Outlook

Michael Rinko, an analyst at Delphi Digital, noted to Reuters that DeFi rates are currently surpassing those of the U.S. Treasury for the first time in a year or so, further attracting capital into the DeFi space. The recent surge in DeFi deposits aligns with the uptick in prices of Bitcoin and Ethereum witnessed in early January, primarily driven by the debut of American spot Bitcoin (BTC) ETFs.

Challenges and Future Prospects

As prices of these major cryptocurrencies soared, investors found increased liquidity, leading them to explore riskier assets like DeFi tokens. However, subsequent to their surges, both Bitcoin and Ethereum have retraced most of their gains, with minimal increases recorded, resulting in a decline in the prices of many DeFi tokens. Nonetheless, some market participants believe that the current surge in DeFi activity may be more sustainable, as evidenced by the robust performance of Solana (SOL), one of the leading DeFi chains, which has quadrupled in price over the past six months, surpassing the growth rates of Bitcoin and Ethereum. Despite optimism, concerns linger regarding the future of DeFi, especially as financial markets adjust expectations for interest rate cuts.